PAST WEEK'S NEWS (April 29 – May 03, 2024)

The Federal Reserve met and has decided not to lower interest rates this time around, citing reaccelerating inflation as a dangerous territory that may hurt confidence if rate cuts were made earlier, which was the trajectory before entering this year. Treasury yields were down slightly, as there is no significant hawkish tone to any rate hike that was endorsed by some Fed members weeks ago. However, the Fed has also announced a reduction in quantitative tightening, from $95 billion to $60 billion per month, signalling a shift towards easier monetary policy. As an analyst suggested, this current cycle is not quantitative easing, but not quantitative tightening either, as fed tries to achieve duration-neutral balance.

The U.S. government and human rights organizations have raised concerns about forced labour and human rights abuses against Uyghurs and other Muslim minorities in China's Xinjiang region. A U.S. Labour Department official stated that it is impossible to conduct independent human rights audits in Xinjiang, making it irresponsible for international companies to operate there. China denies these allegations, claiming vocational training centres aimed to curb terrorism and radicalism. However, experts say alleged mass internment of Uyghurs peaked in 2018, and abuses have continued with labour transfers becoming more prominent.

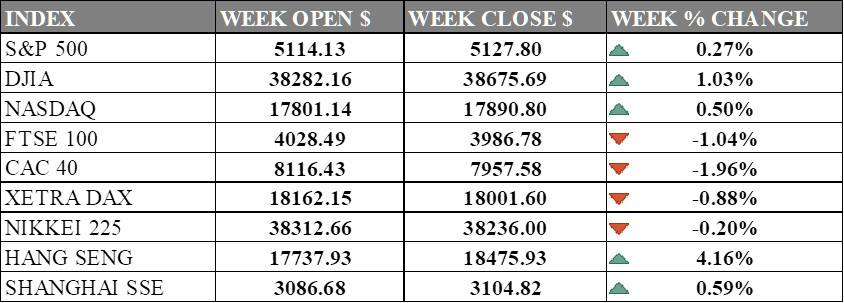

INDICES PERFORMANCE

The major U.S. stock indexes experienced mixed performance although it posted gains across the board last week. The S&P 500 rose 0.27% to close at 5127.80, up from its open of 5114.13. The Dow Jones Industrial Average gained 1.03% to finish at 38675.69 compared to its opening level of 38282.16. The Nasdaq also rose 0.50% to 17890.80 after opening the week at 17801.14. Most of the gain is attributed to Apple as it rose 6% on the day that it announced huge stock buybacks program. Although its optimism all around, it is a warning sign for others like Warren Buffet that have been cutting his apple holdings.

In Europe, the major indexes saw declines. The UK's FTSE 100 fell 1.04% to close at 3986.78 compared to its open of 4028.49. Germany's XETRA DAX dropped 0.88% to settle at 18001.60 from its starting point of 18162.15. France's CAC 40 declined 1.96% to end the week at 7957.58 after opening at 8116.43. The European market were declining as construction sector likely will remain in recession and there won’t be residential investment recovery. However, private consumption and exports growth is expected to improve.

Asian markets had a mixed performance. Japan's Nikkei 225 dipped 0.20%, closing at 38236.00 versus its open of 38312.66 although intervention were made in their currency market that saw a huge single day drop. Hong Kong's Hang Seng surged 4.16% to finish at 18475.93 from its starting level of 17737.93. China's Shanghai Composite gained 0.59%, closing at 3104.82 compared to its open of 3086.68. China is on full stimulus mode as China Development Bank extended 104 billion yuan in loans, expending on infrastructure projects. Manufacturing and services activities are also in expansion, an indicator from private sector shown.

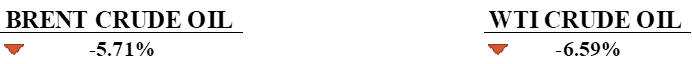

CRUDE OIL PERFORMANCE

Crude oil prices have been pressured by weakening demand, with Brent crude slipping below $85 per barrel. This decline is attributed to hopes of a ceasefire in Gaza and a sharp rise in U.S. crude oil inventories. An unexpected surge in U.S. crude oil inventories last week triggered the price slide and the continuation this week is likely to be influenced by developments in the Middle East, while upcoming fundamental data is expected to support prices. China's customs authority is set to publish trade balance figures on Thursday. The country remains the most important driver of demand this year, with demand dynamics normalizing.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. job growth slowed more than expected in April, with nonfarm payrolls increasing by 175,000 jobs, the fewest in six months. The unemployment rate rose to 3.9% from 3.8% in March but remained below 4% for the 27th straight month.

Financial markets increased their bets on a September rate cut by the Federal Reserve and expected two rate cuts this year, instead of just one. However, some economists believe that if job reports continue to show cooling in labour market activity, the Fed may start easing policy as early as July.

What Can We Expect from The Market This Week

BoE Interest Rate Decision: In the last meeting, the Bank of England's Monetary Policy Committee voted in a rare three-way split to hold interest rates at 5.25%, a 16-year high, which was in line with City forecasts. The BoE hinted that the next move in interest rates would likely be downward, forecasting that inflation would fall below 2% within months.

German Industrial Production: It is projected to decline by 1.5% in 2024 compared to 2023, according to the president of the Federal Association of German Industry (BDI) in April 2024, citing factors like higher energy prices, interest rate hikes, supply chain disruptions, and lingering impacts of the pandemic.

UK GDP Q1: The UK economy is predicted to return to growth in the first quarter of 2024, with GDP rising by 0.2% in January after contracting in the previous quarter; an escape from the short recession.

China CPI April: China's consumer inflation cooled more than expected in April 2024 to 0.1% year-on-year, down from 0.7% in February, while producer prices fell 2.8%, suggesting persistent deflationary pressures that could prompt additional economic stimulus measures.

RBA Interest Rate Decision: The Reserve Bank of Australia held the cash rate unchanged at 4.35% in its March 2024 meeting, noting that inflation remains high but continues to moderate. The RBA gave no clear indication of future rate moves, stating it needs to be confident inflation is sustainably moving to the target range before considering rate cuts, with analyst consensus pointed towards the status quo.