PAST WEEK'S NEWS (Mar 21– Mar 27, 2022)

Stocks of Clever Leaves Holdings Inc. soared as of late Friday following reports indicating the U.S. House Rules Committee has scheduled a Monday afternoon meeting to prepare a federal marijuana legalization bill for floor action.

Clever Leaves is a leading multinational operator and licensed producer of pharmaceutical-grade cannabinoids. The company also reported its financial and operating results late Thursday for the Q4 and full year ended December 31, 2021. The firm increased its revenues in 2021 by 27% accumulating $15.4 million compared to $12.1 million in 2020.

Vallon Pharmaceuticals Inc. stock led the slip last week after the company reported its ADAIR drug that designed to treat ADHD, failed to meet its primary endpoints in a trial.

Stocks Performance

Stocks staged a mixed performance last week with investor risk appetite returning as markets continued to digest the progressing situation in Ukraine along with the growing expectations of U.S. Fed getting the steep interest-rate increases ahead.

Worries about an increasingly hawkish turn by the Federal Reserve seemed to weigh on equity sentiment early in the week, while prompting a sell-off in the bond market. On Monday, Fed Chair Jerome Powell repeated in a speech to the National Association for Business Economics that the central bank could deliver rate increases of larger than 25-bps at future meetings if policymakers deem it necessary to control inflation. Earlier in the day, however, Atlanta Fed President Raphael Bostic said that “elevated levels of uncertainty” have tempered his confidence that an “extremely aggressive rate path” is appropriate for the Fed.

Developments in Russia's war against Ukraine also remained on investors' radar. Heavy fighting continued north of Kyiv, and Ukrainian officials rejected a Russian demand that their forces in Mariupol surrender. Stocks seemed to gain some footing Thursday afternoon after an advisor to Ukrainian President Volodymyr Zelenskyy voiced “cautious optimism” on ceasefire talks.

The ongoing Russia-Ukraine conflict remained a supportive factor for oil and other commodities, explaining the outperformance in the materials sector where steelmakers and fertilizer producers led the way. Information technology stocks outperformed, helped by gains in Apple following news of analyst expectations for strong sales of the iPhone 13, though the sector faced some pressure on Friday as Treasuries widened this week's losses.

The yield on the benchmark 10-year U.S. Treasury note jumped by roughly 35 basis points over the week, mirroring a sharp drop in Treasury prices.

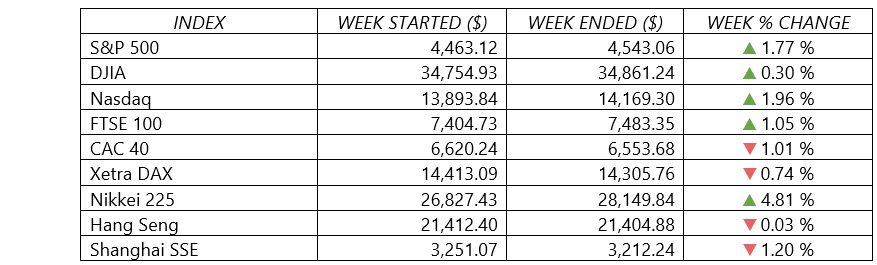

Indices Performance

The major U.S. stock indexes faced some volatility for the week, with the S&P 500 and Nasdaq were able to stage a modest rally, while the Dow underperformed.

Shares in Europe weakened amid the ongoing Russian invasion of Ukraine and the prospect of tighter monetary policy.

Japan’s stock markets rose over the week, with the Nikkei 225 Index gaining almost 5%. Sentiment was boosted by expectations of further economic stimulus and reassurances from the BoJ that it will maintain very accommodative monetary policies.

Chinese markets fell amid delisting fears for U.S.-listed Chinese companies arising from a simmering bilateral dispute over auditing standards. Reports of a worsening coronavirus outbreak across the mainland also depressed risk appetite. China counted more than 56,000 cases nationwide last week.

A Russian stock index fell on Friday, the day after recording gains on Thursday as the market partially reopened following as the country’s invasion of Ukraine reached the one-month mark. Russia has been slowly reopening equity trading after other countries imposed economic sanctions in response to the invasion.

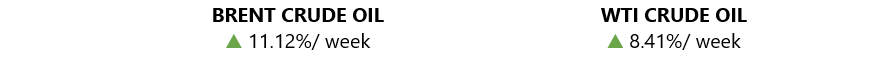

Crude Oil Performance

After modestly retreating the previous week, the price of crude oil benchmarks jumped to record for their first weekly gains in three weeks. Oil futures gains as the potential for more supply disruptions weighed on the market.

The benchmarks started the week lower after the European Union could not agree to impose an immediate oil embargo on Russia, with countries including Germany arguing that the bloc is too dependent on Russia's fossil fuels.

The prices were then supported throughout the week by disruption of Russian and Kazakh crude exports and after a government report showed U.S. crude inventories dropped. Stockpiles in the U.S. fell by 2.5 million barrels last week, while inventories from the U.S. Strategic Petroleum Reserve declined by 4.2 million barrels, according to data from the U.S. EIA. Market participants had expected a modest increase in supplies.

Meanwhile the data from the API industry group showed crude stocks fell by 4.3 million barrels for the week ended March 18.

Kazakhstan's Caspian Pipeline Consortium (CPC) terminal meanwhile had completely halted following storm damage. Russia's Deputy Prime Minister said oil supplies could be stopped for two months. The CPC pipeline carries about 1.2 million barrels per day of mainly Kazakh crude to a port on the Russian Black Sea coast.

The week ended with reports of the potential for another release of oil from the strategic reserve to cool markets.

Other Important Macro Data and Events

The yield on the benchmark 10-year U.S. Treasury note jumped by roughly 35 basis points over the week, mirroring a sharp drop in Treasury prices, sending it up to levels not seen since May 2019. After finishing the previous week at 2.15%, the 10-year yield jumped to 2.49% on Friday. At the end of 2021, the yield was just 1.51%.

Core eurozone bond yields also rose, following the high U.S. Treasuries after hawkish comments from Fed Chair Jerome Powell that raised expectations for more aggressive rate hikes. Against this backdrop, the yield on the German 10-year bund reached its highest level since 2018. UK gilt yields also mostly ended higher.

The week’s economic data had a mixed and arguably puzzling tone, with some data seeming to improve since the Russian invasion. Durable goods orders fell 2.2% in February, the first decline in five months and much more than the consensus expected fall of around 0.5%.

The U.S. housing market got some grim news entering the typically busy spring homebuying season, as a report released on Friday showed a decline in pending home sales for the fourth month in a row. Pending sales in February fell 4.1% compared with the previous month—a drop that came as mortgage rates extended a recent rise.

Conversely, IHS Markit’s gauge of manufacturing activity rose much more than expected in March and hit its highest level since September 2020, while its services gauge indicated the most activity since July 2021. Meanwhile, weekly jobless claims fell much more than expected and hit levels last seen in September 1969.

Eurozone business activity appeared to slow in March, with the composite PMI falling to 54.5 from 55.5 in February.

UK inflation hit a 30-year high in February, putting pressure on the Bank of England to continue raising interest rates. The consumer price index were 6.2% higher in February than a year earlier—below the latest 7.9% annual rate in the U.S., but the U.K.’s fastest annual rise since 1992. Wednesday’s U.K. inflation update came a few days after the nation’s central bank said it expects inflation to rise to around 8.0% in coming months.

On Thursday, the city of Brussels, Belgium, hosted emergency meetings for leaders of NATO, the Group of Seven (G7), and the European Council to discuss the conflict and consider new retaliatory measures directed at Russia. Western countries agreed at several summits to provide more military support for Ukraine, reinforce troops on European borders, and extend sanctions on Russian institutions, companies, and individuals. The economic measures included preventing the Russian central bank from selling its gold reserves to bolster the currency and pay for the invasion of Ukraine. EU leaders also noted focused on tightening existing sanctions and cracking down on evasion but stopped short of imposing additional curbs on Russian energy imports. The U.S. agreed to supply the EU with an additional 15 billion cubic meters of liquified natural gas this year, with the aim of reducing the bloc’s dependence on Russia.

Various news outlets indicate that Ukrainian resistance has stalled the Russian army’s advance, and some claim that Ukrainian forces are staging a counteroffensive in some locations. Nevertheless, Russian attacks over the last month have caused widespread damage, as well as the displacement of more than 3.5 million refugees, according to United Nations data.

Russia's rouble traded slightly higher in the week in Moscow following Russian President Vladimir Putin's vow to start selling gas to "unfriendly" countries in roubles. The yen meanwhile recorded its worst week in two years, pummelled by Japan's rising import costs and low interest rates. Commodity currencies were set for a second consecutive weekly gain on the dollar as export prices remain elevated.

Gold prices recorded a third weekly gain in four as slim material progress in Russia-Ukraine peace talks supported the safe-haven metal, although a spike in U.S. yields on fears of aggressive tightening measures dented bullion's appeal.

What Can We Expect from the Market this Week

The stock market is likely to face more twists and turns, as investors keep watching for the latest developments in the Ukraine-Russia crisis, hawkish U.S. monetary policy, shifts in Chinese economic policy, and ongoing ructions in commodity markets.

A monthly U.S. labor market update due out on Friday will show whether the strong growth recorded in February carried over into March. In February, the economy generated the strongest job growth in seven months, with 678,000 jobs added; the unemployment rate fell to 3.8%.

For the oil market, OPEC+ will hold a virtual meeting during which the group is expected to keep current production plans in place even with crude oil prices trading at a 14-year high, and the International Energy Agency warning on the impact of losing Russian oil.

Also on the economic calendar, another important economic data being released this week include JOLTS Job Openings, GDP, inflation, consumer confidence, hourly earnings growth, and PMIs.