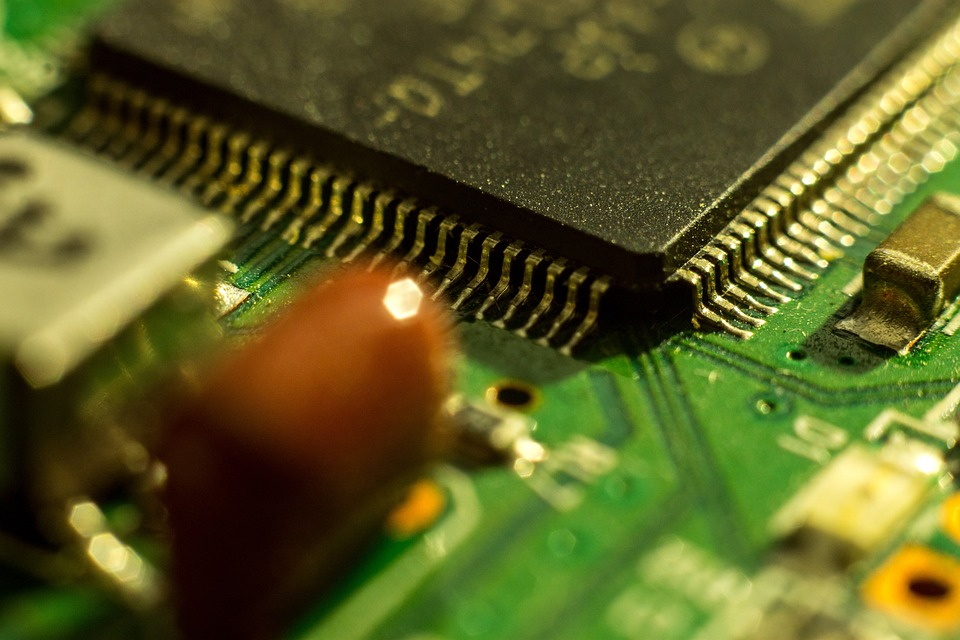

Too much supply, too little demand. Western Digital and Micron Technology's shares surged 8% after Samsung Electronics announced it would reduce near-term memory chip production to address a glut in global chip supplies and lower customer demand. The South Korean company expects a weaker-than-expected first-quarter profit, with its chip unit likely to see a record loss of around $1.6 billion. Micron's stock was also lifted by Goldman Sachs' decision to increase its price target on the US company by $5 to $70 per share, citing a boost from the Samsung output cut. Micron recently posted a narrower-than-expected second-quarter loss and hinted that AI demand could support near-term revenue growth. On average, the PC market shipped 29% less, with Apple leading the drop by 40%, which is feared to weigh on the overall market as Apple contributed to 7% of the main index.

EQUITY

The US stock market closed mixed after recovering from early losses. Tech stocks pulled down the Nasdaq, while industrials boosted the Dow. Sectors tied to the economy outperformed the broader market, hinting that the economy can withstand further rate increases. Inflation data and bank earnings are the focus this week, and the Fed is expected to hike rates in May.

GOLD

Gold prices rose by 0.5% to $2,001.37 per ounce on Tuesday as the dollar weakened ahead of the release of US inflation data. Investors are awaiting this data to gain insight into the trajectory of interest rates before the Fed's May policy meeting. The US employment report released last Friday raised the likelihood of an interest rate hike by the central bank next month.

OIL

Oil prices rose 0.6% on Tuesday on expectations of falling US inventories, strong fuel demand in India, and signs of healthy demand in emerging markets. These gains follow the announcement of new production cuts by OPEC and Russia starting in May. The US inflation report due on Wednesday and China's weak consumer inflation data for March could impact future demand.

CURRENCY

Most Asian currencies rose slightly on Tuesday, limited by less hawkish cues from local central banks amid signs of peaking inflation. The dollar was mixed, with nonfarm payrolls data boosting immediate demand but futures funds indicating limited rate hikes left this year. The focus this week is on the March inflation data and the Fed's March meeting minutes for guidance on interest rates.