PAST WEEK'S NEWS (March 15 – March 21, 2021)

Stocks Performance (U.S. Stocks)

The major indexes continued to move to record highs early in the week, attributed to a combination of fiscal and monetary policy stimulus, more retail investor support, and the better economic outlook given progress in containing the coronavirus. But then lost ground, to end the week mixed, as bond yields spiked to its highest levels in over a year.

Government bond yields in the U.S. pushed higher in the last week, rose above 1.75% for the first time in 14-months on Thursday. Yields returned to pre-pandemic levels to reflect rising expectations of inflationary pressures, as investors focused on the strength of the global economic recovery and progress in delivering vaccines. These trends were reinforced by the Fed officials that significantly upgraded their U.S. economic outlook. Fed also repeated their projection of no interest rate hikes at least through 2023 and stated that the pace of asset purchases would be maintained until “substantial further progress” is made in lifting employment and inflation. The Fed believes that any near-term bump in inflation will be short-lived.

By sectors, the most outperformed weekly stocks were led by Health Services sector at 1.15%, followed by Consumer Non-Durables 0.81%, Health Technology (0.68%), and Retail Trade at 0.36%. Meanwhile, the weakest sectors were from the Energy Minerals at 5.88%, Industrial Services at 2.91%, Non-Energy Minerals (2.70%), and Finance sector (1.65%).

Indices Performance

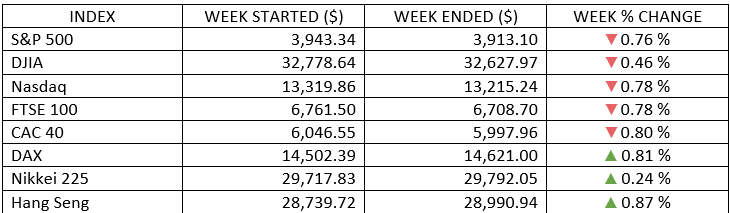

Stocks couldn’t maintain their positive momentum from the previous week, as the three major U.S. indexes recorded modest declines of less than 1%. The S&P 500 hasn’t made any big sustained moves up or down since mid-February.

Most European markets initially trended higher after shrugging off decisions by several countries to suspend the AstraZeneca PLC vaccine. Although retreated to losses in the mid-week after several countries announced new lockdown measures. Germany was strong after the ZEW survey of investor confidence improved for the fourth consecutive month.

Most Asian markets edged higher. Japanese stocks rose after the government confirmed that the Tokyo-area state of emergency ends on weekend, while equities in Hong Kong climbed after strong retail sales and industrial production data from China.

Oil Sector Performance

Oil prices posted its biggest daily drop since the summer on Thursday, driven by data showing abundant global oil supplies and demand concerns due to renewed lockdowns and a bumpy COVID-19 vaccinations rollout in the Europe region.

Market-Moving News

U.S. Stocks Slip

Stocks couldn’t maintain their positive momentum from the previous week, as the three major U.S. indexes recorded modest declines.

Small-Cap Stumble

After surging more than 7% the previous week, a U.S. small-cap stock benchmark fell nearly 3%, underperforming large-cap indexes. Although despite the weekly setback, the Russell 2000 remained up more than 50% over the past six months.

Fed Forecast

The U.S. Federal Reserve upgraded its economic growth outlook as well as its inflation forecast, while also reiterated its expectations that it will keep interest rates to stay near zero through 2023.

YTD Yield Surge

Inflation concerns continued to weigh on bond prices, pushing the yield of the 10-year U.S. Treasury bond above 1.70% for the first time since January 2020. At the end of last year, the yield was just 0.92%.

Bank Setback

A yearlong program that has recently governed how U.S. banks account for assets such as Treasury bonds will be allowed to expire at the end of this month. The U.S. Federal Reserve Bank’s announcement on Friday weighed on stocks of some of the largest U.S. banks, as they had pressed for an extension of the pandemic relief program.

Oil Loses Traction

The price of U.S. crude oil tumbled about 8% on Thursday—the commodity’s biggest single-day decline in about six months—before rebounding modestly on Friday back above $61 per barrel. Thursday’s decline came amid new data showing abundant global oil supplies and concerns that oil demand in Europe could falter amid a bumpy rollout for COVID-19 vaccinations there.

Bitcoin Rally

Early in the week, the price of bitcoin briefly climbed above $60,000 for the first time ever, although it failed to maintain that threshold later in the week.

Other Important Macro Data and Events

For the currencies, this is how they've changed since last week. The dollar steadied, as higher Treasury yields helped it recoup losses seen after the Fed decision on Wednesday. The dollar index advanced 0.28% to stay at 91.919. EUR/USD declined -0.62%, USD/JPY rose 0.07%, GBP/USD slipped -0.63%, and USD/CHF rose 0.74%.

Economic data in the US was mixed, with several key indicators falling short of expectations, including retail sales, industrial production and housing starts — were blamed on severe winter weather in the north-east and, especially, Texas. Also, initial unemployment claims rose much more than expected, rises +45,000 to 770,000, showing a weaker labour market than expectations of a decline to 700,000.

Forward-looking indicators, such as the Empire State Manufacturing Survey and the Philadelphia Fed Business Outlook Survey suggested robust growth in the coming months. Communication services led the advancing sectors in the S&P 500, while energy posted the weakest performance.

Fed Chair Jerome Powell and his colleagues remained dovish at the end of their meeting Wednesday. The U.S. Federal Reserve’s policymaking committee voted to keep short-term borrowing rates near zero in a widely expected move. The Fed also ramped up its expectations for economic growth by 6.5% this year but indicated that there are likely to be no interest rate hikes through 2023.

The Bank of England and the Bank of Japan both echoed the sentiments of the Fed, keeping benchmark interest rates steady and making no significant changes to asset purchase programs.

Core eurozone bond yields ended slightly higher. Germany’s 10-year bund yield climbed midweek, tracking U.S. Treasuries in response to expectations for an uptick in inflation. Yields eased somewhat on Friday on concerns about the increasing number of coronavirus infections in Europe and consequent constraints on economic activity.

UK gilt yields also rose, lifted in part by the Bank of England’s optimistic tone regarding the economic outlook and its decision to keep interest rates unchanged.

Cryptocurrencies: Early in the week, the price of bitcoin briefly climbed above $61,000 for the first time ever, although it failed to maintain that threshold later in the week. About six months ago, bitcoin was trading below $11,000.

What Can We Expect from the Market this Week

With the approval of the fiscal stimulus in the US, the equity markets can now focus on the economic rebound this year and a sustained growth over the next few years. This bodes well for corporate earnings growth and in turn for equities as valuations normalize. However, market volatility is expected to persist driven by anxiety over higher inflation, potentially rising interest rates and less support from the Fed. This can lead to market pullbacks even in the face of strong equity markets.

These short-term bumps can affect investors in several ways. Clear-eyed long-term investors understand that minor dips are inevitable to clear the path to more gains, while others with a shorter-term mindset typically try to time an entry with varying degrees of success. The key here is to remain patient and focus on long-term goals while still having exposure in a diversified portfolio where returns can be compounded, and cost can be minimized. Being proactive rather than reactive will help investors deal with market volatility better on the back of an improving global economy.

Among important U.S. economic data being released this week include the 3rd estimate GDP growth figure, the PMI composite, home sales data, personal income & spending and PCE deflator.