PAST WEEK'S NEWS (February 1 – February 7, 2021)

Stocks Performance (U.S. Stocks)

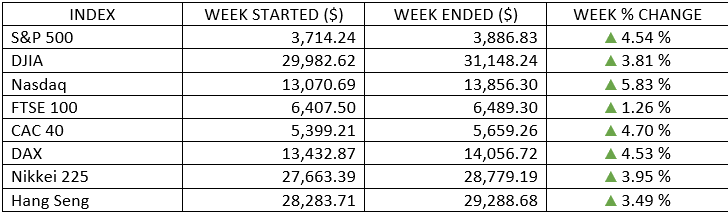

An optimistic mood rebounded global markets last week, sending some major benchmarks to their best weekly gain since November, with the S&P 500, Nasdaq Composite, Canada’s S&P/TSX Composite and Germany’s DAX indices all jumped to all-time highs.

Positive factors this week included the persistent expectations for additional fiscal stimulus plan, progress on vaccine distribution rate, the better-than-expected Q4 earnings reports, encouraging economic data and as the Reddit-fuelled shares reverting to the mean.

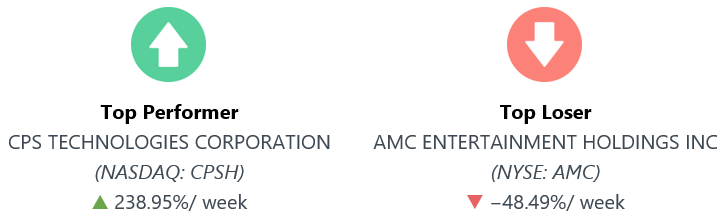

CPS Technologies Corporation shares soared high last week after the Massachusetts-based metal and ceramics specialist company said Wednesday it had received a purchase order for its HybridTech Armor Panels to be installed as ballistic shields on U.S. Navy nuclear-powered aircraft carriers. Meanwhile, AMC Entertainment Holdings falls as Reddit-fuelled trading phenomenon eased out.

By sectors, the most outperformed weekly stocks were led by Technology Services sector at 9.18%, followed by Consumer Durables at 7.73%, Distribution Services (6.85%), and Commercial Services at 6.75%. Meanwhile, the weakest sectors were from the Health Services at -0.12%, Communications at 1.91%, Utilities (2.00 %), and Health Technology sector (3.16%).

Indices Performance

Every major equity market advanced, many by as much as 3%–6% to make up for the previous week’s losses.

In major U.S. stock indexes, the S&P 500 and the NASDAQ set new record highs, eclipsing their levels from a couple weeks earlier, while the Dow was just 0.001% shy of its record.

Shares in Europe rose with global markets on hopes of a quicker economic recovery, spurred in part by hopes that the pace of coronavirus vaccinations would improve and by the prospect of more U.S. fiscal stimulus. Germany’s DAX indices all jumped to all-time highs.

Oil Sector Performance

U.S. crude oil prices jumped for the week to around $57 per barrel, its highest level in more than a year and nearly 60% above the level just four months earlier.

The jumps largely attributed to an improved outlook relating to the COVID-19 pandemic and U.S. economic stimulus, on top of a surprising drawdown in U.S. reserves and OPEC+ decision to maintain production cuts and pushed to clear the supply surplus created by the pandemic.

Market-Moving News

Stocks Rebound

The major U.S. stock indexes posted weekly gains from around 4% to 6%, more than making up for the previous week’s losses. The S&P 500 and the NASDAQ set new record highs, eclipsing their levels from a couple weeks earlier, while the Dow was just 0.001% shy of its record.

Small-Cap Sizzle

Small-cap stocks extended their recent run of outperformance relative to their large-cap peers, as the Russell 2000 Index, a small-cap benchmark, posted a nearly 8% gain to set another record high. Since the end of September 2020, the Russell 2000 has surged 48%.

Sluggish Labour Market

The latest monthly jobs report fell short of expectations, as the economy generated just 49,000 new jobs in January. In addition, December’s jobs estimate was revised downward to reflect a loss of 227,000 jobs for that month. Roughly 10 million U.S. jobs have been lost since the pandemic started.

Stimulus Movement

U.S. lawmakers moved to start a series of negotiations to approve President Biden's $1.9 trillion COVID-19 aid bill as the Senate begins a process that would let Democrats pass the stimulus proposal without Republican votes.

Q4 Earnings Momentum

Q4 earnings results continued to improve, and U.S. companies are now expected to report modest overall earnings increase, rather than the small decline that had been forecast just a week earlier. With results in from 59% of companies in the S&P 500 as of Friday, earnings were projected to end up 1.7% higher than they were a year earlier, according to FactSet.

Oil Recovery

U.S. crude oil prices jumped nearly 9% for the week to around $57 per barrel—the highest level in more than a year and nearly 60% above the level just four months earlier. Analysts attributed the latest weekly gain to an improved outlook relating to the pandemic and U.S. economic stimulus.

Calm Returns

The Cboe Volatility Index, which measures investors’ expectations of short-term stock volatility, tumbled by about 37% for the week, returning to roughly the same level that it had been at prior to a sharp increase in the previous week. The index’s surge in late January came amid frenzied trading in a handful of small-cap stocks.

Other Important Macro Data and Events

Gold prices fell as demand for safe havens diminished. And expectations of continued economic recovery boosted government bond yields and oil prices.

On the U.S. economic front, the January jobs report remained sluggish. Nonfarm payrolls increased by 49,000 following a 227,000 decline in December, while the unemployment rate improved to 6.3% from 6.7% in December, and initial jobless claims declined for the third consecutive week. The January ISM Manufacturing and Non-Manufacturing PMIs came above 50.0% for the eighth straight month.

U.S. dollar lifted to a 2-month high and yield of the 10-year U.S. Treasury bond on Friday sent to 1.17%, the highest level in about 11 months. The recent uptick in yields has been more pronounced at the long end of the yield curve, as the yield of the 30-year U.S. Treasury bond climbed to 1.97%—up from 1.65% at the end of 2020.

In Europe, the better-than-expected eurozone GDP data raised long-term inflation expectations, further lifting yields. Peripheral bond yields broadly fell.

In Italy political situation, former ECB president Mario Draghi accepted an invitation to form a national unity government. The move allows the country to avoid the uncertainty of a snap election in the middle of the pandemic and will facilitate agreement on how to spend Italy’s share of the EU’s Recovery Fund in a way that promotes growth and fiscal sustainability.

In UK, BoE discussed the prospects of eventually needing negative interest rates to support the economy. The BoE said it expected the UK economy to recover quickly over the year and return to its pre-pandemic size by the first quarter of 2022. The central bank lowered its forecast for economic growth in 2021 to 5% from the 7.25% it predicted in November but raised its estimate of 2022 GDP growth to 7.25% from 6.25%.

China PMIs showed a slowing pace of economic recovery and government officials endeavoured to discourage the usual holiday travels related to the Chinese New Year celebrations, a move that will further limit activity.

Japan’s state of emergency status for 10 prefectures extended to March 7 by the Prime Minister Yoshihide Suga.

What We Can Expect from the Market this Week

Going forward, the path ahead for economic and earnings growth remaining favourable, supported by additional fiscal stimulus, accommodative central-bank policies, and the rollout of vaccines. Given the positive outlook, we would view any upcoming pullbacks as attractive buying opportunities for investors with a long-time horizon.

Among economic data being released this week including JOLTS jobs opening and the small-business optimism report on Tuesday, monthly Treasury budget, CPI, wholesale inventories and U.S. crude inventories on Wednesday, weekly unemployment claims and OPEC & EIA oil reports on Thursday, and consumer confidence on Friday.

.jpg)