All eyes were on Davos 2026, where geopolitics and trade dominated the agenda as President Donald Trump delivered a wide-ranging address on tariffs, security, AI, and Greenland, a sign that Arctic strategy has moved into the global economic mainstream. Financial regulation also took centre stage when JPMorgan CEO Jamie Dimon warned that Trump’s proposal to cap credit card interest rates at 10% would be an economic disaster that could greatly restrict consumer credit and radiate through the broader economy. Alongside this, attention turned to Greenland’s strategic value, where claims of a “PayPal cartel” are better understood as growing alignment between tech-sector capital, critical minerals, and geopolitical influence rather than a formal conspiracy. Reporting highlights that major investors and tech power brokers have backed ventures tied to Greenland’s resource potential, reinforcing links between private capital and state strategy.

Trump’s plan to convene talks over Greenland at Davos could be the most important talks between allies, turning Arctic resource geopolitics into immediate market volatility. Greenland’s rare earth reserves, vital for AI, defence, and clean energy, sit at the heart of US competition with China, but Trump’s tariff strategy risks alienating the European allies needed to secure them. Davos could bring either limited de-escalation or a broader trade war, with prediction markets assigning a meaningful chance to some form of Greenland deal before Trump’s term ends. Economists warn that escalating tariffs could weaken the dollar, sustain equity volatility, and raise corporate borrowing costs by structurally repricing geopolitical risk. The core irony is that US pressure may push Europe closer to China and toward independent rare earth supply chains, leaving the Greenland gambit diplomatically costly and economically counterproductive.

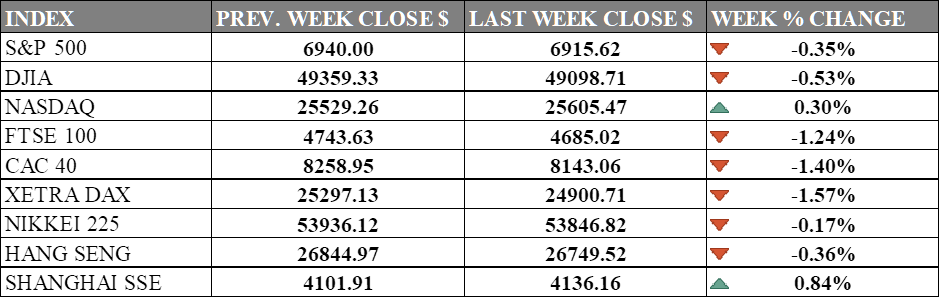

INDICES PERFORMANCE

Wall Street's major indices declined after a week of geopolitical tension that eventually recovered. The S&P 500 fell 0.35% to 6,915.62, while the Dow Jones Industrial Average dropped 0.53% to 49,098.71. The Nasdaq rose 0.30% to 25,605.47, showing resilience as technology stocks provided some support amid cautious market sentiment and mixed corporate earnings. Market momentum remained subdued as investors digested economic data and reassessed expectations for corporate performance in the coming quarters while tech earnings season is in progress.

European markets showed weakness this week. The UK's FTSE 100 fell 1.24% to 4,685.02, declining from the previous week. Germany's XETRA DAX dropped 1.57% to 24,900.71, while France's CAC 40 declined 1.40% to 8,143.06, with all three major European indices posting losses. Investor sentiment in the region was cautious, reflecting mixed corporate earnings and ongoing concerns about monetary policy impacts on economic growth prospects.

Asian markets displayed varied results this week. Japan's Nikkei 225 declined 0.17% to 53,846.82, showing modest weakness despite currency movements. Hong Kong's Hang Seng Index fell 0.36% to 26,749.52, reflecting subdued investor sentiment. In contrast, China's Shanghai Composite rose 0.84% to 4,136.16, bucking the broader regional trend with positive momentum. The mixed regional performance highlighted differing investor responses to local policy developments and global macroeconomic conditions.

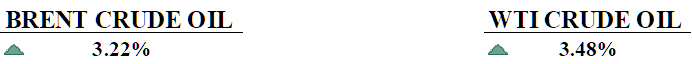

CRUDE OIL PERFORMANCE

Crude oil closed the week on a strong note, with Brent settling at approximately $66.28/bbl and WTI at $61.29/bbl, both benchmarks posting weekly gains of roughly 3% and closing at their highest levels since mid-January. The rally was thanks to geopolitical risk following U.S. escalation of pressure on Iran, including new sanctions and rhetoric surrounding an "armada" moving toward the region, which kept traders alert for potential Middle East supply disruptions. Supply concerns were further reinforced by ongoing uncertainty in Kazakhstan, particularly around Tengiz and CPC Blend exports. On the fundamental side, the latest EIA report showed U.S. crude inventories rose by 3.6 million barrels to 426.0 million, serving as a reminder that stock builds continue to weigh against rallies even as risk premiums push prices higher. Meanwhile, OPEC+ remained supportive heading into the weekend, with expectations that the group would maintain its pause on output increases for March. In short, last week's oil market reflected a tug-of-war between bearish inventory data and soft demand on one side, and bullish geopolitical risk and supply disruption concerns on the other, with the latter prevailing into Friday's close.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. inflation stayed steady but elevated with PCE rising about 2.7% to 2.8 year on year, while consumer spending and GDP remained strong.

U.S. pending home sales fell 9.3% in December to a five month low as severe shortage of existing homes outweighed lower mortgage rates, with declines across all regions and weaker buyer confidence.

What Can We Expect from The Market This Week

Fed Interest Rate Decision: The Federal Open Market Committee’s next rate decision is due, and there is much pressure by the Trump administration, making it a key near-term catalyst for USD rates and risk assets. Markets typically focus not only on the decision itself but also on the statement/press messaging for guidance on the path of policy.

BoC Interest Rate Decision: The Bank of Canada is set to announce its policy decision on the overnight rate target alongside its quarterly Monetary Policy Report (MPR), although no changes are to be expected. A press conference with Governor Tiff Macklem and Senior Deputy Governor Carolyn Rogers follows, adding an additional “headline risk” window.

US Durable Goods Orders: The latest reported figures show orders falling by 2.2% in October, weaker than the -1.5% forecast, highlighting volatility in big-ticket demand (often driven by transportation orders). The next release is forecasted to be at +3.1%, a rebound that could affect USD rate projections if it surprises materially.

German GDP Q4: Early estimates cited by ING suggest Germany grew about 0.2% in Q4 2025, meaning the economy “left stagnation” albeit slightly toward year-end after a difficult year. The overall 2025 result was a modestly positive growth with 0.2% annual GDP figures, supported by private/public consumption, while investment and exports declined.

Chicago PMI: Manufacturing in Chicago improved to 43.5 in December, a little below 50 but much better than the previous month and still consistent with contraction in regional activity.