The stock market has had an uneven start to 2022. Shares dipped sharply in January and February, thanks to the concerns about inflation, interest rate hikes and the conflict in Ukraine, before recovered meaningfully in March and April. It's however, not been a slow start for the whole market, though. There are many hot stocks right now that can profit from higher inflation and potential shortages in commodities and food products. In particular, the agriculture industry is having a boom year. The crisis in Ukraine will likely cause a sharp decline in agricultural commodities production, leading to a lack of supply internationally, and that's leading to strong upswings in related agriculture stocks. Hence, in our opinion, we choose Deere & company as one of the companies that are set to benefit from these trends.

Deere & Company is one of the world's largest producers of farm machinery and industrial equipment, headquartered in Moline, Illinois. The company’s origin dates to 1836, when John Deere invented one of the first steel plows that could till American Midwest prairie soil without clogging. The following year, Deere established a business to manufacture and market the plow, and his own company was incorporated as Deere & Company in 1868.

The company has remained a top manufacturer of industrial and lawn-care machinery. Equipment produced by the company includes tractors, harvesters, sprayers, and crop-maintenance machinery. It also manufactures construction equipment, diesel engines, chain saws, snow-blowers, and lawn trimmers. Deere & Co. has also added financial services to its growing list of operations, offering insurance and leasing to its customers worldwide.

Being one of the world's largest producers of agricultural equipment, it’s been a stunning reversal of fortunes for the company. Deere appeared to be a big loser in the COVID-19 environment as commodity prices slumped. Fast forward to today, however, and farm equipment is now in high demand.

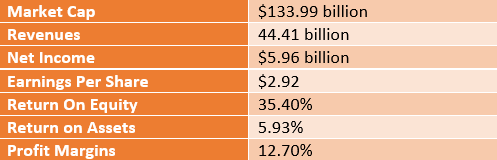

Key Statistics

Stock performance

- The all-time high Deere stock closing price was 437.98 on March 28, 2022.

- The Deere 52-week high stock price is 437.98, which is 2.44% above the current share price.

- The Deere 52-week low stock price is 320.50, which is 33.32% below the current share price.

- The average Deere stock price for the last 52 weeks is 365.16.

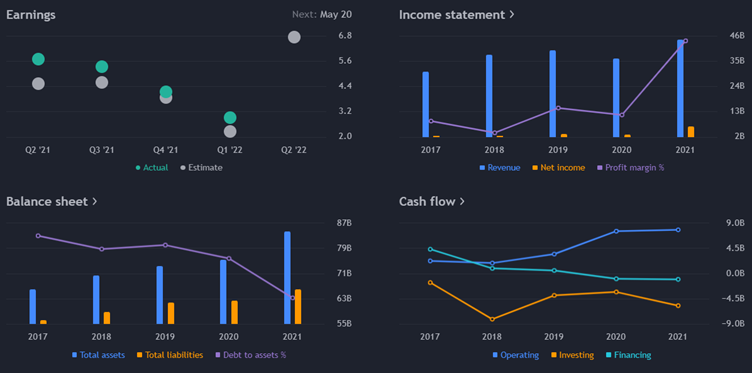

Based on its stock price growth from 5 years, the company stock has driven up by a staggering 300%, with more than half of that was in the past 3 years, around 14% since last year, 32% in the last 6 months, and 10% since last month. This is a consistent, stable growth which portrays the strength of the largest agricultural machinery company.

Better outlook also to be reflected in Deere's expected upcoming 2022 earnings. While last year, farmers were not in position to purchase new equipment due to lower margins, for this year, farmers will have a stronger interest in purchasing new equipment, motivated by the high crop prices amid the conflict in Ukraine and soaring inflation. The supply chain concerns, and potential scarce availability of labor, however, could be a drag for Deere, like with many other industrial companies right now. But prices are simply so high for crops that farmers will find a way to get new equipment one way or another.

Its earnings per share for the quarter ended Jan. 31 was at $2.92 per share, beating the consensus of $2.27, and expected to grow 17% for the next quarter to $6.68. Deere next earnings date will be on May 20.

Now as we look at the income statement, Deere annual revenue for 2019 was $39.25B, a 5.09% increase from 2018. For 2020 it was $35.54B, a 9.47% decline from 2019. And in 2021, it was $44.02B, an increase of 23.87% from the previous year. And in the twelve months ending January 31, was at $44.48B, a 20.15% increase year-over-year. Deere appeared to be a big loser in the COVID-19 environment as commodity prices slumped, before made a stunning reversal motivated by the high crop prices as it rides out the COVID-19 pandemic effect.

Historical dividend payout and yield for Deere was made since 1989. The current dividend payout for Deere is $4.20, and the current dividend yield is 1.00%.

A large harvest, sufficient stocks for the government’s welfare program, and higher grain prices will lead private growers to have a large wheat surplus available to export, easing shortage fears due to the war in Ukraine. Wheat prices are now around 30% higher than before Russia’s invasion. Data from the UN’s FAO indicated that Ukrainian wheat production is expected to significantly fall in 2022, with at least 20% of winter plantations not being harvested due to direct destruction, constrained access, or lack or recourses to harvest the crop. Together, Russia and Ukraine were responsible for nearly 30% of world wheat exports before the war.

Potential/ Future Expectations and Challenges

Looking at the opportunities and challenges for the company, we at Golden Brokers Limited are optimistic on the outlook.

1. Investment in Advancement in Farming Technology

Customers are increasingly relying on advanced technology, smart farming solutions and mechanization to run their operations. Advances in data-crunching, satellite imagery, and mobile computing power have given rise to digital agriculture.

John Deere has emerged as a leader in the category and the technology, and paired with its industry-leading farm equipment, has led to a boom in the stock, which has delivered a total return of more than 10,000% since its debut.

2. Automation

Demand continues to grow for popular features, including automatic guide machines in the field and equipment that plants seeds and applies chemicals and fertilizers with exceptional accuracy. Over the long term, rising population and elevated global demand for food and efficient water use will fuel demand for the industry’s equipment.

3. Customer service

Last month, Deere & Co. also announcing that the company is enhancing its diagnostic tools and expanding their availability to increase the self-repair capabilities of its equipment. Expected in May, it will allow customers and independent repair shops to buy its Customer Service Advisor diagnostic tool directly from its website. The company also added that next year it will launch a service with a mobile interface that will allow customers to download software updates directly to some of its equipment with a 4G connection.

4. Soaring commodity prices

Farm equipment industry has been gaining from rising agricultural commodity prices. This, in turn, is driving farm income and encouraging farmers to invest more in agricultural equipment. Russia’s invasion of Ukraine in February has created uncertainty in the global economy. Being the world’s largest grain exporters, escalating tensions between these countries have fueled concerns of impending supply disruptions of grains. This is driving agricultural commodity prices.

And for the limitation, (1) cost inflation & (2) supply chain woes will give challenges for the company. The industry participants are encountering supply chain tightness and raw material cost, particularly of steel, as well as increased transportation costs. (3) Shortage of labor also might affect the production levels, impairing ability to meet demand. However, these headwinds are expected to abate through the year.

In conclusion, the Deere stock covers many areas of the agricultural industry. Agriculture is a life-sustaining operation, and there are numerous ways for investors to own a piece of the action. The scale required for operations has led to market power being concentrated in a handful of titans. As a company with healthy profits, cash flows, and dividends, in our opinion, the Deere Company will surely offer excellent opportunities for investors.