PAST WEEK'S NEWS (September 16 – September 20, 2024)

The Federal Reserve has officially launched the long-awaited rate-cut cycle, lowering interest rates by 50 basis points, the first cut since 2020 pandemic panic. This decision reflects the Fed's growing confidence in inflation moving towards its 2% target, with core PCE expected to be slower. More importantly, The FOMC has revised its projections, now forecasting the benchmark rate to fall to 4.4% in 2024 and 3.4% in 2025, an aggressive easing stance than previously projected. GDP growth forecasts remain relatively stable at around 2% through 2027, while Fed Chairman Jerome Powell downplayed recession concerns, citing solid growth, cooling inflation, and the unemployment rate remaining low as positive indicators. Now BoE and BoJ rate decisions come into focus to see how other central banks will react to the Fed's decision.

INDICES PERFORMANCE

Wall Street experienced a significant upturn this week, with all major indices recording substantial gains. The S&P 500 rose 4.02% to close at 5,626.01. The Dow Jones Industrial Average saw an increase of 2.60%, finishing at 41,393.78, while the tech-heavy Nasdaq performed the best, surging 5.93% to close at 19,514.58. These market gains are largely attributed to federal reserve oversized cut, with investors showing confidence across all sectors, particularly in technology stocks.

Across the pond, European markets also experienced moderate gains. The UK's FTSE 100 rose 1.80%, closing at 4,042.39. France's CAC 40 saw a 1.54% increase, closing at 7,465.26. Germany's DAX experienced a 2.17% climb, ending at 18,699.40. European markets reflected the positive sentiment in US equities, with various sectors contributing to the overall gains.

Asian markets presented a mixed picture, with gains in Japan but losses in China and Hong Kong. Japan's Nikkei 225 saw a modest increase, rising 0.52% to 36,581.69. Hong Kong's Hang Seng Index posted a slight loss of 0.43%, closing at 17,369.10. The Shanghai Composite in mainland China experienced a more significant decline, falling 2.23% to close at 2,704.09. Rumours are going around China economy is undergoing implosion, with more pain incoming.

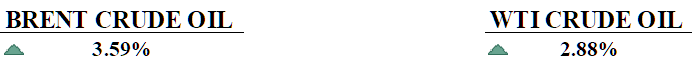

CRUDE OIL PERFORMANCE

Oil prices traded higher last week, driven by increased Middle East tensions and prospects of lower interest rates improving demand. The market is rebounding from near three-year lows, further supported by supply disruptions from Hurricane Francine and OPEC+'s decision to extend production cuts through 2024. The Federal Reserve's recent interest rate cut, and the start of an easing cycle have bolstered hopes for economic growth and increased crude demand. Ongoing conflicts in the Middle East, particularly Israel's actions in Gaza and Lebanon, have added a risk premium to oil prices due to potential supply disruptions. Wells Fargo maintains an optimistic outlook for oil prices in 2024, with targets of $80-$90 per barrel for WTI crude and $85-$95 for Brent crude, citing OPEC+'s production cuts as a stabilizing factor offsetting recent global demand weakness.

OTHER IMPORTANT MACRO DATA AND EVENTS

China's youth unemployment rate climbed to 18.8% in August, the highest since last December, as new graduates entered the job market. This rise, along with slowing economic growth, increases pressure on policymakers, with the overall national jobless rate also edging up to 5.3%.

UK consumer confidence has dropped to a six-month low of -20, driven by Prime Minister Keir Starmer's warnings about potential tax increases and a challenging budget. Despite some retail sales growth in August, households are anxious about rising public debt and upcoming economic decisions.

What Can We Expect from The Market This Week

RBA Interest Rate Decision: After federal reserve cut, only the Commonwealth Bank among Australia’s "big four" expects a rate cut by the end of the year. Even though markets still expect a potential cut from the Reserve Bank of Australia, employment growth and strong economic data have eased those prospects.

SNB Interest Rate Decision: Economists are predicting a 25 basis point cut, though a larger cut is possible due to the strong Swiss franc. Even though inflation is falling and economic growth forecasts remain modest, the SNB's decision will likely impact the EUR/CHF exchange rate, with higher rates anticipated in the coming quarters.

US GDP Q2: The final figures for U.S. economic growth are expected, with an earlier figure estimated at around 3% growth, pointing toward a resilient economy. The Fed's cutting rate could mean that the figure will be the same or lower, as easing fiscal policy could support growth.

US PCE Price Index: The last core PCE price index rose 0.16%, with a three-month average suggesting a 1.7% annualised rate, the lowest this year. Disinflation is expected to continue, with the PCE rate holding at 2.6% through late 2024 before slowing to 2.2% in early 2025.

CB Consumer Confidence: the index rose to 103.3 in August, revealing improved optimism, particularly among older consumers and higher-income groups. However, concerns about labour market stability and inflation persist.