PAST WEEK'S NEWS (September 02 – September 06, 2024)

Over the past century, September has historically been noted as the worst month for the stock market, a phenomenon known as the "September Effect," where it has consistently underperformed. Theories behind this pattern include traders returning from vacations and rebalancing their portfolios, increased bond offerings that divert funds from stocks, and mutual funds closing out losing positions for tax reasons. However, none of these theories fully explain the trend, and some factors, such as algorithmic trading and the ability to work remotely, have countered those reasons. Looking at current market conditions, however, it could be another rut for the market as Japan carry trade unwinds might continue and the shrinking manufacturing sector is lingering. Labour market data later in the week will determine if the fear grows or subsides.

It seems like a distant memory when the yield curve is inverted, and recession alarmists are widespread. The relationship between the highlighted 10-year and 2-year Treasury yields just now normalised on Wednesday, reversing a classic recession indicator. One of the factors stems from a sharp decline in job openings and dovish stance from the Federal Reserve. An inverted yield curve, where shorter-duration yields are higher than longer-duration ones, has historically signalled most recessions since World War II. However, this event does not necessarily indicate positive economic times ahead. In fact, the curve typically reverts before a recession hits, suggesting the real challenge is now here. The yield curve inversion had been the longest on record, lasting 544 consecutive trading days as of Wednesday.

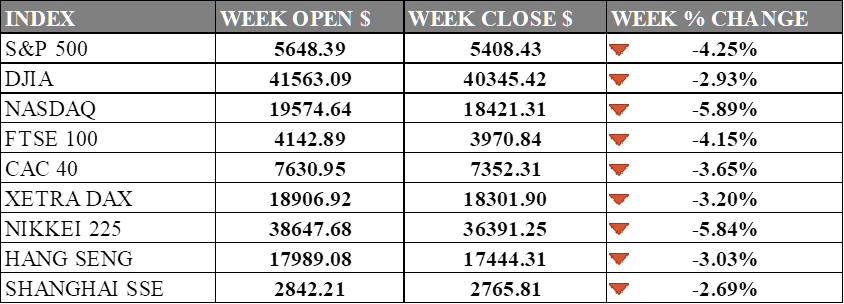

INDICES PERFORMANCE

Wall Street experienced a significant downturn this week, with all major indices recording substantial losses. The S&P 500 fell 4.25% to close at 5,408.43. The Dow Jones Industrial Average saw a decline of 2.93%, finishing at 40,345.42, while the tech-heavy Nasdaq suffered the most, plummeting 5.89% to close at 18,421.31. These market declines are largely attributed to growing concerns about the economic outlook, with investors showing caution across all sectors, particularly in technology stocks.

Across the pond, European markets also experienced sharp declines. The UK's FTSE 100 fell 4.15%, closing at 3,970.84. France's CAC 40 saw a 3.65% decrease, closing at 7,352.31. Germany's DAX experienced a 3.20% drop, ending at 18,301.90. European markets mirrored the negative sentiment in global equities, with various sectors contributing to the overall losses.

Asian markets presented a uniformly negative picture, with significant declines across the board. Japan's Nikkei 225 saw a substantial decrease, falling 5.84% to 36,391.25. Hong Kong's Hang Seng Index posted a loss of 3.03%, closing at 17,444.31. The Shanghai Composite in mainland China also experienced a decline, falling 2.69% to close at 2,765.81.

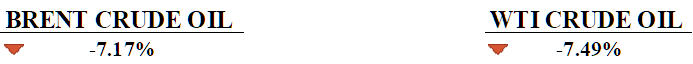

CRUDE OIL PERFORMANCE

Crude oil prices rebounded early in the week after a substantial selloff. However, the previous week saw a significant drop in prices, attributed to weakening economic condition, particularly disappointing U.S. jobs data which raised concerns about oil demand in the world's largest consumer. OPEC+'s decision to delay planned output increases signalled the group's commitment to market balance, with Morgan Stanley analysts projecting Brent prices to remain around the mid-$70s barring further demand weakening. Key market reports from OPEC, the IEA, and the EIA are expected this week, which could influence price movements. Meanwhile, Saudi Aramco has cut its October pricing for Arab Light crude oil across various markets, with Asian prices reaching a three-year low, reflecting concerns about weak demand in the region despite a rebound in Chinese crude oil imports in August.

OTHER IMPORTANT MACRO DATA AND EVENTS

The US economy added 142,000 jobs in August, falling short of the 164,000 expected, but revised July figures were much lower than previously reported. The unemployment rate held steady at 4.2%, and analysts expect the Federal Reserve to consider a rate cut during their September meeting, with the possibility of a 25 or 50 basis-point reduction.

U.S. factory orders went up 5.0% in July, mainly due to a 12.9% jump in defence aircraft orders, while demand in other areas stayed modest. Business investment in equipment were solid despite higher interest rates, with shipments of non-defence capital goods rising 4.9%.

What Can We Expect from The Market This Week

ECB Interest Rate Decision: The ECB is expected to cut interest rates again this week as inflation moves closer to its 2% target, but policymakers are unlikely to reveal future plans. Although signs of easing inflation and economic weakness are showing in parts of the eurozone, the ECB is expected to remain cautious.

German CPI August: Consumer prices grew by 1.9% year-over-year in August, with inflation slowing compared to July's 2.3%. As inflation trends cool, the market is cautious about the potential impact on the European Central Bank's upcoming rate decisions, with mixed views on whether further rate hikes are necessary.

US CPI August: The August CPI inflation data is expected to show a slight drop in headline inflation to 2.6% YoY, while core inflation remains steady at 3.2%. With softer inflation and job growth numbers, the Fed is thought unlikely to pursue a larger rate cut, with a 25 basis point adjustment being more probable.

OPEC Monthly Report: This month's monthly report by OPEC is highly looked forward to as crude oil prices have plunged to multi-month lows, and the report could suggest either the continuation or reversal of price.

US 10-Year Note Auction: The current yield is at 3.75% and is expected to be lower if consumer data comes in lower than expected, where it will be reported after the cpi data is released.