PAST WEEK'S NEWS (April 18– April 24, 2022)

On the NASDAQ Composite, the biggest winner of the week was the autonomous vehicle technology company Cyngn Inc. After recently making its public debut, the company has launched a turnkey autonomous vehicle solution, called DriveMod Kit, containing all the advanced sensors and hardware components needed for AV technology integration.

Arqit Quantum Inc. led the decline for the week.

Stocks Performance

Equity markets fell on the week, on the concerns about rising rates and the Fed's hawkish mindset and weakening technical factors.

A strong start wasn’t enough to prevent the major stock indexes from falling for the third week in a row. The market had been on track for a positive week before Friday in particular saw downside volatility, owing to expectations that the Federal Reserve may aggressively raise interest rates over the next three meetings, based on Thursday’s public comments from Jerome Powell. The Fed chair said the central bank is likely to raise its benchmark rate by a half percentage point at its meeting on May 4.

Aside from the volatility in the equities, the recent pullback in bonds also capturing more of the attention, as the surge in interest rates has driven abnormal. The broad increase in rates reflects the progressing inflation environment, as the YoY increase in U.S. consumer prices reached 40-year highs. While this is not completely surprising given the ongoing impacts of the pandemic, inflation pressures have received an unanticipated boost from the commodity-price effects stemming from the war in Ukraine. The 10-year yield rapidly approached 3.00%, hitting 2.97% at its highest in 3-1/2 years, before ending the week eight basis points higher at 2.91%.

The earnings season so far has been somewhat balanced between some sizzling results such as of Tesla and major disappointments, with Netflix tanked 35% the day after reporting a decline in subscribers.

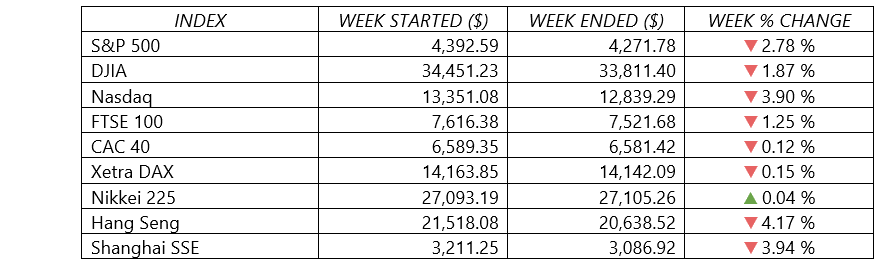

Indices Performance

With its heavy weighting in technology stocks, the NASDAQ trailed the S&P 500 and the Dow by wide margins for the third consecutive week. Shares in Europe also fell, amid ongoing concerns about the war in Ukraine and increased hawkishness among central bank policymakers.

Chinese markets slid as investors worried about the economic fallout from coronavirus lockdowns after officials said tough restrictions would remain in place, even with case numbers have been slowly declining. PBOC keeps interest rates steady, leaving the 1-year loan prime rate and the five-year rate unchanged, that raised expectations for further easing measures. Japan’s stock markets rose modestly over the week.

Crude Oil Performance

Oil prices dropped more than 4% for the week, burdened by the prospect of rate hikes, weaker global growth and COVID-19 lockdowns in China hurting demand, even as the EU weighed a ban on Russian oil.

Concerns about the Ukraine conflict stoking inflation and denting economic growth dominated trading in the second half of the week, with the IMF slashing its global growth forecast by nearly a full percentage point. Adding to negative sentiment for oil, comments from U.S. Federal Reserve Chairman Jerome Powell on Thursday meanwhile pointing to aggressive rate increases which drove up the dollar and makes oil more expensive for buyers holding other currencies.

But all of that comes in a tight market, which could face even shorter supply if the European Union goes ahead with a ban on Russian oil.

Crude inventories fell by 8 million barrels in the week ended April 15 to 413.7 million barrels, the Energy Information Administration said on Wednesday. U.S. gasoline stocks meanwhile fell by 761,000 barrels in the week to 232.4 million barrels. Distillate stockpiles, which include diesel and heating oil, fell by 2.7 million barrels to 108.7 million barrels, hitting levels not seen since May 2008.

Other Important Macro Data and Events

Benchmark US 10-year Treasury yields extended gains on the back of Powell’s comments who took a hawkish tone on tightening policy, cementing the view that the U.S. central bank will hike interest rates aggressively as it fights soaring inflation.

On Thursday, the yield of the 10-year U.S. Treasury bond briefly climbed as high as 2.95%; and closed on Friday eight basis points higher at 2.91%. The 2-yr yield, which is sensitive to expectations for the fed funds rate, climbed 27 basis points to 2.72%.

Gold prices recorded its first weekly loss in three, pressured by the strength in U.S. Treasury yields and the dollar.

Markets also reeling comments by ECB officials that the central bank might start hiking euro zone rates as early as July. German two-year yields hit an eight-year high. Speaking at the annual IMF/World Bank meeting, ECB President Christine Lagarde reiterated that its asset purchase program will conclude in the Q3, and that incoming data will determine interest rate moves.

Emmanuel Macron has won France's presidential election, fending off a historic challenge from far-right candidate Marine Le Pen during Sunday's runoff vote. Macron took 58.55% of Sunday's vote, making him the first French leader to be re-elected in 20 years. He and Le Pen advanced to the runoff after finishing in first and second place, respectively, among 12 candidates who ran in the first round on April 10.

Shanghai remained locked down as part of the government’s effort to contain China’s biggest COVID-19 outbreak of the pandemic, hampering commerce in a city that’s a global hub for manufacturing and exports. While case numbers have been slowly declining amid the lockdown of recent weeks, tight restrictions remained in place.

What Can We Expect from the Market this Week

The bigger focus may be on Federal Reserve expectations, with FOMC members will be in a pre-meeting blackout period from giving talks, but analysts will continue to buzz.

Economic calendar will include updates on new home sales, durable goods orders, pending home sales, GDP, trade balance, and the Markit PMI index. A Q1 GDP report scheduled to be released on Thursday will show whether the U.S. economy’s strong late 2021 momentum carried over into early 2022. In the previous quarter, the economy expanded at an annual rate of 6.9%; for full-year 2021, the rate was 5.7% on an inflation-adjusted basis—the fastest growth since 1984.

Tech giants will be pushed into the spotlight with Apple, Amazon, Microsoft, Alphabet, Meta Platforms (FB), and Intel all on the earnings stage.