PAST WEEK'S NEWS (September 30 – October 4, 2024)

A massive dock workers' strike erupted Monday across 36 East and Gulf Coast ports, throwing a wrench into 60% of America's container trade as labour negotiations crumbled over pay and automation concerns. Smart retailers saw the storm coming and padded their inventories, creating a buffer against immediate shortages for most goods, though banana lovers might need to pivot to apples. Each idle day at the ports fans the flames of supply chain chaos and could spark price inflation, but political pressure cookers near election season make a two-week resolution likely. The aftermath will ripple through mid-November as ports tackle the container backlog, with attempts to bypass the bottleneck via West Coast shipping routes proving both costly and impractical. Union leader Harold Daggett, representing 45,000 workers, is determined to secure a 77% wage increase for the next 6 years.

The U.S. is heading toward an inevitable economic event known as the "Great Melt Up," where inflation is expected to re-accelerate sharply primarily due to the national debt crisis, which has surpassed $35 trillion in 2024, with growing interest payments accounting for 20% of the government's income. As borrowing continues to rise, the U.S. government is forced to prioritise inflation over deflation to manage the debt, which will worsen wealth inequality. The government relies heavily on tax revenue, but spending outpaces income by trillions, creating a house of cards that can only be temporarily sustained by cutting interest rates. Even if a technological breakthrough boosts productivity, inflation remains the best bad option for survival.

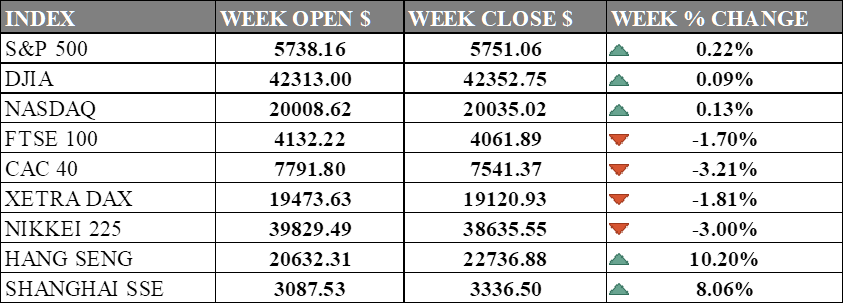

INDICES PERFORMANCE

Wall Street recorded modest gains this week, with all major US indices showing slight upticks. The S&P 500 rose 0.22% to close at 5,751.06. The Dow Jones Industrial Average saw a minimal increase of 0.09%, finishing at 42,352.75, while the tech-heavy Nasdaq edged up 0.13% to close at 20,035.02. These modest market gains suggest cautious investor sentiment across various sectors, despite ongoing discussions about the size of potential future rate cuts.

In contrast, European markets experienced significant declines. The UK's FTSE 100 fell 1.70%, closing at 4,061.89. France's CAC 40 saw a substantial 3.21% decrease, closing at 7,541.37. Germany's DAX also declined, falling 1.81% to end at 19,120.93. European markets underperformed their US counterparts this week, possibly reflecting regional economic concerns and geopolitical tensions.

Asian markets presented a mixed picture, with stark divergences between different regions. Japan's Nikkei 225 saw a considerable decline, falling 3.00% to 38,635.55. However, Chinese markets showed remarkable strength, with Hong Kong's Hang Seng Index posting an impressive gain of 10.20%, closing at 22,736.88. The Shanghai Composite in mainland China also experienced a significant surge, rising 8.06% to close at 3,336.50. These substantial gains in Chinese markets suggest growing investor confidence in China's economic outlook and recent stimulus measures, while Japanese markets faced headwinds.

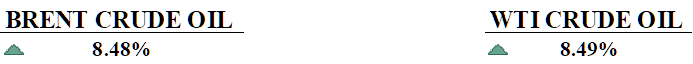

CRUDE OIL PERFORMANCE

Oil prices are on the rise last week, with Brent and WTI up 8% as tensions grew in the Middle East. Prices eventually fell Monday as traders took profits. Markets monitoring closely Israel's response to Iran's attack, though Biden discouraged strikes on oil facilities. Oil inventories are at lows, but OPEC+'s capacity of 7 million barrels per day could offset supply disruptions from conflict. ANZ Research noted oil markets react less to events than before. OPEC+ production increases and China's recovery status limit price gains despite the Middle East situation.

OTHER IMPORTANT MACRO DATA AND EVENTS

US employment growth exceeded expectations in September, with 254,000 jobs added and the unemployment rate falling to 4.1%. The strong labour market limit bets on a large interest rate cut by the Federal Reserve, shifting expectations toward a smaller, quarter-point reduction.

Japan's service sector grew for the third consecutive month in September, but the pace slowed slightly, with confidence dipping due to manufacturing weakness, according to a private survey. The service PMI fell to 53.1 from 53.7 in August, while the composite PMI combining manufacturing and services dipped to 52.0.

What Can We Expect from The Market This Week

US CPI September: Economists expect inflation to rise by 0.1% in September. Core inflation, which excludes food and energy costs, is predicted to go up by 0.2%. Over the past year, overall inflation is expected to drop to 2.3% (down from 2.5% in August), while core inflation is likely to stay steady at 3.2%.

UK GDP August: The UK economy grew 0.5% in the second quarter of 2024, which is less than the initial estimate of 0.6%. However, this still indicates a continued recovery from the recession at the end of 2023, albeit at a slower pace than previously thought.

RBNZ Interest Rate Decision: RBNZ is expected to cut interest rates by 0.50% at its upcoming meeting, with declining inflation and signs of economic slowdown, including rising unemployment and contracting GDP. The NZD/USD has fallen sharply ahead of the event, mostly due to the stronger U.S. dollar and fed changing pace in rate cuts.

FOMC Meeting Minutes: While the market is already in uproar in light of the Fed's recent rate, these minutes will give retrospect on their views on the economy and reasons for the cut. Traders often look at increased volatility as they try to predict future rate moves, though the Fed has been clear about likely cutting rates again this year, although slower and staying data dependent.

German CPI September: Inflation in Germany dropped to 1.6% in September in the preliminary report from 1.9% in August. The monthly CPI stayed the same after a 0.1% dip in August. The Harmonised Index of Consumer Prices, used by the European Central Bank, rose 1.8% yearly, lower than the 2% in August and below the expected 1.9%.