How A Russian-Ukraine Conflict Might Hit Global Economy & Markets

Last Thursday, Russia launched an invasion of Ukraine by land and air, the scale of which surprised markets, triggering a spike in volatility and outsized declines in equities. The events represent a major escalation in the conflict, marking the worst security crisis Europe has witnessed in decades.

Russia continued its advance into Ukraine this week, with reports of fighting on the streets and forces encircling Kyiv. Russian President Vladimir Putin also reportedly put his country’s deterrence forces, which include nuclear capabilities, on high alert in response to aggressive statements by NATO leaders and the range of economic sanctions imposed by the West. The US, UK, Europe, Japan, and Australia have imposed sanctions on Russia, including asset freezes, travel bans, and imports and exports bans.

The invasion of Ukraine by neighbouring Russia would be felt across several markets, from wheat and energy prices and the region's sovereign dollar bonds to safe-haven assets. Here at Golden Brokers Limited, we take a look at how the escalation of tensions could potentially be felt across global markets:

Oil and Gas

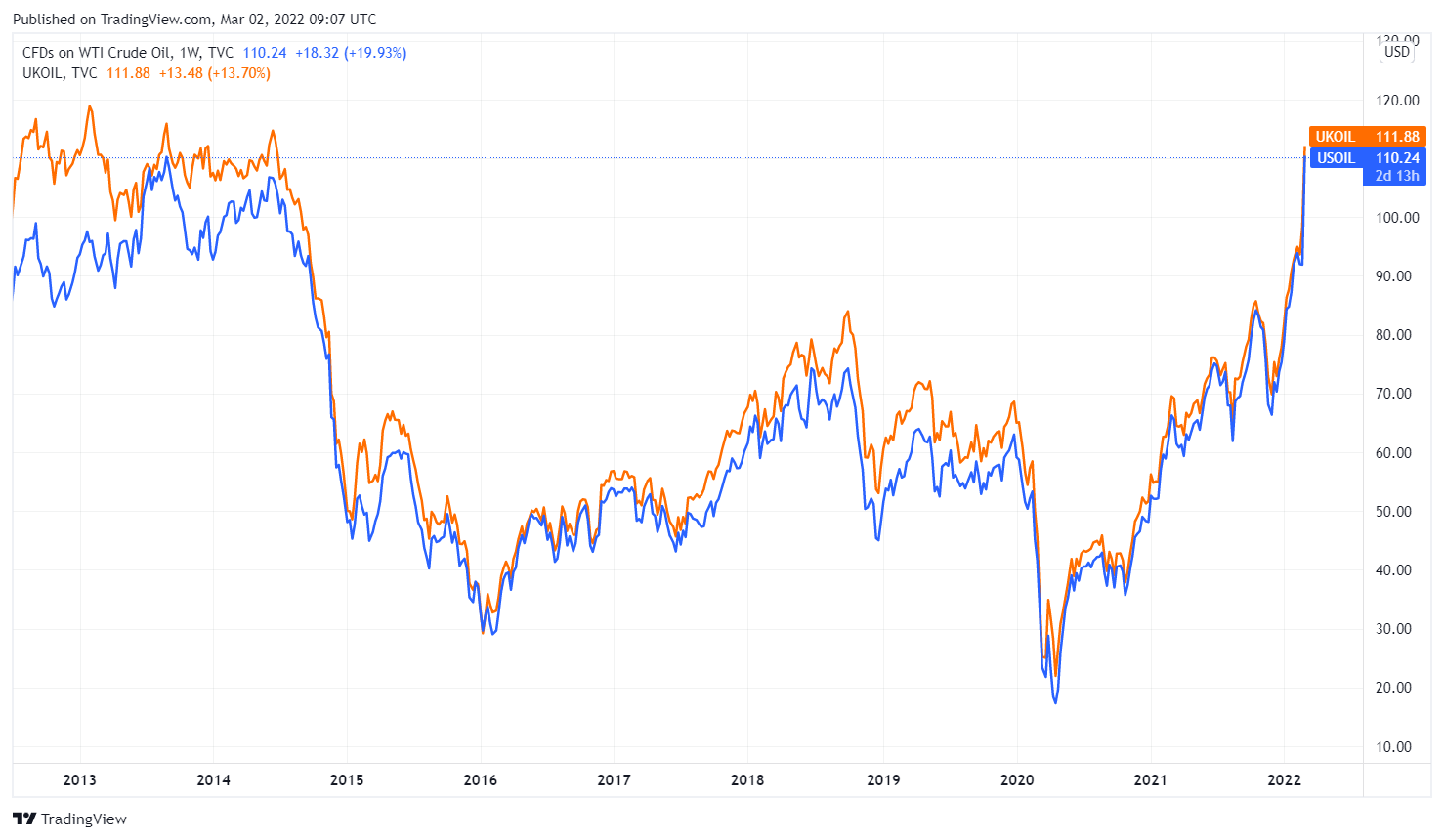

The most meaningful impact to financial markets would likely be centred around energy markets, with Russia being the world’s third-largest oil producer and the largest exporter of crude oil. Europe relies on Russia for nearly 40% of its natural gas, mostly coming through pipelines which cross Belarus and Poland to Germany, Nord Stream 1 which goes directly to Germany, and others through Ukraine.

Military action against Ukraine would no doubt trigger sanctions against Russia, rocking an already tight oil market. Speculation has crept into oil prices with Brent and WTI crude benchmarks on Wednesday, 2 March breaking above levels last seen in July 2014, and September 2013, respectively.

In addition, Germany’s suspension of the construction of the Nord Stream 2 pipeline supplying natural gas from Russia to Western Europe, along with sanctions on Russian oil exports, in the worst-case scenario, is likely to result in a classic supply-side energy shock that could tip the economy back into recession.

However, we don't think that the high oil prices will necessarily be the new long-term normal, as supply can possibly increase to ease some of the pressures. For the moment, the U.S. appears closer to lifting sanctions on Iran's oil, while also reportedly coordinating the release of strategic reserves with other countries. The U.S. shale producers also could ramp up production, incentivized by the high prices.

Agricultural Commodities

A major casualty could be even higher food prices. Ukraine and Russia together are heavyweights in global wheat, corn and sunflower oil trade, leaving buyers from Asia to Africa and the Middle East vulnerable to more expensive bread and meat if supplies are disrupted. That would add to food-commodity costs that are already the highest in a decade.

Four major exporters - Ukraine, Russia, Kazakhstan, and Romania - shipped grain from ports in the Black Sea. As the Western nations imposed stiff sanctions on Moscow and cut off some Russian banks from the SWIFT international payment system, Russia will be facing severe disruption to its exports of all commodities. Any interruption to the flow of grain out of the Black Sea region is likely to have a major impact on prices and further fuel food inflation at a time when affordability is a major concern across the globe following the economic damage caused by the COVID-19 pandemic. While metals and agricultural commodities aren’t in the direct crosshairs of western policymakers, prices are surging as investors bet that the latest measures could snarl payments to suppliers, and prompt banks to further curtail financing for purchases of Russian goods.

Ukraine and Russia are both major exporters of some of the world’s most basic foodstuffs, together accounting for about 29% of global wheat exports, 19% of world corn supplies and 80% of world sunflower oil exports.

Wheat futures rallied at a staggering pace since early in the week, rose near its highest level in more than 13 years on Monday, while corn futures hit an 8-month high on concern that conflict could disrupt grain supply from the Black Sea export region.

The market is also discussing what will happen to summer crop planting in the Ukraine. Growers are due to start planting spring barley soon. And corn planting is due to be planted in April. Ukraine alone is large enough to have a market impact.

Russia also exports crop nutrients, which is critical for producing nitrogen-based fertilisers. In total, 25% of the European supply of the key crop nutrients nitrogen, potash and phosphate come from Russia.

With the geopolitical conditions out of balance, the biggest sources of raw material to Europe’s food production are being subject to limitations, and there are no short-term alternatives.

Gold & Precious Metals

The latest news has fuelled the return of investors demand for traditional safe havens such as gold. In fact, over the past month, gold has strengthening progressively in the face of rising interest rates and the start of imminent rate hikes form the U.S. Federal Reserve in March. And with this latest development, the gold price was pushed above the headline level of $1,900 an ounce. The latest Western sanctions also had prompted a pledge from Russia’s central bank to resume purchases of the precious metal that have been on pause for nearly two years.

While we note a near-term technical upside for gold prices, its fundamental view of the commodities remains neutral, as a further strengthening may not be sustainable given the projected 150-basis-point hike in the Fed funds rate this year.

Russia is also a major supplier of aluminium, titanium, nickel, and especially palladium. Russia produces about 40% of the palladium mined globally, and the auto-catalyst metal reached its highest level since July 2021 at $2,711.18 last week.

Bond & Currencies

Haven demand also boosted bond yields along with the dollar, Japanese yen, and Swiss franc while the euro sank after Russian President Vladimir Putin put nuclear-armed forces on high alert on Sunday, the fourth day of the biggest assault on a European state since World War Two.

A major risk event usually sees investors rushing back to bonds, generally seen as the safest assets, and this time may not be different, even if a Russian invasion of Ukraine risks further fanning oil prices, and therefore inflation.

The Russian rouble meanwhile plunged nearly 30% to a fresh record low on Monday after Western nations imposed new sanctions on Russia for its invasion of Ukraine, including blocking some banks from the SWIFT international payments system.

Stock Market and Companies

The direct impact on the U.S. economy and corporate earnings is likely limited, in our view. Trade between the U.S. and Russia is relatively insignificant, and Russia's economy is only the 11th largest, accounting for less than 2% of global GDP. For perspective, the German economy is almost three times larger, despite having half the population.

Russia's equity markets remained suspended for a third day in a row on Wednesday, with only limited range of operations for the first time this week. Russian assets went into freefall with London-listed iShares MSCI Russia plunging 33% to a fresh record low and shares of Sberbank, Russia's biggest lender, falling to 21 cents on the dollar from just under $9 before the invasion.

Global sanctions against Russia have prompted a string of major companies to announce suspensions to or exits from their businesses in the country. Exxon Mobil said on Tuesday that it will exit Russia operations, including oil production fields, following similar decisions by British oil giants BP PLC and Shell, and Norway's Equinor SA.

Central Banks and Inflation Control

The Russia-Ukraine conflict complicates central banks' efforts to tame inflation because it exacerbates the same problem policymakers are trying to address, at a time that they would normally ease policy to help growth. The likelihood of a slowing global economy has led to concerns that the Federal Reserve and other central banks will not be as aggressive in hiking interest rates in coming months.

European banks also will be under some pressure given some Russian exposure and concerns around what that will mean if payments are restricted. Austrian banks are most exposed, with Russian counterparties representing 1.6% of banking assets, followed by 0.6% for Italy and 0.2% for France. The ECB will be expected to provide ample liquidity and national authorities to provide what support and forbearance is allowed to manage those exposures.