PAST WEEK'S NEWS (July 19 – July 25, 2021)

Shares of NanoVibronix Inc. rocketing more than tripled in very volatile and active trading of the week, after the company pointed out an upbeat report regarding its treatment for urinary tract infections. Meanwhile the Chinese loan-services firm Sentage Holdings lost its value as the stock continued to scale back much of a 940% intraday pop it enjoyed on its IPO trading day on July 9. However, although the stock has been sliding ever since hitting its $52 peak, it remains above its $5 IPO price.

Stocks Performance (U.S. Stocks)

On Monday, markets declined from a recent high, reportedly weak on concerns over rising cases of the Delta variant slowing down economic growth and higher than expected inflation prints in the U.S. and UK.

The benchmark index rebounded and subsequently closed higher every day after Monday until the end of the week, as investors embraced a buy-the-dip and FOMO mindset and piled into the largest stocks in the market, concentrated mostly in technology and internet-related giants—the so-called FANG+ stocks.

A strong economic growth, positive investor sentiment, and extreme amounts of Fed liquidity combined to produce price momentum gains with limited drawdowns along the way. Signs of peak growth still lingered, though, which likely restrained the rebound gains in many of the value/cyclical stocks.

From a sector perspective, advancing sectors were led by Technology Services sector at 4.05%, followed by Producer Manufacturing at 3.08%, Distribution Services (2.94%), and Health Technology at 2.85%. Meanwhile, Communications fared worst to decline -0.89%, followed by Utilities at -0.74%, Energy Minerals (-0.68%), and Consumer Non-Durables sector (0.23%).

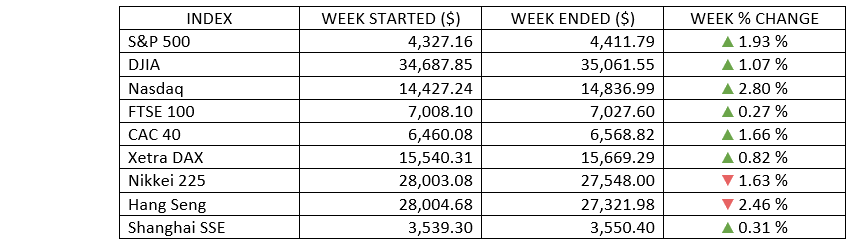

Indices Performance

Each of the major U.S. indexes ended the week at record highs, after a rough start early on. Each of the major indices rose between 1-3%.

Shares in Europe rose on optimism about the upcoming corporate earnings season and the ECB’s reaffirmation of its dovish monetary policies.

Japan’s stock markets closed in negative territory on Wednesday, ahead of a long weekend that marked the start of the Tokyo Olympics. Chinese stocks recorded a mixed week.

Oil Sector Performance

Oil prices ends the week steady, underpinned by expectations of tighter supplies until the end of the year as economies recover from the pandemic, even after OPEC+ agreed to expand production.

An agreement over the weekend within the OPEC+ to boost output, sparking some oversupply worries as COVID-19 infections continue to rise in many countries. Oil prices suffered their biggest daily decline since April 2020 earlier in the week after the oil producing countries struck the deal.

Market-Moving News

Shaky Start

The major U.S. stock indexes dropped around 1% to 2% on Monday amid growing concerns about the rapid spread of the Delta variant of COVID-19. An index that measures investors’ expectations of short-term stock volatility jumped 22% for the day.

Indices Bouncing Back

Strong quarterly earnings helped stocks rebound from the previous week’s modest declines, as the major U.S. indexes rose around 1% to 3%, with the NASDAQ outperforming the S&P 500 and the Dow. The results pushed stocks above the record levels that they set less than two weeks earlier, and the Dow topped 35,000 points for the first time.

Growth Surge

U.S. large-cap growth stocks extended their recent run of outperformance versus their value counterparts, as a growth index climbed gained more than 3% while a value index added 1%. The latest weekly result leaves the two equity styles with roughly equal performance year to date, with gains of 17% to 18%.

Earnings Surprises

As of Friday, 88% of the S&P 500 companies that had reported the Q2 results that exceeded analysts’ earnings estimates, according to FactSet. That so-called beat rate ranks above the 75% five-year average, and it’s currently the highest rate since FactSet began tracking that data in 2008. Results were in from 24% of S&P 500 companies as of Friday.

Sinking Yields

Prices of government bonds continued to rally, sending yields lower. The yield of the 10-year U.S. Treasury bond sank on Monday to around 1.19%—the lowest in 5-months, and finished the week at around 1.28%. As recently as late March, the yield was 1.74%.

Fed Ahead

Despite concerns about inflation, the U.S. Federal Reserve is widely expected to keep its benchmark interest rate unchanged—and at a near-zero level—when it concludes a two-day meeting on Wednesday. Instead, Fed officials are expected to focus on beginning to wind down the central bank’s asset purchase program as the economy continues to recover from the pandemic.

GDP On Tap

The U.S. government’s initial estimate of Q2 GDP growth is scheduled to be released Thursday. Many economists expect the report will show that GDP growth accelerated from the Q1 6.4% rate, although they see growth tapering off somewhat in the Q3.

Other Important Macro Data and Events

U.S. Treasury yields followed a similar pattern to the equity benchmarks. Growing fears surrounding the Delta variant spurred a steep decline in the benchmark 10-year Treasury note yield at the start of the week, dipped below 1.14%, before ending around 1.29%.

In the latest U.S. economic data, building permits, which are a leading indicator, declined 5.1% m/m to a seasonally adjusted annual rate of 1.598 million, weekly initial claims reached their highest level since mid-May at 419,000, the Conference Board's Leading Economic Index increased at its slowest pace since February at 0.7%, and the preliminary IHS Markit Services PMI decreased to 59.8 in July from 64.6 in June.

Core eurozone government bond yields also fell. Concerns about the spread of the coronavirus and the ECB reiterating its view that inflationary pressures should prove transitory contributed to demand for high-quality government bonds. UK gilt yields fluctuated, as surging coronavirus cases spurred flows into bonds midway through the week.

The ECB pledged to keep interest rates at record lows for even longer to boost sluggish inflation and warned that the rapidly spreading Delta variant of the COVID-19 poses a risk to the eurozone's recovery. It would not hike borrowing costs until it sees inflation reach its 2% target "well ahead of the end of its projection horizon and durably" - a controversial decision that generated significant dissent.

IHS Markit’s flash eurozone composite PMI climbed to 60.6 in July—its highest reading since July 2000. Meanwhile, the IHS Markit/CIPS UK composite PMI fell to its lowest level since March 2021, as labor shortages caused by the surge in coronavirus infections crimped output.

What Can We Expect from the Market this Week

Expectations that the mega-caps will provide strong earnings reports next week after a heavy slate of good earnings news this week. The increased spread of the Delta variant captured the spotlight last week, but we suspect inflation and the implications for Fed policy will take center stage over the balance of the year.

FOMC rate decision is awaited later in the week. Despite concerns about inflation, the U.S. Federal Reserve is widely expected to keep its benchmark interest rate unchanged—and at a near-zero level—when it concludes a two-day meeting on Wednesday. Instead, Fed officials are expected to focus on beginning to wind down the central bank’s asset purchase program as the economy continues to recover from the pandemic.

Important U.S. economic data being released this week including the new and pending home sales, FOMC rate decision, Q2 GDP, durable goods orders, and personal income and consumption.