PAST WEEK'S NEWS (October 28 – November 01, 2024)

Big tech companies pumped a staggering $50.6 billion into AI infrastructure last quarter, yet their combined cloud revenue of $63 billion raises questions about the return on investment. While cloud growth looks promising at companies like Google, which saw a 35% growth, the massive spending on data centres and AI development continues to outpace the actual money coming in. Microsoft, Amazon, and Meta are doubling down on their AI investments despite the uncertain payoff, with Meta alone spending $9.2 billion on infrastructure in just three months. Though Microsoft trumpets that its AI products will bring in $10 billion annually, that figure pales next to the enormous costs these tech giants are racking up in their AI arms race, with OpenAI expected to burn a total of $5 billion this year. The market seems to share these concerns as investors grapple with whether the AI gold rush will ever justify its cost.

Chinese EV makers are starting November on a high note, with stock prices jumping after October delivery numbers were better than expected. BYD led the pack with an eye-catching milestone, delivering half a million plug-in electric and hybrid vehicles last month alone - their best performance yet. Other major players like Xpeng and Geely saw their shares climb more than 6% as they too posted strong delivery growth, showing the broader strength across China's EV sector. The market's excitement comes as these companies keep pushing out more cars, even while facing some regulatory hurdles from Europe, where the EU has been looking into possible tariffs on Chinese EVs. Back at home, though, Chinese officials aren't sitting idle - they're working with countries like France to find ways around these trade tensions and keep the EV export channels open.

INDICES PERFORMANCE

Wall Street are not the only one experiencing a challenging week across major indices. The S&P 500 closed 1.37% lower at 5,728.81. The Dow Jones Industrial Average saw a modest decline of 0.15%, finishing at 42,052.19, while the tech-heavy Nasdaq fell 1.57% to close at 20,033.14. Big tech earnings season came out mixed with google and amazon being ahead while Nvidia, Apple, Tesla, and Microsoft lagged, and the broader S&P 500 remains flat in the face of rising Treasury yields. Consumer savings rate is improving, but weak job growth at only 12k vs 223k last month put labour market at centre of attention although jobless claims keep falling.

European markets also faced downward pressure across the board. The UK's FTSE 100 declined 1.65%, closing at 4,005.26. France's CAC 40 fell 1.18%, closing at 7,409.10. Germany's DAX aligned with its European peers, dropping 1.07% to end at 19,254.97. These losses indicate a broadly negative week for European markets, reflecting similar bearish sentiment seen in US indices.

Asian markets showed mixed performance, with Japan standing out as the sole gainer. Japan's Nikkei 225 rose 0.37% to 38,053.60, possibly due to higher raw material, labour, and utility prices. Chinese markets faced moderate pressure, with Hong Kong's Hang Seng Index posting a loss of 0.41%, closing at 20,506.44. The Shanghai Composite in mainland China also declined, falling 0.84% to 3,272.01. China is considering issuing over 10 trillion yuan in extra debt to revive its economy, but experts believe this may not significantly boost demand as much of the debt could simply shift from local government to the central government and state banks.

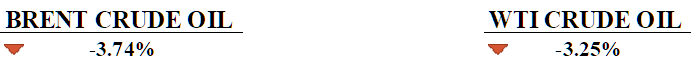

CRUDE OIL PERFORMANCE

Oil prices took a hit this week, with Brent crude falling almost 4% as traders weighed several major developments. Israeli intelligence reports of potential Iranian attacks from Iraq added temporary price support, but couldn't overcome broader market concerns. U.S. oil production keeps breaking records, with companies like Exxon and Chevron hitting all-time highs while American drillers pulled an impressive 13.5 million barrels per day from the ground. OPEC+ might delay its planned December production increase by at least a month, showing the group's worry about weak demand and falling prices. Saudi Arabia looks ready to cut its oil prices for Asian buyers next month, suggesting they're seeing softer demand in key markets. The oil market now faces three big wildcards: growing Middle East tensions, next week's U.S. presidential election, and the impact of China's new stimulus package.

OTHER IMPORTANT MACRO DATA AND EVENTS

The ISM Manufacturing PMI dropped to 46.5, a deeper-than-expected contraction in US manufacturing. This decline, lower than last month's 47.2 and the forecasted 47.6, highlights ongoing challenges in production, new orders, and employment.

U.S. job growth slowed sharply in October, with nonfarm payrolls adding just 12,000 jobs with strikes and hurricane disruptions, though the unemployment rate held steady at 4.1%. The market however stand unfazed due to anticipated external factors affecting the data.

What Can We Expect from The Market This Week

US Presidential Election: Americans are preparing to vote for the next president and Congress members, whose decisions will impact U.S. laws and policies. Kamala Harris, representing the Democrats with Tim Walz, and Donald Trump, the Republican nominee with JD Vance, lead a high-stakes race shaped by policies on immigration, the economy, and international relations.

Fed Interest Rate Decision: The FOMC is expected to lower interest rates again on November 7, with markets projecting a 0.25% cut, though a larger reduction remains possible if economic data supports it. The FOMC is closely monitoring jobs and inflation data to determine the appropriate adjustment as they aim to maintain economic stability without triggering a recession.

BoE Interest Rate Decision: Britain's recent budget has boosted the prospects for a higher Bank of England interest rate path, but the pound’s weakness suggests scepticism as to the BoE’s commitment to a hawkish stance. Markets have adjusted forecasts to expect fewer rate cuts next year, with some doubt on any immediate easing due to elevated growth and inflation projections.

RBA Interest Rate Decision: Australia's central bank is expected to hold its interest rate at 4.35% through the end of 2024, with a possible cut in February 2025. While consumer inflation has hit target levels, core inflation remains high, making the RBA cautious about easing rates.

ISM Non-Manufacturing PMI: Services PMI rose to 54.9, the highest since February 2023, a healthy and continued expansion in the services sector for the third month straight. Business activity and new orders saw notable growth, but employment declined, and slower supplier deliveries highlighted increased demand and supply constraints.