PAST WEEK'S NEWS (Aug 23 – Aug 29, 2021)

Shares of Support.com surged last week, gaining almost 200% on the receiving end of an epic short squeeze and a benefit from a cryptocurrency connection. The company, which provides technical support services and cloud-based software, has been on fire all week after stockholder vote neared on the proposed merger with bitcoin miner Greenidge Generation Holdings Inc.

Shares of Cassava Sciences meanwhile fell after a lawyer asked the U.S. FDA to halt the company’s clinical trials of its Simufilam, a drug for Alzheimer’s disease, citing concern about the quality of past studies of the medicine.

Stocks Performance (U.S. Stocks)

Markets continue to be driven by the broader outlook for the progressing economic and earnings expansions. Prior to Fed Chair Powell's speech, the market was in-tune with a buy-the-dip mindset amid various developments, including 1) the FDA granting full approval for the Pfizer-BioNTech vaccine for people 16 years and older; 2) the House advancing the $3.5 trillion budget resolution and the $1 trillion bipartisan infrastructure bill; 3) reports indicating White House advisors and Treasury Secretary Yellen are on board with nominating Fed Chair Powell for a second term; 4) positive preliminary manufacturing and services PMIs for August; and 5) as earnings reports for the most part continuing to beat expectations.

Despite all the good news, gains were mild entering Friday, weighted by the geopolitical uncertainty in Afghanistan, hawkish-sounding Fed commentary about wanting to taper sooner rather than later, and some hesitancy in front of Fed Chair Powell's speech.

From a sector perspective, advancing sectors were led by the energy that rebounded 7.3% higher as crude oil prices gained about 10% for the week, followed by the non-energy minerals sector at 5.99%, industrial services (4.90%), producer manufacturing (3.98%), and consumer durables (3.98%) sector.

The defensive-oriented utilities (-1.06%), consumer staples, health care, and real estate sectors closed lower, loosely reflecting a greater tolerance for riskier stocks.

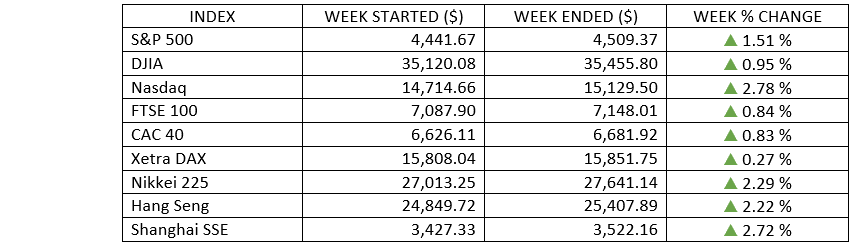

Indices Performance

The S&P 500 and Nasdaq Composite set record highs every day last week, except for Thursday.

Shares in Europe gained ground on central banks’ accommodative policies, signs that economic growth remained strong in August and hopes that higher vaccination rates might help to prevent hospitalizations and deaths.

In Asia, Japan’s stock markets rose over the week, with the Nikkei 225 Index gaining, despite more negative developments on the coronavirus front and extension of the COVID-19 state of emergency. Chinese stocks continued to recover from their late-July lows. On the coronavirus front, China’s daily cases dropped to single-digit levels following tough measures in recent weeks.

Oil Sector Performance

U.S. crude oil prices surged around 10% for the week, reversing the previous week’s decline. The gains came as U.S. government data showed that domestic demand for oil climbed to its highest level since the start of the pandemic.

The strong rally also came following the FDA full regulatory approval of vaccines for COVID-19 earlier in the week, and as Mexico suffered a large production outage due to a fire on its oil platform that halted 421,000 bpd of production. Meanwhile on Thursday, energy companies began shutting production in the Gulf of Mexico ahead of a potential hurricane forecast that hit on the weekend. Gulf of Mexico offshore wells account for 17% of U.S. crude oil production and 5% of dry natural gas production. Over 45% of total U.S. refining capacity lies along the Gulf Coast.

Market-Moving News

Positive Momentum Shift

After posting declines the previous week, the major U.S. stock indexes perked up, recovering most or all the ground lost earlier. The NASDAQ outperformed the S&P 500 and the Dow by wide margins.

Fresh Records

The S&P 500 on Friday closed above the 4,500-point level for the first time, three days after it eclipsed a record that it hit at the start of the previous week. The NASDAQ also set a new standard, breaching 15,000 for the first time on Tuesday, broke a record that it had set three weeks earlier.

Small-Cap Surge

The Russell 2000, an index of U.S. small-cap stocks, climbed more than 5% for the week, outperforming its large-cap peers by a wide margin. Small caps’ biggest daily gain came on Friday in the wake of comments by U.S. Federal Reserve Chairman Jerome Powell. The Russell 2000 nevertheless remains more than 3% below its record high, which was set in March 2021.

Taper Talk

U.S. Federal Reserve Chairman Jerome Powell on Friday confirmed that the central bank expects to begin tapering its bond purchasing program later this year. However, he didn’t set a specific date, and he warned against rushing to tighten monetary policy in response to recent inflation. Stocks rallied following his speech at the virtual Jackson Hole conference.

Oil Recovery

U.S. crude oil prices surged around 10% for the week, reversing the previous week’s decline and rising back above $68 per barrel.

Inflation gauge

The personal consumption expenditure price index climbed 0.4% in July, and the 12-month rate rose to 4.2% from 4.0%—the highest level since 1991.

Other Important Macro Data and Events

Monday’s news about the FDA providing full approval of the Pfizer shot, which could convince more employers to mandate use of the vaccine, boosted stocks early in the week. However, stocks fell on Thursday as an attack at the Kabul airport in Afghanistan amid the U.S. military’s withdrawal from the country resulted in casualties. Speeches by three regional Fed presidents expressing support for a faster start to tapering the central bank’s bond purchases also weighed on sentiment.

The hawkish commentary continued Friday morning, but Fed Chair Powell struck a diplomatic tone that appeased the market. Briefly, Mr. Powell said "substantial further progress" has been met on inflation and that "clear progress" has been made on employment, implying it's not yet time for the Fed to start tapering asset purchases because the labor market still has room for improvement. While the Fed chair acknowledged that tapering should probably start before the year ends, he reminded market participants that even when the central bank ends purchases, financial conditions will still be accommodative and that the criteria for interest-rate hikes will be based on a more careful assessment of the economy.

Treasury yields lost some rebound momentum following the comments by the Fed Chair Powell. The 10-yr yield settled five basis points higher at 1.31% after hitting 1.37% earlier in the week. The U.S. dollar index fell 0.9% to 92.68.

The week’s economic data releases were generally positive. July existing home sales rose 2% from June, a slightly higher increase than consensus expectations, likely because of more inventory available on the housing market. July new home sales were up 1% from June but down 27% from July 2020. Weekly initial jobless claims ticked up but remained near their lowest levels of the pandemic, indicating that the labour market is still strengthening even as the Delta variant spreads in the U.S. The Commerce Department’s revised estimate of Q2 GDP growth showed that the economy expanded at a 6.6% seasonally adjusted annual rate, slightly above the 6.5% initial reading.

Core and peripheral eurozone bond yields rose this week, largely reflecting moves in U.S. Treasuries. UK gilt yields broadly followed core markets this week.

The Bank of Korea is the first major Asian central bank to raise its benchmark policy interest rate since the coronavirus pandemic began in the spring of 2020. South Korea’s central bank decided to hike rates 25 basis points to 0.75% from 0.50% this week. The move was generally expected as the bank wants to stem rising inflation, higher household debt, and a surge in housing prices.

What Can We Expect from the Market this Week

The transition from August to September will be busy, with several major economic reports scheduled to be released. Housing market data is due out on Monday and Tuesday, followed by reports on manufacturing and service economy trends on Wednesday and Friday, respectively. A private report on employment to be issued on Wednesday will offer a preview of the government’s monthly release on Friday of jobs, unemployment, and wage numbers.

A monthly jobs report due out on Friday will give a further indication of the U.S. labor market’s health as the Delta variant’s spread threatens to slow economic growth. The update will follow a strong July jobs report that showed the economy generated 943,000 new jobs—the largest gain in 11 months—as the unemployment rate fell to 5.4%.