PAST WEEK'S NEWS (May 16 – May 22, 2022)

Stocks Performance

The major equity markets fell on the week, as investors are adopted a risk-off mode due to precarious headwinds for global GDP growth and corporate earnings expectations, grappled by punitive inflation, prolonged supply chain snarls, hawkish Fed, and rising geopolitical tensions in Europe (precipitated by Russia-Ukraine war, and Finland and Sweden both announcing their bids to join the NATO).

Most Asia-Pacific stocks meanwhile recovered some ground at the end of the week, on easing of lockdowns in Shanghai and further relaxations on a year-long clampdown on technology giants.

The week’s economic data meanwhile offered mixed signals about whether a recession was imminent.

Markets were especially rattled last week by earnings reports from key retail giants like Walmart, Target, and Ross Stores. Each cited sticky cost pressures for their disappointing results and cautious outlooks. Cisco, Applied Materials, and Deere, meanwhile, highlighted supply chain problems in their earnings reports.

Conversely, the utilities, health care, and energy sectors each ended the week in positive territory.

Indices Performance

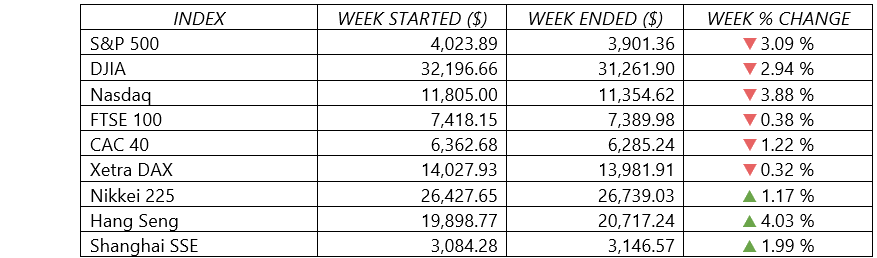

Wall Street continued its weekly losing streak for the seventh week in a row, as the major U.S. indexes fell around 3% to 4% for the week.

Market continued to face downward pressure, with Wednesday marking the biggest one-day decline in the S&P 500 since June 2020. The S&P 500 briefly enters bear market territory, before rebounded at the end of the week.

Shares in Europe also pulled back amid fears of slowing economic growth and faster interest rate increases.

Asia’s stock market returns meanwhile were positive for the week. Regional sentiment toward the end of the week was boosted by China’s action to support its property sector, the latest in a series of monetary easing measures aimed at boosting an economy weighed down by coronavirus lockdowns. While announcements by government of each countries on strict border control measures would be eased further also lent some support.

Crude Oil Performance

|

Oil prices were little changed for the week, as lingering fears over tight global supplies were weighed by fears over slower economic growth.

Other Important Macro Data and Events

Prices of U.S. government bonds climbed for the second week in a row, taking some of the edge off a year-to-date price decline that sent yields surging.

The yield on the benchmark 10-year U.S. Treasury note fell as low as 2.77% in intraday trading on Thursday, its lowest level in nearly a month. Ending on Friday, the yield of the 10-year U.S. Treasury bond was at 2.79%, down from 3.13% just a couple weeks earlier. Still, that’s a long way up from the 1.51% yield at the close of 2021. The 2-year yield decreased one basis point to 2.58%.

Core eurozone government bond yields fluctuated, ending roughly unchanged. Hawkish signals from several ECB officials caused yields to rise early in the week. ECB Governing Council member Klaas Knot, for example, appeared to suggest the possibility of a 50-bps interest rate increase in July. Yields subsequently pulled back, as weak retail earnings in the U.S. worsened fears of an economic slowdown. Peripheral eurozone bond yields, which broadly tracked core markets over the week, ended slightly higher. UK gilt yields rose on inflation reaching its highest level in 40 years.

The latest macro data provided more evidence that the UK economy may be on the brink of stagnation. Inflation accelerated in April to the highest level since 1982, hitting 9.0% on surging electricity and gas prices, according to the Office for National Statistics.

The week’s U.S. economic data meanwhile offered mixed signals about whether a recession was imminent, and Wall Street’s reaction to the data was also arguably hard to decipher. On Tuesday, investors seemed to welcome news that retail sales. Retail sales rose at a 0.9% pace relative to the previous month, marking the fourth straight month of higher spending. However, retail sales aren’t adjusted for inflation, so sales figures tend to rise in tandem with price increases, which erode consumers’ buying power.

On Thursday, , a gauge of manufacturing activity in the Mid-Atlantic region fell short of expectations by a wide margin, and weekly jobless claims rose more than expected. Housing starts and existing home sales also came in lower than expected, reflecting the pressure from higher mortgage rates.

In other developments, China cuts borrowing rate again, lowered the five-year loan prime rate (LPR) by 15 basis points to 4.45%, the biggest reduction since China revamped the mechanism in 2019. The moves come as COVID-19-related lockdowns in some of China’s biggest cities weigh on demand for new loans from businesses and homebuyers. The one-year LPR was unchanged at 3.70%.

Gold rose recorded its first weekly gain since mid-April, as the U.S. dollar receded from two-decade highs and mounting concerns over U.S. economic growth revived safe-haven demand.

What Can We Expect from the Market this Week

With monetary policy and inflation front and centre, the pending releases of two reports are likely to attract plenty of attention in the new week. On Wednesday, the U.S. Federal Reserve is scheduled to release minutes from its policy meeting in early May. While on Friday, the government will update its Personal Consumption Expenditures Price Index, the Fed’s preferred gauge for tracking inflation.

Another important economic data being released this week also include new and pending home sales, durable goods order, the PMI composite and personal income and consumer spending.

Investors also may be jittery going into next week with more retailers due to report, following on the jarring reports in the previous week that precipitated broad selling across sectors. Costco, Best Buy, Advance Auto Parts, Nordstrom, Dick's Sporting Goods and Macy's are a few of the key reports to watch from consumer-facing companies.