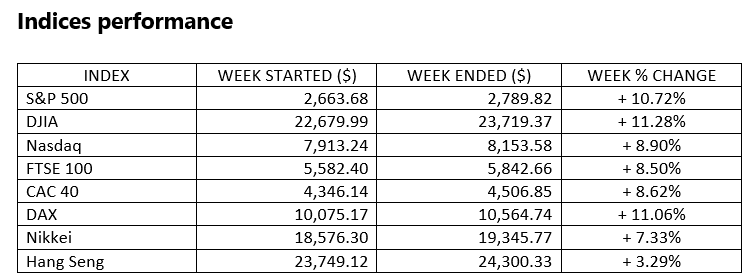

Stocks performance (U.S. stocks) Stocks recorded one of their best weekly gains on record, as some encouraging trends in global coronavirus infection and hospitalization rates lifted hopes that stay-at-home orders might soon be eased. The most beaten-down asset classes fared best, with small-caps outperforming large-caps and slower-growing value shares outpacing higher-valuation growth stocks. The same was true among sectors of the S&P 500 Index, with energy shares and industrial services shares regaining some lost ground, while consumer staples stocks lagged. The gains brought the large-cap indexes and the technology-heavy Nasdaq Composite Index within 20% of their February high, out of bear market territory.

The most outperformed weekly stocks by sectors was led by Process Industries sector at 16.42%, followed by Commercial Services (15.58%), Consumer Durables (15.08%) and Finance sector (14.92%). Meanwhile, the weakest sectors were the Communications sector (4.34%), Energy Minerals (5.57%), Health Technology (7.42%) and Consumer Non-Durables sector (8.07%).

U.S. markets were closed Friday in observation of the Good Friday holiday.

The strongest were in some that had been hit hardest year-to-date, including consumer discretionary, health care, and real estate. The energy sector was an exception, as crude prices remained in flux. The consumer staples and communications services sectors also underperformed.

Oil prices dipped as a landmark agreement by OPEC and its allies to slash output by a record amount failed to give investors any cause for lasting optimism about the economic outlook. OPEC+ has made the largest oil output cut in history. This sustainable output cut strategy will last until April 2022, starting with a reduction of 10 million bpd during May and June.

Market-moving News Climbing back.Although the stock market’s recent gains have gone a long way to recover ground, the major indexes remained far short of a full comeback. As of Thursday’s close, S&P 500 was up nearly 25% from a recent low on March 23, but it was almost 18% below its record high set about a month earlier.

Small-cap surge.

Small-cap stocks had a huge week, outpacing large-cap indexes by wide margins. A small-cap benchmark, the Russell 2000 Index, jumped nearly 19%. Since a recent low on March 18, the index was up 26%.

Fed's latest economic stimulus announcement.

The U.S. Federal Reserve took another step aimed at stabilizing the economy, extending $2.3 trillion in financing to small and midsize businesses as well as state and municipal governments. The Fed on Thursday also expanded previously announced corporate lending programs to include classes of higher-risk debt that had been excluded from an earlier initiative.

Unemployment upheaval.

Total of 6.6 million benefits applications filed in the latest week―in addition to more than 10.0 million total claims over the previous two weeks. At the end of March, a record 7.5 million Americans were receiving unemployment benefits.

Losing confidence.

A gauge of U.S. consumer sentiment fell abruptly to its lowest level since 2011. Preliminary results released Thursday from a monthly survey by the University of Michigan showed a decline from an index reading of 89 to 71, the biggest-ever month-to-month slide.

Other important macro data and events

After a marathon meeting that lasted more than nine hours, OPEC and OPEC+, on Thursday agreed to historic production cuts. The proposed production cuts are as follow:

- 10 million barrels per day in May and June.

- 8 million barrels per day from July through the end 2020.

- 6 million barrels per day beginning in January 2021 until April 2022.

The U.S. dollar slipped lower, volatility indices dropped, yields on government bonds climbed higher globally, and gold reclaimed recent liquidity-driven losses.

Dividend drop-off. For the first time in more than a decade, net changes to dividend payments by companies in the S&P 500 were negative in this year’s first quarter, with dividend cuts exceeding increases, according to S&P Dow Jones Indices. In March alone, 13 companies announced dividend cuts, and many more such announcements are expected in coming weeks as companies report first-quarter earnings.

EU finance ministers agreed on Friday on a €540 billion stimulus relief package via the European Stability Mechanism, meant to support member stated.

To date, number of confirmed worldwide cases for COVID-19 pandemic has now reached more than 1,853,000 today, affecting 210 countries and territories around the world and 2 international conveyances, recording more than 115,000 fatality globally.

The US has become the epicentre of the coronavirus pandemic, with over 560,000 contagions and the death toll above 22,000, surpassing that of Italy. The crisis in the American country continues to steepen. In Italy and Spain, the curves seem to be flattening, although the numbers are still outrageous. The economic comeback is not yet at sight.

What We Can Expect from The Market This Week

We have closed the first quarter of 2020. It has been difficult months for the market because while most of the investors were aware of being close to an end of the economic cycle, nobody could have expected such a shock on the economy due to the Coronavirus pandemic. As a matter of fact, in March financial markets have been uniquely driven by news and updates about the pandemic situation: from the equity market to FX and commodities, all major movements have been driven by the COVID-19.

OPEC+ has made the largest oil output cut in history. It is still too early to know if the agreed 10 million barrel per day output cut from OPEC+ producers will be enough to balance the demand deficit - in the short term at least. However, over the medium term, we will likely see a more tangible impact as the cuts gradually absorb the glut as lockdowns are lifted around the world, and as inventories deplete.

It has been another harrowing week. While it looks like COVID-19 infections are peaking in many places around the world, the hoped-for V-shaped recovery from the economic damage it caused is looking less likely.