PAST WEEK'S NEWS (May 2 – May 8, 2022)

Stocks Performance

Most of the major benchmarks endured a fifth consecutive week of losses as interest rate and inflation worries continued to weigh on sentiment.

The week began with modest gains on Monday and Tuesday before rallying around higher on Wednesday as the U.S. Federal Reserve announced its latest policy moves of rate hike and a balance sheet reduction plan.

As expected, the U.S. Federal Reserve approved an interest-rate increase of half a percentage pointꟷtwice as big as March’s quarter-point hike. While further increases are still to come, Chair Jerome Powell acknowledged that the central bank wasn’t considering sharply raising rates in increments of 75-bps hike, which lifted the S&P 500 to a one-week high.

Whatever positives were gleaned from Wednesday's rally, however, were forgotten by the end of Thursday's session, which saw the major averages cough up their gains from the previous day while crude oil remained resilient, and the U.S. dollar index pushed to a fresh 20-year high. Friday's session was also uninspiring as the day went on.

Quarterly earnings continued pouring in during the past week, but even positive results were often met with selling amid concerns about headwinds from soaring inflation.

With China’s COVID-19 lockdowns and the war in Ukraine continuing to fuel inflation, several of the world’s biggest central banks joined the U.S. Fed in lifting interest rates. Among them was the Bank of England, which said it expects U.K. inflation to climb to a 10% annual rate.

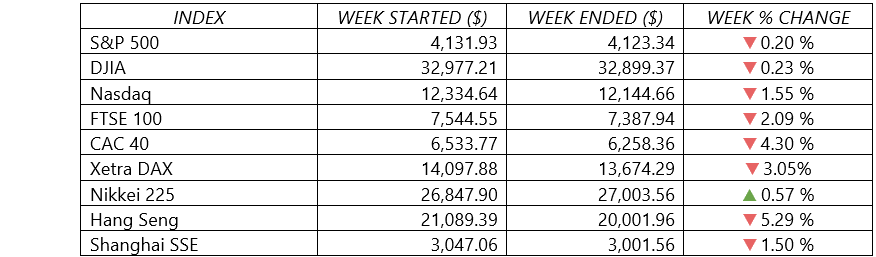

Indices Performance

The major U.S. indexes fell for the fifth week in a row after a rapid shift in sentiment in U.S. Federal Reserve’s latest policy moves sent stocks reeling on Thursday.

Shares in Europe also tumbled amid fears that central banks may have to step up their efforts to control inflation, potentially increasing the risk to economic growth. Ukraine conflict added to the uncertainty.

In a holiday-shortened week (the market was closed May 3‒5), Japanese equities rose modestly. The Nikkei 225 Index gained 0.5% despite the volatility induced by the U.S. Fed’s decision to implement the first 50-bps interest rate rise since 2000.

Chinese markets meanwhile fell as Beijing showed no sign of relaxing its zero-tolerance approach to the coronavirus, raising worries about the economic cost of widespread lockdowns.

Crude Oil Performance

After cooling off through most of April, the price of U.S. crude oil rebounded on Friday to more than $110 per barrel, the highest level since late March.

Concerns about global economic growth were shrugged off as worries about tightening supplies underpinned prices ahead of an impending European Union embargo on Russian oil. The EU, the world's largest trading bloc, spelled out some of the details of its plan to phase out imports of Russian oil, heightening concerns about supply, offsetting demand worries in top importer China. European Commission President Ursula von der Leyen proposed a phased oil embargo on Russia over its war in Ukraine. The sanctions proposal will need unanimous backing by the 27 EU countries to take effect. It also proposes to ban in a month's time all shipping, brokerage, insurance, and financing services offered by EU companies for the transportation of Russian oil.

Meanwhile on supply side, ignoring calls from Western nations to hike output more, OPEC+ agreed to raise June production by 432,000 barrels per day, in line with its plan to unwind curbs made when the pandemic hammered demand.

Chinese demand concerns capped further gain. Authorities in Beijing are continuing to crack down on COVID-19 outbreaks and trying to avert the city-wide lockdown that has shrouded Shanghai for a month.

Other Important Macro Data and Events

Prices of government bonds fell, sending the yield of the 10-year U.S. Treasury Bond surging late in the week. The yield jumped to 3.13% on Friday, the highest level since November 2018. As recently as mid-2020, the yield was around 0.50%.

The yield curve continued its recent steepening trend as long-term inflation expectations—and long-maturity Treasury yields—increased, and more investors eliminated bets that the yield curve would flatten.

The dollar index recorded a fifth winning week versus major peers. It touched 103.94 on Thursday for the first time in two decades.

Core eurozone government bond yields also rose mostly in tandem with U.S. Treasury yields. UK gilt yields fell after the Bank of England raised rates but cut its forecast for economic growth and warned of a potential recession.

The BoE raised its key interest rate 25-bps to 1.0%, the highest level since 2009, seeking to dampen inflation. However, the central bank delayed reducing its stockpile of bonds bought under its asset purchase program. The bank also highlighted the potential of the UK slipping into a recession by year-end and warned that inflation could exceed 10% in the Q4. These developments pushed the British pound to a two-year low.

Chinese markets fell as Beijing showed no sign of relaxing its zero-tolerance approach to the coronavirus, raising worries about the economic cost of widespread lockdowns. Many of Shanghai’s 25 million residents remain under varying degrees of lockdown even though the city started to ease restrictions as infections have declined. Meanwhile, Beijing announced mass testing and increased restrictions in response to a growing outbreak.

Gold prices fell for a third straight week, weighed down by a robust dollar and rising yields.

What Can We Expect from the Market this Week

A U.S. Consumer Price Index report scheduled to be released on Wednesday will show whether the U.S. economy got any relief in April from surging inflation. A month earlier, the government reported that inflation accelerated in March at an 8.5% annual rate—the highest since 1981—eclipsing the previous month’s 7.9% figure.

Another important economic data being released this week also include wholesale inventories, Federal budget, PPI, unemployment claims, consumer sentiment.

For oil market watcher, IEA market report and OPEC’s monthly report will be on Thursday.

The earnings calendar features trips by 3D Systems, Coinbase Global, and Disney into the earnings confessional.