PAST WEEK'S NEWS (February 26 – March 01, 2024)

The US economy reported continued growth of 3.2% in Q4 2023, possibly driven by strong consumer spending, which will be confirmed today. Despite a weak start in 2024 due to bad weather, economists remain optimistic, citing a potential rebound and tax refunds. While core inflation rose slightly, it remains near the Fed's target, while credit spreads are closely watched for estimations of Fed rate cut timing. Business investment in structures grew, but equipment investment contracted based on durable goods orders, which grew slower last Tuesday. Though the goods trade deficit widened, exports contributed positively to GDP growth.

In a bid to diversify its AI partnerships in this ever-expanding AI boom, Microsoft announced partnership with French startup Mistral AI, a company established just a year ago. While the financial details remain undisclosed, the deal dwarfs Microsoft's billion-dollar investment in OpenAI. Mistral, which no longer boasts an "open-source" approach under Microsoft, unveiled its flagship model, "Mistral Large," exclusively on Microsoft's Azure cloud. This multilingual model, claiming top-tier reasoning capabilities, rivals OpenAI's GPT-4 in cost effectiveness. Additionally, Mistral also released "Le Chat," a user-friendly AI assistant designed to showcase its diverse AI applications and rival the wildly popular ChatGPT.

INDICES PERFORMANCE

The major U.S. stock indexes ended mostly higher last week, supported by major company’s earnings. The S&P 500 rose 0.87% to close at 5137.07, up from its open of 5093.00. The Dow Jones Industrial Average fell -0.15% to finish at 39087.39 compared to its starting point of 39144.79. The tech-heavy Nasdaq gained 1.85% to 18302.91 after opening the week at 17970.21. Super Micro Computer Inc. and Deckers Outdoor Corp. replaced Whirlpool Corp. and Zions Bancorporation in the S&P 500, leading to a rally in the shares of the newly added companies after hours on Friday. Market waits for its rebalance which is expected on the third Friday of March.

In Europe, the major indexes were mixed. The UK's FTSE 100 increased 0.11% to close at 3939.75 compared to its open of 3935.45. France's CAC 40 fell -0.20% to end the week at 7934.18 after opening at 7950.15. Germany's XETRA DAX rose 1.94% to settle at 17735.07 from its starting point of 17396.74. Investors welcomed positive corporate earnings despite concerns about stubbornly high core prices. Rate-sensitive stocks led the charge, driving gains in sectors like real estate and technology.

Asian indexes were mixed but mostly higher on the week. Japan's Nikkei 225 surged 1.50%, closing at 39910.75 versus its open of 39320.64 hovering near the 40,000 mark, boosted by Wall Street's reaction to US inflation data, despite manufacturing challenges and corporate changes. Hong Kong's Hang Seng fell -0.57% to finish at 16589.45 from its starting level of 16684.96. China's Shanghai Composite rose 0.83%, closing at 3027.02 compared to its open of 3002.12. The Chinese market is expected to receive additional economic stimulus ahead of the annual session of Parliament, in lieu of its weak manufacturing data. Traders are optimistic about potential measures to support the economy, particularly in sectors like technology and consumer goods.

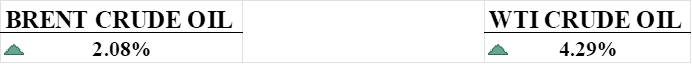

CRUDE OIL PERFORMANCE

OPEC+ extended production cuts by 2.2 million barrels per day into the second quarter, aiming to prop up oil prices. This surprised analysts, especially with Russia's additional cuts, which may be the core reason for last week gain. The move comes despite concerns of slowing global economic growth and rising output from producers outside the group. The decision indicates OPEC+ is cautious about increasing supply too quickly, potentially keeping prices higher. Oil prices are expected to rise on this news, after already gaining over 8.5% this year.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. construction spending unexpectedly fell in January, with a decline of 0.2%, driven by weaker outlays on public projects despite a modest increase in private homebuilding. The drop in spending reflects the ongoing challenges in the housing market, with tight supply supporting demand while higher mortgage rates deter some potential buyers, particularly first-time buyers, from entering the market.

Japan's manufacturing sector saw its sharpest contraction in over three years, reflecting weakening demand both domestically and internationally. This contraction, along with ongoing challenges like production delays and slower export sales, suggests continued economic struggles for Japan, which fell into recession in the final quarter of last year.

What Can We Expect from The Market This Week

US Nonfarm Payrolls: key indicator that measures the state of employment in the economy, excluding certain sectors like farming and government. The U.S. economy added 353,000 jobs in January, with softer expectations in February, while unemployment remained steady at 3.7%.

ECB Interest Rate Decision: The European Central Bank has maintained its key interest rates unchanged since September 2023, with the main refinancing operations, marginal lending facility, and deposit facility rates at 4.50%, 4.75%, and 4.00%, respectively. In related news, ECB officials emphasised the need for more evidence of inflation returning to their 2% goal before considering rate cuts.

Eurozone GDP Q4: The Eurozone economy stabilised in Q4 2023, although in a technical recession according to revision, with a slight GDP contraction compared to the early quarter report of economic stagnation. The ECB interest rate hikes have tightened financial conditions in its fight against inflation, reducing it from 10.6% in October 2022 to 2.9% in December.

German Factory Orders: It refers to the total number of domestic and foreign purchase orders received by manufacturers in Germany. Factory orders saw an unexpected surge, with new orders jumping 8.9% MoM, the highest since August 2020. This growth was largely driven by big-ticket items, although orders for motor vehicles and chemical products declined.

JOLTs Job Openings: insights into the U.S. labour market that measure the number of job openings and offer a view of labour demand and turnover within the economy. Job openings are up slightly to 9.026 million in December 2023, with softer expectations of 8.895 million in February. Worsened consumer confidence could see the forecast met and could lead to a decline in the U.S. dollar index.