PAST WEEK'S NEWS (July 29 – August 02, 2024)

The Federal Reserve has concluded its FOMC meeting and, as expected, decided not to cut interest rates. However, market expectations indicate a 100% chance of a rate cut at the next meeting on September 18th. According to the CME fed tool, there's an 86.5% chance of a trim and a 13.5% chance of a drastic cut. The Federal Reserve's projections outline their expectations for various economic indicators. For 2024, they project core PCE inflation at 2.8% and plan to lower interest rates to 5.25%. The Fed anticipates continued rate cuts in the coming years, with projections of 4.25% by the end of 2025 and 3.25% by the end of 2026. Fed Chair Powell stressed that no decision has been made and the focus remains on upcoming CPI and employment data, noting that the economy isn't currently signalling for drastic measures.

China's economy is running on fumes, and its leaders are scrambling for a quick fix. The Politburo, China's top decision-making body, is now focusing on consumers as the key to hitting growth targets by fattening wallets and beefing up social safety nets to get people spending again. This shift comes as the world's second-largest economy faces a nasty combo of missed growth forecasts and deflation fears, which discourage spending. While keeping their cards close to their chests, officials promise a "batch of incremental policy steps" to jumpstart the economy. Meanwhile, in the financial arena, China's market watchdog is sharpening its teeth, with enforcement chief Li Ming likely to be promoted to vice chairman, known for being tough on market manipulation and insider trading. This move shows Beijing's determination to keep a tighter leash on its massive $5.1 trillion stock market.

INDICES PERFORMANCE

Wall Street wrapped up one of the worst week in its history, with all major U.S. indexes ending in negative territory. The tech-heavy Nasdaq suffered the steepest decline, falling 3.56% to close at 18,440.85. The S&P 500 dropped 2.37% to 5,346.55, while the Dow Jones Industrial Average saw a decline of 2.26%, finishing at 39,737.27. These market downturns are due to tech sector weakness that is being sacrificed in what the market call a carry trade where loan made in Yen is repaid through fire sale of these stocks as offshore loan are tracking the dollar treasury yields, although DJI managed to limit losses through gain in industrial stocks.

Across the pond, European markets also faced somewhat the same fate. Germany's DAX saw the most significant drop, falling 4.75% to close at 17,661.22. The UK's FTSE 100 experienced a 3.03% decline, ending at 3,922.61, while France's CAC 40 fell 3.92% to close at 7,251.81. Europe market is pressured by the same concerns in the US market on top of German automakers potentially facing retaliatory tariffs from China, with shares of companies like Porsche and Volkswagen dropping significantly.

Asian markets presented a mixed picture, with most indices trending downward but shanghai. Japan's Nikkei 225 saw the most significant decline, plummeting 5.85% to 35,909.63. This purging in the Japanese market are caused by the monstrous amount of volume in its forex market, pushing yen value to multi-month highs. Hong Kong's Hang Seng Index also fell, though less dramatically, dropping 1.46% to 16,945.52. Bucking the trend, the Shanghai Composite in mainland China managed a slight gain, rising 0.55% to close at 2,905.34, providing a rare positive note in an otherwise bearish week for global markets.

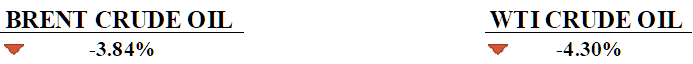

CRUDE OIL PERFORMANCE

Oil prices hit its lowest point since January and marking the fourth week in a row of losses. The main reasons for the fall were lower U.S. jobs numbers and China's slowing economy, which raised demand concern. These economic concerns outweighed tensions in the Middle East, which had briefly pushed prices up earlier in the week. OPEC+ decided to keep its oil production plans the same at its meeting on Thursday, including its intention to start easing production cuts in October. Adding to the gloomy outlook, U.S. oil production is expected to grow by 500,000 barrels per day this year, sparking another supply glut concern that was apparent late last year.

OTHER IMPORTANT MACRO DATA AND EVENTS

The U.S. added far fewer jobs in July, with only 114,000 new positions, the lowest number since January 2021, and the unemployment rate climbed to 4.3% while a recent increase in ongoing jobless claims indicates potential labour market weakening.

The U.S. manufacturing PMI dropped to an eight-month low of 46.8 in July, indicating contraction in the sector. However, this likely overstates the industry's struggles, as factory production rebounded sharply in the second quarter and government data suggests the manufacturing sector has stabilized.

What Can We Expect from The Market This Week

RBA Interest Rate Decision: The RBA decided to maintain the official cash rate at 4.35% in its last meeting since its last hike in November 2023, citing reinflation risk with inflation at 3.8%, up from 3.6%. This conservative approach suggests that the RBA will continue to closely monitor economic conditions before making any future rate changes.

US Note Auction: The recent US note auctions in July 2024, with the 2-year and 5-year Treasury note yields falling to 4.434% and 4.121%, respectively, indicate strong investor demand and a potential easing of borrowing costs for the government that will spread into the upcoming 30-year and 10-year notes.

ISM Non-Manufacturing PMI: The PMI figures reported a significant contraction to 48.8 in July, indicating a downturn in the service sector, although consensus is positive at 51.4. This unexpected decline has raised concerns about the economic outlook and increased expectations of rate cuts.

German CPI July: Germany's July CPI is projected to increase by 2.3% year-on-year, a slight uptick from June's 2.2%, driven by rising food prices and stable service costs . This unexpected rise may influence the European Central Bank's decision to hold its rate for another cycle after cutting pre-emptively in June.

China Trade Balance: China's trade balance showed significant growth and a surplus of USD 99.05 billion, driven by an 8.6% year-on-year rise in exports and a 2.3% decline in imports. This trend highlights China's continued dominance in global trade, with a total trade surplus of USD 435 billion for the first half of 2024.