PAST WEEK'S NEWS (Nov 8 – Nov 14, 2021)

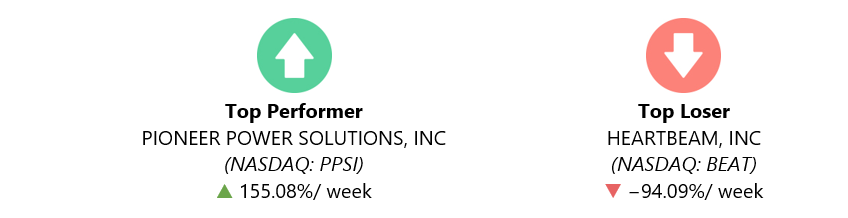

Pioneer Power Solutions rocketed on massive volume, mostly on Monday and Tuesday after the company on Tuesday announced the launch of its E-Boost portfolio of mobile electric-vehicle charging products. The portfolio includes a truck-mounted product, providing truck and car owners with dispatchable charging services; a trailer-mounted product for higher capacity EV charging, which also provides options for towing; and stationary EV charging products, and can provide high-speed DC fast charging to two vehicles.

Pioneer Power Solutions manufactures, sells and services a broad range of specialty electrical transmission, distribution and on-site power generation equipment for applications in the utility, industrial, commercial and backup power markets.

Heartbeam struggles to shine on its Nasdaq IPO on Nov. 11. HeartBeam is a development stage digital healthcare company with proprietary ECG telemedicine technology, to diagnose cardiovascular patients in an ambulatory setting at any time and any place. The company priced its public offering of 2,750,000 units at $6 but ends the week at $4.25.

Another notable IPO for the week was of the electric vehicle maker Rivian, finished 66% above its IPO price, bringing the EV-maker's market capitalization over $110 billion, the largest for a U.S. company since Facebook’s in 2012.

Stocks Performance

Each of the U.S. major indexes retreated from record highs set the previous week. The catalyst for the setback at the index level was profit-taking interest and a sharp rise in Treasury yields, which were urged by hawkish Fed expectations for next year, as investors confronted a high inflation data.

The inflation in the U.S. remains hot, with both the PPI and CPI coming in above expectations. The headline CPI reading came in at 0.9% and was up 6.2% YoY, its largest 12-month increase since November 1990, while the PPI reading was 8.6%, the highest on record since 2010.

Meanwhile shares in Europe rose as continuing ultra-loose monetary policy and optimism about economic growth helped allay inflation concerns. While the markets initially pared expectations for interest rate increases after dovish comments from the ECB, higher-than-expected U.S. inflation caused a reversal.

Quarterly earnings season continued with ongoing strong results, as profit margins held up well despite higher commodity prices and supply chain disruptions in various industries.

Indices Performance

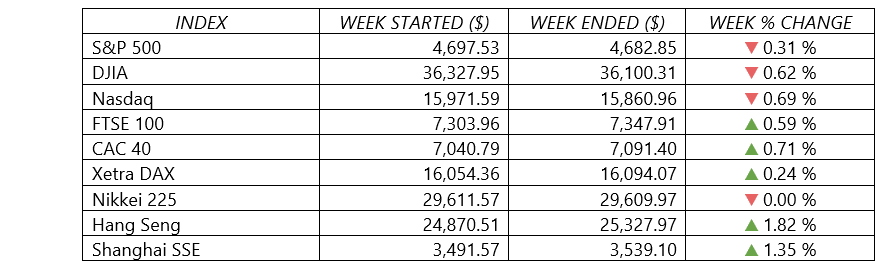

The S&P 500's eight-session winning streak and the Nasdaq Composite's 11-session winning streak was put to an end this week, as both declined less than 1%. Each of the U.S. major indexes retreated from record highs set the previous week.

Shares in Europe rose as continuing ultra-loose monetary policy and optimism about economic growth helped relieve inflation concerns.

Japanese equities generated flat returns following mixed sentiment. New details about the government’s upcoming fiscal stimulus package and perceptions that valuations were lagging U.S. peers provided some tailwinds for Japan’s stock markets during the week.

Chinese stock markets advanced amid speculation that Beijing would announce easing measures to help indebted property companies. Property sector is a key pillar of China’s economy. In previous week, cash-strapped developer China Evergrande Group once again averted a last-minute default for the third time in the past month. Meanwhile, Kaisa Group, which has the most offshore bonds of any Chinese developer after Evergrande, also approached default as the company reportedly informed creditors that it “may not be able to pay the coupons” on its bonds because of legal and cross-default issues domestically and offshore.

Oil Sector Performance

Oil market recorded its third consecutive weekly losses. The market grappled with a stronger U.S. dollar along with concern over increasing U.S. inflation, and after OPEC cut its 2021 oil demand forecast due to high prices. In a monthly report, the cartel of major oil producers cut its forecast by around 160,000 bpd, citing weaker demand in major consumers China and India, and an expected hit from high energy prices.

The prices also weighted after U.S. President Joe Biden said he asked the National Economic Council to work to reduce energy costs and the Federal Trade Commission to push back on market manipulation in the energy sector to reverse inflation. Some of the efforts to cut energy costs might include releasing more crude from the U.S. Strategic Petroleum Reserve (SPR). Wednesday's EIA figures showed the U.S. did release roughly 3.1 million barrels from the SPR — the largest one-week release since July 2017.

EIA figures also showed crude inventories rose by 1 million barrels in the week to Nov. 5, compared with analysts' expectations for an increase of 2.1 million barrels.

The decline, however, were less than last week, partly following the passage of the U.S. infrastructure bill and China's export growth, as well as supported following Saudi Arabia's state-owned producer, Aramco, that raised the official selling price for its crude.

Other Important Macro Data and Events

The upside inflation surprise forced U.S. Treasury yields higher, with the benchmark 10-year U.S. Treasury note’s yield ending the week around 1.58%. Earlier in the week, the 10-year yield fell to 1.41% during intraday trading.

Economic data released during the week were generally mixed. Following from the CPI measure, the U.S. job gains was overshadowed by inflation worries. The weekly jobless claims hit a new pandemic-era low of 267,000, and the Labor Department reported that there were 10.44 million job openings in October, declining modestly from the 10.63 million openings reported two months earlier. Friday’s report also showed that a record 4.4 million Americans quit their jobs in September. Also on Friday, University of Michigan reported that their gauge of consumer sentiment fell to its lowest level (66.8) in a decade due to inflation worries.

Eurozone industrial production fell in September, although the magnitude of the decline was less than expected due to increased output of non-durable consumer goods. Output shrank 0.2% sequentially, for an annual increase of 5.2%.

UK GDP growth slowed to a 1.3% rate in the three months ended September 30, down from 5.5% in the Q2 and below the 1.5% forecast by the Bank of England. Shortages of goods, labor, and components and rising coronavirus cases weighed on activity. However, the monthly rate of expansion in September was 0.6%—an improvement from 0.2% in August—due to increased health care activity, although data for previous months were revised lower.

China’s PPI accelerated to a greater-than-forecast 13.5% in October over a year ago, a 26-year high, from September’s 10.7% rise.

Cryptocurrencies setting another new all-time high last week. Bitcoin scaled to an all-time high of $68,990 on Wednesday, and ether, the second-biggest cryptocurrency by market value, also hit record peak when it went over $4,865. Enthusiasm for cryptocurrency adoption, fears about inflation, as well as the debut of the NYSE first Bitcoin ETF lent support to the asset class.

Gold prices also shines as inflation concerns provided a catalyst. The price of gold climbed to the highest level in more than five months.

What Can We Expect from the Market this Week

With inflation concerns looming large and the holiday shopping season approaching, the October Retail Sales report hitting on November 16 is likely to be watched more closely than usual. The last monthly report, covering September, showed that sales at retail stores, restaurants, and online sellers climbed a seasonally adjusted 0.7%.

Aside from the Retail Sales, another important U.S. economic data being released this week include the business inventories, industrial production and capacity utilization, Housing Market Index, Leading Economic Indicators index, and housing starts.

The earnings reports for the retail sector also high on expectation, with a large number of earnings reports due. In the week ahead, Walmart, Target, Home Depot and Lowe's all scheduled to reports earnings and post guidance for the holiday quarter.

On the geopolitical front, U.S. President Joe Biden and Chinese President Xi Jinping are expected to hold a virtual summit on November 15.

In oil report, the International Energy Agency, a Paris-based energy policy advisor to 29 countries and the European Commission, will release its closely watched monthly oil report on Tuesday. In its October report, the agency had raised its forecast for global oil demand for this year and the next because of a severe shortage of natural gas and coal supply and rising mobility trends. While last week, the OPEC had reduced its worldwide oil demand forecast. This puts the spotlight on IEA. Will it do the same?