Stocks Performance (U.S. Stocks)

Global stock markets climbed as investors grew more confident in the economic rebound and discounted the likelihood of further business closures due to increasing numbers of coronavirus cases.

Equities jumped worldwide, primarily in response to talk of more U.S. fiscal stimulus and Federal Reserve pledge to begin buying a broad portfolio of U.S. corporate bonds. Sentiment got a positive boost from surprisingly strong economic data in the US and Europe, as well as reports that China plans to accelerate purchases of American farm goods to comply with the phase one trade deal. Improved investor confidence also reflected in higher oil prices.

By sectors, the most outperformed weekly stocks were led by Health Technology at 4.71%, followed by Technology Services at 3.90%, Retail Trade at 3.90%, and Consumer Durables (3.13%). Meanwhile, the weakest sectors were from the Energy Minerals sector (-1.65%), Utilities (-1.03%), Communications (0.18%) and Finance sector (0.24%).

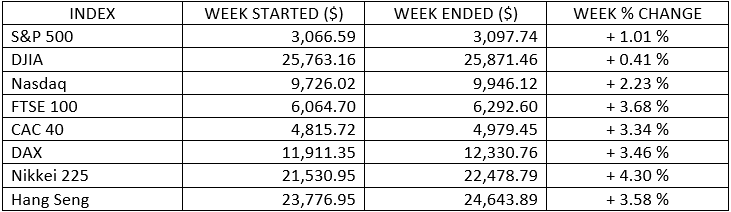

Indices Performance

The S&P 500 has ripped more than 41% higher since hitting an intraday low on March 23. For the quarter, the broader market index is up nearly 20%. Technology-heavy Nasdaq Composite Index fared best and briefly moved close to the all-time intraday high it established on June 10.

News of the Federal Reserve buying corporate bonds along with a record spike in U.S. retail sales lifted sentiment on Wall Street last. Expectations of an economic recovery also pushed up stock prices. However, the number of newly confirmed coronavirus cases continues to increase, raising questions about the recovery.

Oil Sector Performance

Oil prices rebound, helped by signs that major oil-exporting nations were adhering to previously agreed production cuts as well as optimism for increased global demand.

Market-Moving News

Back on Track

After decline the previous week, major U.S. stock indexes resumed their previously upward momentum, rising around 1% to 4%. Most of the gains came early in the week.

Oil Around $40 Again

With more vehicles returning to the road and oil companies cutting production, price of U.S. crude oil briefly touched $40 per barrel on Friday, up from a recent low of $18 in late April.

Retail Report Jump

U.S. retail sales posted a record gain in May, jumping nearly 18%, as thousands of stores reopened after coronavirus-related restrictions were eased across much of the nation. Though, May’s retail surge followed two months of record declines, and last month’s sales were still down 8% from February.

Fed's Corporate Bond Buying Decision

U.S. Federal Reserve announced that it will now buy individual corporate bonds, in addition to the bond exchange-traded funds that it already had been purchasing under a program introduced in March.

NASDAQ Flirts with 10K

Nine days after eclipsing 10,000 for the first time, NASDAQ briefly climbed back to that level in intraday trading on Friday, extending the index’s run of year-to-date outperformance.

China's Market Comeback

A key Chinese stock index on Friday became one of just a few international indexes to enter positive territory on a year-to-date basis. China’s market recently gained momentum after reeling early in the year amid the first outbreak that triggered the coronavirus pandemic.

Real Estate Economic Reports

Scheduled for Monday and Tuesday on existing home sales and new home sales in May will be among this week’s most closely watched economic reports. The data could help reveal how much of an impact the coronavirus pandemic has had on the typical surge in springtime homebuying activity.

Other Important Macro Data and Events

The reopening narrative was back in play, evidenced by the 10% gain in WTI crude futures ($39.74/bbl, $3.50, +9.7%), but it did run into some resistance at the end of the week.

Economic were warned that rebound in the second half of the year will likely be slower than initially expected due to the continued spread of the coronavirus. Arizona, Florida, and California reported noticeable daily increases in coronavirus cases, and it was reported that Apple (AAPL) will temporarily re-close some stores again due to COVID risks.

Report on initial jobless claims for the week ending June 13 remained elevated at 1.508 million.

U.S. Treasuries traded in a relatively narrow range this week and closed near their starting positions. The 2-yr yield increased one basis point to 0.19%, and the 10-yr yield was flat at 0.70%. The U.S. Dollar Index gained 0.4% to 97.67

What We Can Expect from the Market this Week

Governments look set to proceed with reopening, but the real driver of growth will be behavioural normalization and that is very likely to be impended by the steady negative coronavirus news flow.

Scheduled for Monday and Tuesday are existing home sales and new home sales in May. The data could help reveal how much of an impact the coronavirus pandemic has had on the typical surge in springtime homebuying activity. In April, existing home sales plunged nearly 18%.

Other important economic data being released include new home sales and existing home sales on Monday and Tuesday, the preliminary Purchasing Managers' Index for June on Tuesday, durable goods orders and GDP Q1 on Thursday and personal income and spending and Univ. of Michigan Consumer Sentiment Index on Friday.