PAST WEEK'S NEWS (August 8 – August 12, 2022)

Stocks rallied as investors welcomed indications of a modest easing in inflation. Although U.S. inflation remains near its highest level since the early 1980s, the latest monthly CPI report brought some relief, which triggered a stock market rally on Wednesday. Prior to the data, the major indices were all sporting losses for the week.

This understanding triggered a huge upswing in the major indices, as investors relished the idea that inflation might have peaked, that the Fed might be able to temper the pace of its rate hikes, and that the U.S. economy, which learned last week that 528,000 positions had been added to nonfarm payrolls in July, might be able to enjoy a soft landing.

Though various Fed officials attempted to downplay the idea of the Fed being ready to take its foot off the rate-hike pedal. Federal Reserve officials reiterated that the central bank still had work to do in taming inflation, but the market still appeared to lower its expectations for a 75-bps rate hike in September.

Almost all sectors closed higher for the week. Cyclical sectors saw some of the biggest gains and value stocks out legged growth stocks in a move that showed reduced fears about the economy suffering a hard landing.

An increase in steepening bets among investors following lower-than-projected inflation data aiding a pullback in front-end rates and a modest rise in longer-term yields. The 10-yr note yield settled the week up one basis point at 2.84%, up about five basis points from where it was trading before the release of the CPI report. The 2-yr note yield, which is sensitive to changes in the fed funds rate, ended the week up two basis points at 3.25%, virtually unchanged from where it was when the CPI report was released.

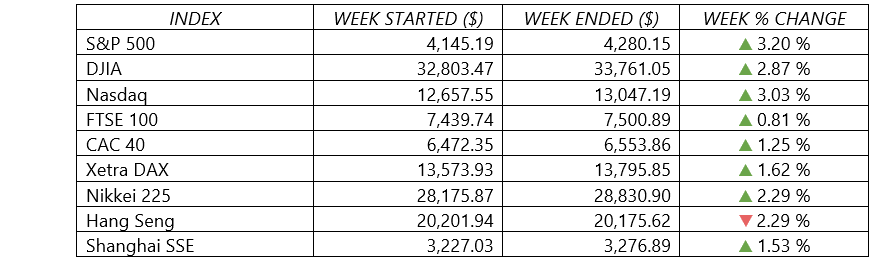

Indices Performance

The major U.S. stock indexes each posted returns exceeding 3%. For the S&P 500 and the NASDAQ, it was the fourth positive result in a row - the longest string of weekly gains since November 2021. European major shares also rose as fears of more aggressive interest rate hikes eased.

China’s stock markets ended the week on a mixed note as a flare-up in coronavirus cases offset news of a record trade surplus last month and a central bank report signalling support for growth. The spike in COVID-19 infections coupled with a continued housing market slowdown are considered among the largest risks to China’s economy in the near term. Coronavirus cases in China climbed to a three-month high, roughly half of them recorded in the southern coastal island of Hainan, which was widely on lockdown last week.

Crude Oil Performance

The benchmark contracts recorded weekly gains as recession fears eased and as traders weighed the prospects of higher demand this winter, recouping part of last week's heavy loss.

Monthly oil reports from the International Energy Agency (IEA) and the Organization of the Petroleum Exporting Countries (OPEC) were due on Thursday. The OPEC cut its forecast for growth in world oil demand in 2022 by 260,000 bpd. It now expects demand to rise by 3.1 million bpd this year. That contradicts the view from the IEA. The International Energy Agency raised its forecast for demand growth, to 2.1 million bpd, as soaring natural gas prices lead some consumers in power generation to switch to oil. At the same time, the IEA raised its outlook for Russian oil supply by 500,000 bpd for the second half of 2022, as the country's output had proven more resilient than expected despite sanctions over the Ukraine conflict.

U.S. crude oil stocks rose by 5.5 million barrels in the most recent week, the U.S. Energy Information Administration said, more than the expected increase of 73,000 barrels. Gasoline product supplied rose in the most recent week to 9.1 million barrels per day, though that figure still shows demand down 6% over the past four weeks compared with the year-ago period.

Meanwhile according to market sources citing American Petroleum Institute figures, U.S. crude stocks rose by about 2.2 million barrels for the week ended Aug. 5. Analysts had forecast a small 400,000-barrel drop in crude inventories.

Investors also weigh recessionary concerns with news that some oil exports had been suspended on the Russia-to-Europe Druzhba pipeline that transits Ukraine, while also awaited on the latest progress in last-ditch talks to revive the 2015 Iran nuclear accord, which would clear the way to boost its crude exports in a tight market. The European Union on Monday put forward a "final" text to revive the 2015 Iran nuclear deal, awaiting approvals from Washington and Tehran. A senior EU official said a final decision on the proposal was expected within "very, very few weeks".

Other Important Macro Data and Events

The dollar index was at its third weekly loss in four, though is still up 10% this year, rising alongside the 225 basis points of Fed rate rises since March.

All eyes were on the July inflation print, given its possible implications for monetary policy, the economy, and markets. Headline inflation rose at an annual 8.5% rate in July, marking a slowdown from the previous month’s 9.1% figure and expectations of 8.7%. Lower fuel and energy prices were largely responsible for the decline. Another surprise is the core inflation, which excludes volatile food and energy costs, was also below estimates and unchanged from the prior month. Core CPI came in at 5.9% year-over-year, versus a forecast of 6.1%. This was driven by lower prices in areas like used cars, select apparel, and airline fares.

Like the CPI reading, U.S. PPI figures also came in below expectations, although they remain elevated versus history as well. Headline PPI came in at 9.8% year-over-year, versus an expectation of 10.4%, and well below last month's 11.3% reading, benefiting from the lower energy prices. Core PPI came in at 7.6%, also below forecasts of 7.8%.

What we have seen as a result of this month's inflation readings is a shift in the market expectations of the magnitude of Fed rate hikes. Markets now expect a 50-basis-point rate hike (0.50%) at the September meeting versus a 75-basis-point hike just earlier this week. The expectation now is for another 50-basis-point hike in November, followed by a 25-basis-point hike in December, bringing the fed funds rate to a 3.50%-3.75% range before pausing.

A monthly gauge of U.S. consumer sentiment meanwhile rose, marking the second monthly gain since it fell in June to the lowest level in records dating to 1952. Friday’s preliminary report from the University of Michigan’s consumer sentiment index also indicated that consumers’ future inflation expectations improved but remained elevated.

Core eurozone government bond yields ended higher. UK and peripheral eurozone government bond yields broadly tracked core markets.

The UK economy contracted less than forecast in June. The GDP shrank 0.6% compared with the previous month; with consensus forecast had called for a 1.3% contraction. In the Q2, UK GDP fell 0.1% sequentially. The BoE expects a recession to begin at the end of the year.

Gold prices is at their fourth consecutive weekly gain, as broader weakness in the dollar countered pressure from an uptick in the Treasury yields and prospects of U.S. interest rate hikes.

What Can We Expect from the Market this Week

Investors are looking forward at the housing market trends with releases on the NAHB Housing Market Index, building permits, housing starts, and existing home sales being thrown into the mix for the week, for how the impact of interest rate increases has affected the purchasing power of homebuyers and real estate investors.

Another important economic data being released this week also to include the industrial production and capacity utilization, LEI index, retail sales, and business inventories.

Alongside that, some of the notable companies heading into the earnings confessional include reports from Home Depot, Lowe's, Target, Walmart, and Macy's.

After surprising to the upside last month, markets welcomed the lower-than-expected headline and core readings. However, inflation remains elevated compared with almost any period in history, and we would expect the Federal Reserve to continue to push rates higher in this backdrop. Nonetheless, investors cheered this first step in the right direction. While we may see increased volatility in the weeks ahead, if inflation continues to moderate consistently, markets could be poised for a more sustained rally longer-term.

Looking at the road ahead, Federal Reserve members will meet in Jackson Hole at the end of August and have a new inflation and jobs reports to digest before deciding whether to pull the trigger on a 50-point or 75-point rate hike at the September meeting.