Stocks Performance (U.S. Stocks)

Stocks Performance (U.S. Stocks) Stocks regained moderate momentum at midweek, helped by some positive earnings surprises and hopes for additional fiscal stimulus. On Thursday, the House of Representatives overwhelmingly passed a $484 billion spending bill to replenish a new but swiftly depleted program providing loans to small businesses, as well as to provide further funding for coronavirus testing and hospitals.

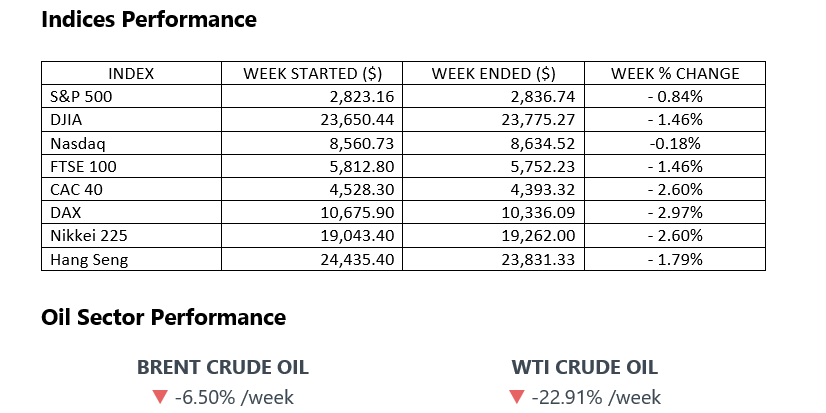

Most major stock markets around the world slipped lower this week after oil suffered its biggest-ever one-day price drop. Ironically, energy stocks outperformed within the S&P 500 Index after a sharp rally on Thursday, while consumer staples, financials, and utilities shares fared worst.

The turmoil in energy futures seemed to weigh heavily on overall sentiment early in the week. On Monday, the May futures contract for West Texas Intermediate crude oil, due to expire Tuesday, closed at -$37.63 per barrel - meaning that buyers were getting paid to take and store each barrel. Oil futures moved back into positive territory on Tuesday, but the major stock indexes continued to decline as weakness spread to technology-related shares, with Wall Street analysts cutting estimates on both Alphabet (parent company of Google) and Facebook.

The most outperformed weekly stocks by sectors was led by Non-Energy Minerals at 3.55%, followed by Industrial Services at 1.95%, Health Technology (1.23%), and Distribution Services (0.89%). Meanwhile, the weakest sectors were the Finance sector (-3.03%), Consumer Non-Durables (-2.96%), Utilities (-2.24%) and Communications (-1.38%).

The surprising move in crude prices began Monday when the WTI “front month” contract fell well into negative territory as it approached its expiry date. The decline was a result of traders trying to avoid holding contracts that would force them to take physical delivery of the commodity in May. Other oil futures contracts with further expiries did not drop in the same manner. While this was in part due to a technical quirk of the contract expiry, it still highlighted the large supply building in oil markets.

Market-Moving News Sub-Zero AnomalyTechnical factors combined with the coronavirus-related plunge in global oil demand to trigger an event that is never happened before: prices of U.S. crude oil futures briefly sank below zero. The anomaly involving contracts for deliveries in May happened on Monday and again on Tuesday when producers ran out of places to store crude. By Friday, U.S. crude was back in positive territory at around $17 per barrel, but prices still sustained another big weekly decline.

Slipping Back

Stocks could not maintain the momentum from a pair of big back-to-back weekly gains, as the S&P 500 and the Dow both fell modestly, losing less than 2%; the NASDAQ’s decline was less than a percentage point. Rallies on Wednesday and Friday were not enough to offset big selloffs on Monday and Tuesday.

Asian Setback

As with the U.S. market, stock indexes fell across Asia for the first time in weeks as the positive trend that began in late March stalled. Indexes in China, Japan, and South Korea all slipped around 1% for the latest week.

Mounting Unemployment

With Thursday’s latest weekly figure of 4.4 million, U.S. unemployment claims over a five-week period grew to a total of 26 million - a trend that is certain to trigger a huge jump in the unemployment rate in coming months.

More Legislative Relief

U.S.’s House of Senate on Thursday approved another infusion of aid, and the measure was signed into law on Friday. The $484 billion bill replenishes two depleted small business-relief programs, offers additional assistance to hospitals, and funds an expansion of coronavirus testing capacity.

Other Important Macro Data and Events

High yield bonds sold off as many investors focused on turmoil in the oil market, and the energy segment significantly underperformed. Energy-related issuers have a relatively large weight in high yield indexes.

Equities in Europe weakened on continuing divisions in Europe over a fiscal response to the economic shock caused by the coronavirus pandemic, disappointment with the failure of a coronavirus drug trial in China, and a historic crash in oil prices.

China's central bank, the People’s Bank of China (PBoC), cut the key loan prime rate (LPR) for banks by 20 basis points to 3.85%, causing the bond market to rally.

What We Can Expect from The Market This Week

With Thursday’s latest weekly figure of 4.4 million, U.S. unemployment claims over a five-week period grew to a total of 26 million. A broader picture of the nation’s troubled labour market will emerge on May 8, when the government reports monthly job.

In the wake of emergency cuts that reduced its benchmark interest rate to near zero, the U.S. Federal Reserve is expected to keep rates unchanged when it concludes a regular meeting on Wednesday. Fed statements will be closely watched for any indications as to the central bank’s next moves to help stabilize the economy amid the coronavirus pandemic.

It’s the peak of earnings season, with 172 companies in the S&P 500 Index and 12 of the Dow’s 30 components scheduled to report quarterly results in the week that starts April 27.

Investors also seemed to look forward with a mixture of worry and anticipation to the partial end of lockdowns in some states, with Georgia poised to lead the nation in reopening a range of businesses.