PAST WEEK'S NEWS (June 20 – June 26, 2022)

Stocks Performance

After declining for several weeks in a row, the major indices gained some ground last week, though remain down between 7.0% and 12.3% for the month. Aggressive central-bank tightening, concerns around inflation, and global growth have led to a rapid adjustment in interest rates, valuations, and sentiment.

Glimmer of hope for a slowing down of inflation increases helped stocks rally sharply. The Federal Reserve last week said it is committed to fighting inflation without triggering a recession and is still looking for that soft landing in this new rising-rates environment. Fed Chair Jerome Powell testified before Congress on Wednesday and Thursday that inflation expectations appeared to remain anchored, which seemed to play a role in boosting sentiment in both equity and fixed income markets.

The week’s economic data also offered several signals that the Federal Reserve’s forceful turn toward monetary tightening was having the intended effect of slowing the economy and moderating inflation.

Nearly every sector in the index recorded strong gains. Energy stocks were the notable exception, as oil continued to back off from its recent highs over most of the week.

Indices Performance

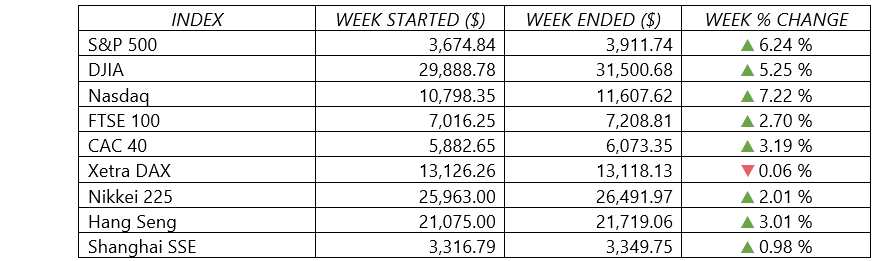

After declining for three weeks in a row, the major U.S. stock indexes regained their footing, with the NASDAQ surging more than 7%, the S&P 500 adding more than 6%, and the Dow rising more than 5%. The results marked a near mirror-image reversal from the previous week, when the S&P fell into a bear market as it tumbled more than 20% from a recent high in early January.

Shares in Europe also snapped three weeks of losses as signs that the economy is slowing cast doubt on whether central banks would seek to increase interest rates aggressively. Germany’s DAX Index, however, was little changed.

Japan’s stock markets registered gains for the week, with the Nikkei 225 Index rising more than 2%. Sentiment was supported by continued expectations that the BoJ would keep its monetary policy ultra-loose, despite upward trending consumer prices and the yen at fresh lows.

Chinese stock markets advanced on stimulus hopes after President Xi Jinping pledged to roll out more measures to support the economy and minimize the impact of COVID-19.

Crude Oil Performance

Oil prices fell for the second week in a row, as investors recalibrated assessments of recession risks and fuel demand amid interest rate hikes in major economies. The prices also weighed as the U.S. prepared to step up its fight against lofty pump prices by calling plans for a three-month suspension of the 18.4-cents a gallon federal tax on gasoline.

Other Important Macro Data and Events

The U.S. dollar remained under pressure alongside U.S. Treasury yields, recorded its first weekly decline this month as it wallowed near two-week lows amid rising concerns of a recession. The dollar has been choppy with markets now betting on more cautious policy action from the Fed after another expected 75 basis point rate increase in July.

Prices for U.S. government bonds rose for the second week in a row, sending the yield of the 10-year U.S. Treasury bond down to 3.13% on Friday. That’s down from a recent high on June 14 of 3.48%—a level not seen since April 2011. The 2-yr note yield meanwhile dropped 12 basis points for the week to 3.06% after dipping below 2.90% earlier in the week.

A monthly survey of U.S. corporate PMI showed that growth in economic activity across manufacturing and services fell to the lowest level in five months. In the eurozone, a similar survey showed that growth fell to the lowest in 16 months. The slowdown worldwide partly because China's COVID-19 curbs and Russia's invasion of Ukraine have disrupted supply chains and added to inflation problems.

Core eurozone government bond yields fell, as the weaker-than-expected PMI readings sparked fears of an economic slowdown and prompted the market to pare expectations for policy tightening. Peripheral eurozone government bond yields broadly tracked core markets, as did UK gilt yields.

Record UK inflation and a drop in consumer confidence intensified fears about the economic outlook, exerting further downward pressure on yields.

Japan’s inflation rate recorded 2.5% on Friday. Though it remains far below the rates of most of the world’s developed economies, the figure exceeded the Bank of Japan’s 2.0% target for the second month in a row. The central bank remain as an outlier, has so far avoided joining other countries in raising interest rates to fight inflation.

Norway’s central bank raised interest rates by a larger-than-expected 50 bps to 1.25%.

Germany moved to the second “alarm stage” of its emergency plans to reduce gas consumption and increase storage inventories of the thermal fuel after Russia sharply reduced pipeline flows. Sweden and Denmark joined Germany, Austria, and the Netherlands in implementing measures aimed at countering a supply squeeze and averting winter shortages. In addition, Germany, Austria, and Romania moved to reopen some coal plants for electricity generation.

Growth fears continue to drag on commodities. Precious metal, agriculture and oil prices slid to end the week lower. Precious metals slipped lower for the week, with gold, silver, platinum and copper ended lower. The price of copper, an industrial metal, posted a steep decline, sinking to a 16-month low. Palladium gained about 3% for the week.

The price of Bitcoin hovered around $20,000 to $21,000 for most of the week. That relatively narrow range came after Bitcoin tumbled about 30% in the previous week. At the end of May, it was trading above $32,000.

What Can We Expect from the Market this Week

The economic calendar includes updates on durable goods orders on June 27, home prices on June 28, GDP on June 29, PMI on June 30, and construction spending on July 1. A report scheduled to be released on Thursday will be closely watched for any signs that U.S. inflation may have peaked. The government will update its Personal Consumption Expenditures Price Index, the Fed’s preferred gauge for tracking inflation. The latest report showed that PCE inflation moderated at an annual rate of 6.3%, although it remained close to the highest level in four decades.

Near the end of the week, oil traders will be watching the OPEC+ meeting to see if the plan is to proceed with the targeted August oil production increase against a backdrop of high prices and limited spare capacity for some members.

OPEC+ will likely stick to a plan for accelerated output increases in August in hopes of easing crude prices and inflation as US President Joe Biden plans to visit Saudi Arabia. The group agreed in its last meeting on June 2 to boost output by 648,000 barrels a day in July, or 7% of global demand, and by the same amount in August, up from the initial plan to add 432,000 bpd a month over three months until September. However, the group has struggled to hit the monthly increase targets due to underinvestment in oilfields by some OPEC members and, more recently, losses in Russian output.

A rough second quarter in the market will come to an end this week, but not before big earnings reports from Nike and Micron land on the laps of investors.