PAST WEEK'S NEWS (July 08 – July 12, 2024)

The latest inflation data came in lower than expected, reinforcing dovish messaging from Powell and supporting the idea that the Fed's tighter policy stance is effectively lowering consumer price inflation. Traders have responded by pricing in a high probability of a September rate cut, currently at 86%, with increasing odds of additional cuts by year-end. The slowing cost of shelter is seen as a notable development, even with higher energy costs compared to last month. As the Fed approaches its July 30-31 meeting, attention will focus on potential changes to the policy statement and whether officials will continue to refer to inflation as "elevated."

OPEC, in its latest report, has maintained its forecast for global oil demand growth, projecting an increase of 2.25 million barrels per day (bpd) in 2024 and 1.85 million bpd in 2025. The organisation cites resilient economic growth and strong air travel as key factors supporting fuel use, especially during the northern summer. OPEC raised its global economic growth forecast for 2024 to 2.9% from 2.8%, noting potential upside due to momentum outside developed countries. However, there's a growing divergence among forecasters regarding the strength of oil demand growth, partly due to differing views on the pace of the transition to cleaner fuels.

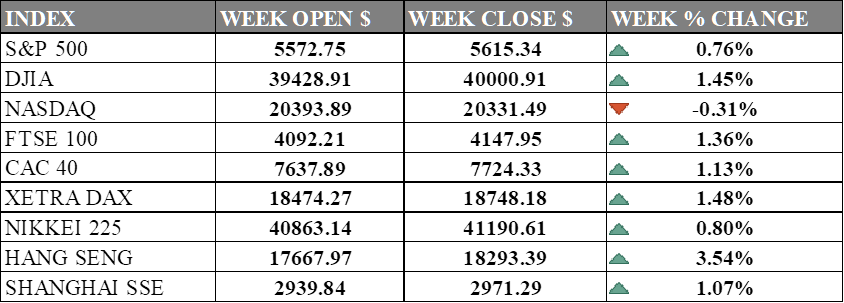

INDICES PERFORMANCE

Wall Street wrapped up a mixed week, with the Dow leading the charge among U.S. indexes. The blue-chip index climbed 1.45%, breaking the 40,000 marks for the first time to close at 40,000.91. The S&P 500 also ended in positive territory, inching up 0.76% to 5,615.34. However, tech stocks took a breather, with the Nasdaq slipping 0.31% to 20,331.49. The broad gain is attributed to mixed inflation data and strong bank earnings, despite investor concerns over future net interest income projections from Wells Fargo. The real estate sector led the gains with a 4.4%, while the communication services sector fell 3.6%, with Netflix shares dropping 6.2% despite positive analyst price target adjustments.

Across the pond, European markets had a solid run. Germany's DAX set the pace with a 1.48% gain, closing at 18,748.18. The UK's FTSE 100 wasn't far behind, rising 1.36% to 4,147.95, while France's CAC 40 added 1.13% to end at 7,724.33. Analysts at Macquarie and Deutsche Bank predict earlier and more frequent rate cuts by the Federal Reserve and European Central Bank (ECB) respectively, in response to improving economic conditions. However, market does not expect another cut by ECB this week.

Asian markets stole the show, with Hong Kong's Hang Seng Index surging 3.54% to 18,293.39, outperforming all other major indexes. The Shanghai Composite in mainland China climbed 1.07% to 2,971.29, while Japan's Nikkei 225 advanced 0.80% to finish at 41,190.61. The market responded positively to the possibility of economic stimulus, overshadowing varied corporate performances like Cirrus Aircraft's flat debut and Deson Development's increased losses. Japan on the other hand plummeted after a suspected currency intervention that saw dollar to yen went from top of 161 to 157 in 45 minutes.

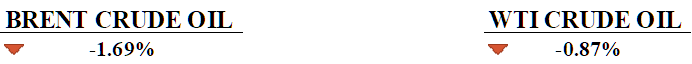

CRUDE OIL PERFORMANCE

Oil markets saw a volatile week, with both Brent and WTI crude futures ending slightly lower after four consecutive weeks of gains. Prices were pulled in different directions by a mix of factors. On one hand, weak U.S. consumer sentiment and concerns about China's oil demand weighed on the market. But on the flip side, hopes for a Fed rate cut in September and strong U.S. summer fuel consumption provided some support. Interestingly, U.S. oil rig counts dropped to their lowest since late 2021, hinting at potential future supply tightness. Despite the weekly dip in prices, money managers seem to be betting on oil's upside, increasing their net long positions in U.S. crude futures and options.

OTHER IMPORTANT MACRO DATA AND EVENTS

China's trade surplus hit $99.05 billion in June, thanks to an 8.6% boost in exports and a 2.3% drop in imports due to weak local demand. However, the economy only grew 4.7% in the second quarter, with sluggish consumer spending and ongoing recovery issues.

U.S. consumer prices fell by 0.1% in June, marking the weakest monthly reading since May 2020, which primed the Federal Reserve's confidence in their inflation battle and increased the likelihood of upcoming interest-rate cuts. With this latest data, traders and analysts are expecting cuts earliest by September, though the exact timing remains uncertain, with Fed officials stay data-dependant.

What Can We Expect from The Market This Week

ECB Interest Rate Decision: The ECB reduced its key interest rates by 25 basis points last month based on an improving inflation outlook, lowering the main refinancing rate to 4.25%. This decision, aimed at supporting economic growth, led to a positive reaction in European markets as investors welcomed the move, although they were not expecting another cut .

UK CPI June: the UK’s consumer price inflated by 2.0% year-on-year, a decline from the previous month’s 2.3%, attributed to falling food prices and a slight increase in motor fuel prices. The Bank of England maintained the bank rate at 5.25% even at the 2% target, being cautious of reinflation.

US Retail Sales: May data saw a slight gain of 0.1% from the previous month, reaching $703.1 billion, with a 2.3% rise from May last year, with notable gains in non-store retailers and food services even with reduced sales in gasoline stations and furniture stores. The National Retail Federation forecasts moderate growth in retail sales for 2024, predicting an increase between 2.5% and 3.5% for the year.

Fed Chair Powell Speech: Federal Reserve Chair Jerome Powell will sit down with the Economic Club of Washington, DC, for a conversation on the economy and monetary policy.

Philadelphia Fed Manufacturing Index: The business condition index dropped to 1.3 from 4.5 in May, marking the lowest reading in five months and indicating a slowdown in manufacturing activity. Key components showed mixed results, with shipments falling to -7.2, new orders improving to -2.2, and employment levels remaining negative.