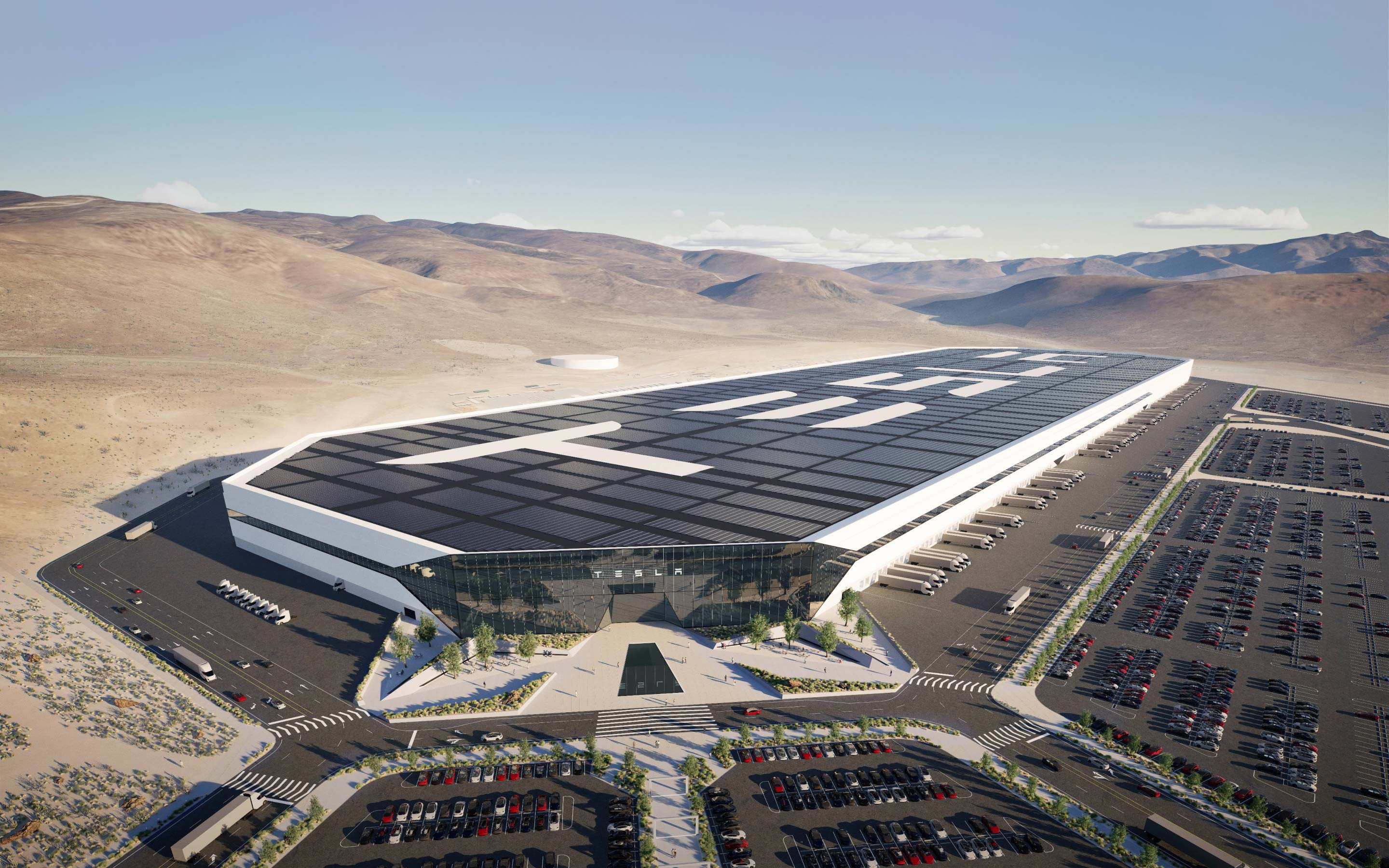

Tesla Inc. is expanding its worldwide electric vehicle dominance with a new assembly plant in northern Mexico. The plant will cost over $5 billion and produce one million vehicles annually for both domestic and international markets. Tesla CEO Elon Musk has agreed to recycle the water used in the assembly process, boosting Mexico's efforts to become a hub for nearshoring investment. The plant is expected to manufacture the Semi truck, the Roadster sports car, and a potential SUV. Elon Musk has also announced his intention to assemble a team to rival the widely popular ChatGPT, dubbed as BasedAI.

EQUITY

Both the S&P 500 and Dow Jones closed lower, while the Nasdaq stayed the same with high volatility in between trading periods. Economic data released on Tuesday, however, showed a drop in consumer confidence and a slowing of the home price gauge. Target announced better than expected earnings, and Salesforce Inc. earnings will be in focus today.

GOLD

Gold prices recovered for the second day and currently meet a resistance level of 1830 that was previously broken by last week's decline. While weaker-than-expected US business activity and consumer confidence data provided some relief to the metal markets, the central bank has not yet indicated when it will stop raising interest rates. Visa and Mastercard have suspended their efforts to accept cryptocurrency as a form of payment while the crypto industry struggles to stabilise.

OIL

Oil prices rose for a second day on reports of expanding manufacturing activity in China, boosting the outlook for global fuel demand. Brent crude rose 1% to $83.91 per barrel, while WTI crude rose 0.89% to $77.46 per barrel. However, rising crude stockpiles in the US by 6.2 million barrels may offset the strong demand signal.

CURRENCY

The US dollar strengthened against major currencies, registering its first monthly gain since September. Current expectations are that interest rates will remain high to tackle inflation. Upbeat data in February supported this trend, and upcoming ISM PMI and employment data could reaffirm the Fed's policy.