Stocks Performance (U.S. Stocks)

Stocks gained across all major global markets as investors grew more confident that another US fiscal stimulus bill would get finalized, despite an intervention by President Trump to drop the negotiation. Equities received further support from the continued widening of Joe Biden’s lead over President Donald Trump in opinion polls, which in turn decreased the chances of an inconclusive, or contested election.

The market rose four of the five days, and every sector ended the week in positive territory. The one day the market closed lower was when President Trump said he called off stimulus negotiations until after the election, before clarifying that he wanted a different, smaller, standalone bills for airlines, small businesses, and households.

Technology stocks performed well this week but not as well as many small cap/value/cyclical stocks, as investors felt more confident in a recovery.

By sectors, the most outperformed weekly stocks were led by Process Industries at 6.08%, followed by Producer Manufacturing sector at 5.86%, Energy Minerals 5.78%, and Electronic Technology at 5.31%.

Meanwhile, the weakest sectors were from the Communications at 1.74%, weighed down by weakness in video gaming and cable stocks. Miscellaneous sector at 1.88%, Consumer Non-Durables (2.94%), and Consumer Services sector (3.06%).

Indices Performance

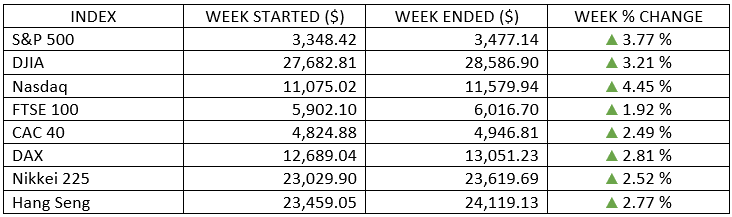

The S&P 500 Index had its best weekly gain in three months, as investors seemed to grow more optimistic about a new round of fiscal stimulus, as well as on the vaccine treatments front.

Every major European and Asian equity market was higher. Meanwhile, UK stocks lagged as statements from both UK and EU politicians made a no-deal Brexit at the end of 2020 look more likely. Stock markets in China only trading for one-day Friday for the Golden Week holidays all week.

Oil Sector Performance

Oil price edged higher supported by several factor:

1. The escalating workers’ strike in Norway over pay. The strike cut Norway’s total output capacity by just over 330,000 bpd, or about 8% of total production, according to the Norwegian Oil and Gas Association (NOG).

2. Storm brewed in the U.S. Gulf of Mexico. The evacuation of oil platforms in the Gulf ahead of Tropical Storm Delta heading toward Louisiana and Florida forced the shutdown of 80% of the production.

3. Positive development on President Trump’s illness. The president returned to the White House from hospital on Monday after a three-night hospital stay, being admitted for treatment for COVID-19 since last Friday.

Despite the recent volatility, oil has stayed in a narrow range of around $37 to $43 over the past four months.

Market-Moving News

Stock Indexes Rally

The major U.S. stock indexes each rose more than 3%, and the S&P 500 posted its best weekly result in three months. The NASDAQ Composite’s rose nearly 5%, the biggest gain among the indexes.

Small-Cap Surge

U.S. small-cap stocks outperformed the broader market by a wide margin for the second week in a row, as the Russell 2000 Index, a small-cap benchmark, climbed more than 6%. At Friday’s close, the index was up 13% from a recent low on September 23.

Crude Climbing

U.S. crude oil prices surged around 10%, climbing above the $40 per barrel threshold and recovering all the ground lost in the previous week’s sell-off. Despite the recent volatility, oil has stayed in a narrow range of around $37 to $43 over the past four months.

Coronavirus Stimulus

Market sentiment was boosted by signs that White House officials and congressional leaders were bridging differences on measures to help airlines, small businesses, and households. Though these measures are unlikely to take effect before the election, the resumption of coronavirus relief talks fueled optimism.

Fed’s Statement

U.S. Federal Reserve Chairman Jerome Powell issued a warning to Congress and the White House, saying the risks of not doing enough to provide further coronavirus-related economic relief are greater than the risks of doing too much. Powell said that the economic recovery is still at an early stage and the current expansion is “far from complete.”

COVID-19 Surge

Globally, the pace of COVID-19 cases continued to rise, weighing on prospects for economic growth and financial markets. Spain’s government declared a state of emergency in Madrid, the UK reported a spike in cases, and India was set to cross 7 million cases after a surge in rural areas.

Companies Playing Close to Chest

As third-quarter earnings reports start to come in, an unusually large number of companies remain reluctant to offer financial guidance for their full-year 2020 and 2021 results, owing largely to uncertainty from the pandemic. As of Friday, 147 companies in the S&P 500 that have traditionally issued annual earnings guidance had done so, compared with 138 that hadn’t, according to FactSet.

Dividend Drop-Off

The pace of dividend cuts by companies in the S&P 500 slowed considerably in this year’s third quarter. While overall dividend payments in the latest quarter fell by $2.3 billion on a net basis relative to increases, the decline was far smaller than the second quarter’s $42.5 billion drop, according to S&P Dow Jones Indices.

Other Important Macro Data and Events

Economic data was mostly better than expected considering rising anxiety about COVID-19 infections and the possibility of renewed restrictions on activity in many areas. The week saw a positive reading from the ISM services Purchasing Managers’ Index, suggesting resiliency in some of the hardest hit economic sectors.

An anticipation of another stimulus package to be passed also fuelled 10-year US treasury bonds to rose to a four-month high. The 2-year yield increased three basis points to 0.16%, and the 10-year yield increased eight basis points to 0.78%. The U.S. dollar Index fell 0.9% to 93.06.

What We Can Expect from the Market this Week

Two forces were in the driver's seat last week: policy and politics. The same elements expected to follow.

The upcoming U.S. presidential election expected to keep a hand on the wheel in coming weeks.

Moreover, an encouraging release of economic data will likely also be influential to lift global stocks. A combination of a sustained but gradual economic expansion, an extension of monetary-policy stimulus and a rebound in corporate profits will set the broader course for the markets.

Important economic news released this week including Federal budget and CPI on Tuesday, PPI on Wednesday, import/export price and weekly unemployment claims on Thursday, retail sales, industrial production and capacity utilization on Friday.