Stocks Performance (U.S. Stocks)

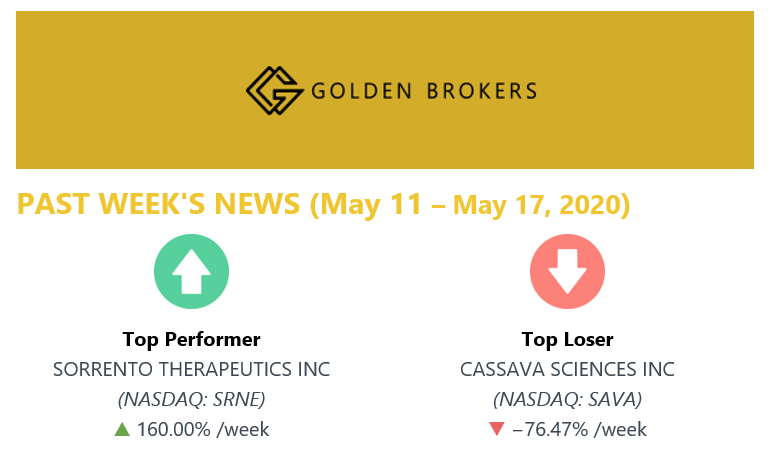

Stocks Performance (U.S. Stocks) Stocks erased most of the prior week's gains after a string of disappointing economic releases and escalating tensions between the U.S. and China. The declines were most pronounced among small-caps and slower-growing value stocks.

By sectors, the most outperformed weekly stocks were led by Health Technology at 1.39%, followed by Retail Trade at 1.20%, and Health Services (1.12%). These three sectors were the only sectors that recording a positive performance throughout the week.

Meanwhile, the weakest sectors were the Energy Minerals sector (-7.58%), Finance (-5.71%), Transportation (-5.63%) and Producer Manufacturing sector (-5.55%).

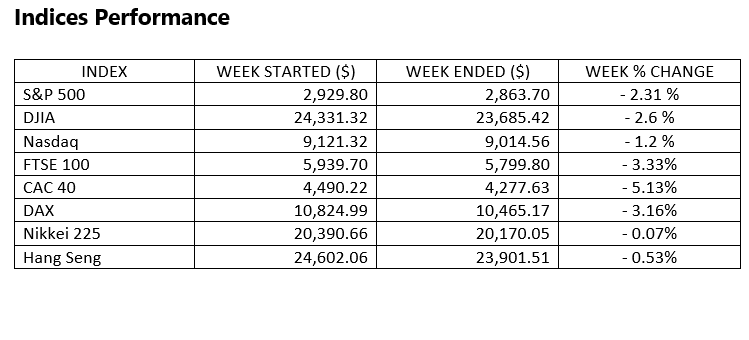

Global equities retreated this week after new COVID-19 cases began to climb in many countries that had previously taken measures to relax economic restrictions — notably South Korea and Germany.

The S&P finished the week down more than 2%, posting the biggest weekly decline since March, in what has been a robust 27% rally from the March 23 low.

Oil Sector Performance

Oil prices jumped to their highest in more than a month, supported by ongoing output cuts and signs of gradual recovery in fuel demand as more countries ease curbs imposed to stop the coronavirus pandemic spreading.

Market-Moving News Oil MomentumU.S. crude oil prices surged for the third week in a row, eclipsing $29 per barrel to a level that’s more than double the $12 price recorded on April 29. Oil has been boosted by recent production cuts as well as rising demand.

China's Reopening

Data from China shows that some segments of the world’s second-largest economy have begun to perk up as COVID-19-related restrictions ease.

Another Step Down

Stocks pulled back, with the major indexes declining around 1% to 3%. It was the third negative week out of the past four, and returns were choppy, with indexes tumbling around 2% on both Tuesday and Wednesday and then rallying on Thursday.

Data Dump

Economic reports released on Friday provided fresh evidence of COVID-19’s devastating impact on the U.S. economy. Retail sales fell a record 16.4% in April, while industrial production fell 11.2%. However, an index of consumer sentiment rose relative to its reading from four weeks earlier.

Inflation in Check

So far, the economic damage from COVID-19 appears to be having a bigger impact on inflation than the recent crisis-driven surge in government spending. Consumer prices fell 0.8% in April, the biggest such monthly decline since 2008. Lower gasoline prices fueled much of the latest drop. Also, Japan's economy slipped into recession for the first time in more than 4 years.

Other Important Macro Data and Events

The tone in markets skewed more negative with signs of increased tensions in the US-China trade relationship. US President Donald Trump mused upon economic sanctions against China for the way it dealt with the early stages of the COVID-19 outbreak, including blocking a government retirement fund from investing in Chinese equities.

U.S. retail sales and industrial production registered their steepest declines on record for the month of April, reflecting the full and sudden stop of economic activity. The U.S. administration moved to block semiconductor shipments to Huawei, adding to investor caution.

The most recent inflation reading showed a sharp decline in core inflation from 2.1% to 1.4%, the largest decline since 19571. In our view, the impact from the pandemic is deflationary, which implies that central banks will maintain very accommodative monetary policies for the foreseeable future.

House of Democrats unveiled a $3 trillion relief bill to start the conversation among lawmakers. Reports later indicated (after the release of another dismal weekly jobless claims report) that the White House was interested in a fourth coronavirus relief bill, but just not the plan outlined by House Democrats

The eurozone economy contracted by a record 3.8% in the first quarter compared with the final three months of 2019.

The UK economy contracted by 2.0% from the last three months of 2019, the biggest drop since late 2008.

What We Can Expect from The Market This Week

Important economic data being released include housing starts on Tuesday, the Fed meeting minutes on Wednesday, and the May preliminary PMIs on Thursday.

Chinese data on house prices and loan rates could also provide some further information on how that country is emerging from its prolonged coronavirus hibernation.