Stocks Performance (U.S. Stocks)

A new round of vaccine optimism and diminishing political uncertainty helped stocks build on recent gains for the holiday-shortened week, with Thanksgiving Thursday off and the markets closing early on Friday. Economic data releases were light, putting the emphasis on the high-wire act investors are walking between positive vaccine news and rapidly climbing COVID-19 cases and hospitalizations.

Positive catalysts included a boost after the U.S. General Services Administration acknowledged Joe Biden as the winner of the presidential election, allowing the transition process to proceed more smoothly. Investors also applauded the news that Joe Biden will nominate former Fed Chair Janet Yellen as Treasury Secretary, and more upbeat vaccine treatment updates for COVID-19.

Regeneron Pharma (NASDAQ: REGN) said it received emergency use authorization from the FDA for its antibody cocktail. AstraZeneca (LON: AZN) and Oxford said their vaccine has an efficacy rate of up to 90%, though the company’s shares fell back after acknowledging at the end of the week that it made a dosage mistake in its trials, likely prolonging federal approval in the U.S. In other news, Tesla (NASDAQ: TSLA) surged 20%, and Palantir (NYSE: PLTR) surged 52%.

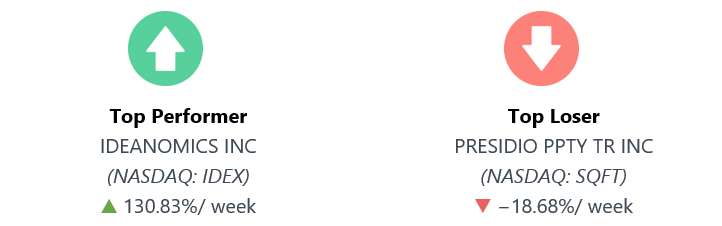

Value, cyclical, and small-cap stocks retained their leadership roles in this part of the bull market. By sectors, the most outperformed weekly stocks were led by Energy Minerals sector at 8.45%, followed by Consumer Durables at 8.35%, Industrial Services 4.23%, and Non-Energy Minerals at 4.17%. Meanwhile, the weakest sectors were from the Consumer Non- Durables at 0.47%, Utilities at 0.60%, Health Services (1.21%), and Electronic Technology sector (1.21%).

Indices Performance

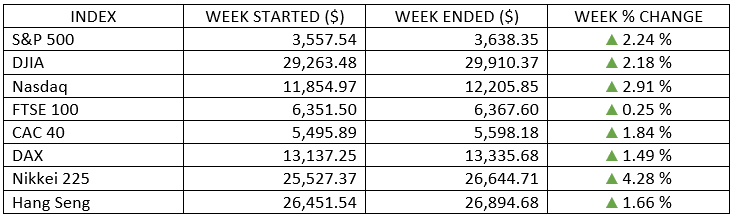

Each of the major U.S. indices rose more than 2.0% this shortened week and set new record highs, including the Dow Jones Industrial Average, which crossed above 30,000 for the first time ever, and on-track to have the best monthly gain since January 1987.

All major stock markets in Europe and Asia also higher as vaccine optimism trumped falling consumer and business confidence. Signs that cases may be peaking in Europe led to some governments temporarily loosening restrictions for the holidays.

Japan’s Nikkei-225 Stock Average advanced to its highest level since May 1991.

Oil Sector Performance

Apart from growing economic optimism that buoyed oil prices, the sector also received added support from a U.S. EIA that showed a surprise drawdown in U.S. crude stockpiles. WTI oil climbed to its highest price in eight months.

Market-Moving News

Indexes Back on Track

After posting mixed results in the previous week, the major indexes resumed the upward momentum seen since the start of November. Weekly gains totaled 2% to 3%, coming amid positive news regarding coronavirus vaccines.

Record Highs All Around

The S&P 500 and the Dow added to the records they had set earlier in November, while the NASDAQ topped a previous all-time high that it had recorded in early September. The Dow topped 30,000 points for the first time on Tuesday but slipped below that level by Friday’s close.

Crude Climbed

The price of U.S. crude oil climbed for the fourth week in a row, briefly rising above $46 per barrel on Wednesday to the highest level in more than eight months. A report showing an unexpectedly large drop in U.S. crude supplies helped fuel the latest price rise.

Jobs Setback

Labor market’s recovery stalling, as the number of Americans filing for unemployment benefits rose to the highest level in five weeks. The latest weekly report shows about 778,000 people filed for first-time benefits, marking the second consecutive weekly increase.

Confidence Shaken

The latest monthly numbers on U.S. consumer confidence indicate that spiking coronavirus cases may have reversed a recent uptick in optimism. The Conference Board cited the pandemic as it reported that its confidence index fell to 96.1 in November, the lowest level since August, and down from a revised figure of 101.4 in October.

Earnings Losers

Quarterly earnings season shows that just three out of the 63 industries in the S&P 500 accounted for an outsized share of the index’s overall 6% earnings decline. Excluding those three industries, the S&P 500 would have reported earnings growth rather than a decline, according to FactSet. The trio of losers are the oil, gas, and consumable fuels industry; the airlines industry; and the hotels, restaurants, and leisure industry.

Other Important Macro Data and Events

Safe haven assets slumped, including gold and government bonds. As bond prices fell, yields moved higher. The 10-yr yield Treasury note yield edged higher by two basis points to 0.85% ahead of the bond market close on Friday.

The expectation of higher demand also lifted prices of commodities tied to economic growth. WTI oil climbed to its highest price in eight months, and copper to its best level in two and a half years.

Economic data for the week was more mixed. While some PMI suggested activity was increasing at the fastest pace since 2015, consumer confidence slipped, and unemployment benefit claims rose for the second consecutive week.

What We Can Expect from the Market this Week

The resurgence in coronavirus cases and record U.S. hospitalizations, along with new restrictions in several states, are a reminder that the near-term path to a full economic recovery will be bumpy. News on vaccine developments, and expectations of new U.S. economic stimulus will also drive the market.

Important economic news released this week including pending home sales on Monday, manufacturing PMI, vehicle sales and construction spending on Tuesday, ADP National Employment Report on Wednesday, unemployment claims on Thursday, trade balance, factory orders and monthly labour market update on Friday.

A monthly labour market update due out on Friday is likely to be the week’s most closely watched economic report. The data will show whether November will maintain the pace of job growth seen in October, when the economy generated 638,000 new jobs and unemployment fell to 6.9% from 7.9% in the previous month.