PAST WEEK'S NEWS (MAY 12 – JUNE 16, 2023)

The Federal Reserve announced that it would maintain the current interest rates but surprised many with a vote among members that thought there would be two more rate hikes this year. The main reason for the decision is to avoid causing more economic damage to sectors that are already struggling, such as commercial real estate, residential real estate, and smaller regional banks. The Federal Reserve is open to the idea of further interest rate increases later this year, but it will depend on the economy's ability to cope with them during this pause period. Wall Street expressed surprise at the decision not to raise rates given the economic conditions showing signs of degradation with declining GDP growth, which is expected to intensify, potentially leading to a recession later this year.

The May CPI inflation came in at 4.0 percent, while core inflation remained at 5.3 percent, a minor improvement. Energy prices dropped the most by 11.7 percent following the drop in crude oil prices, while food prices rose by 6.7 percent, outpacing income growth at 3.4%. Shelter prices increased by 8.0 percent, and services excluding housing rose by 6.6 percent, both remaining elevated. The Federal Reserve is expected to keep interest rates unchanged, but concerns remain about the potential economic consequences of further rate hikes after the pause and their impact on real estate markets and financial sectors.

INDICES PERFORMANCE

The week ending on June 9, 2023, saw positive results for the major stock market indices around the world. The Nasdaq had its longest weekly gain since March 2019, as tech-heavy stocks performed well. Despite a slight dip on Friday, the S&P 500 and Nasdaq extended their winning streaks, with investors optimistic about the Federal Reserve's efforts to control inflation and avoid a recession. Dow Jones however did not perform as well albeit still positive for third consecutive weeks.

Japan's Nikkei reached a three-decade high and achieved its 10th consecutive weekly gain as the Bank of Japan maintained its ultra-easy policy settings. The market responded positively to the central bank's decision, with financials being the only weak spot, while travel, consumer, and technology stocks performed well. Hong Kong stocks closed the week with gains as optimism continued to rise, fuelled by expectations of China implementing additional support measures to boost its economy. Analysts anticipate Beijing delivering more stimulus and adjusting loan prime rates to revive the economy and support the struggling property sector, while the Chinese government explores injecting $140 billion into the economy and easing restrictions on purchasing second homes in smaller cities.

European shares closed at a three-week high, driven by luxury and defensive stocks following major central bank policy decisions. The CAC 40 index gained 1.91% and had its best performance in over two weeks, with China-focused luxury stocks and defensive sectors leading the gains. German stocks ended the week positively as eurozone inflation continued to cool, boosting market sentiment. The DAX index closed with a 1.90% gain, while Danske Bank analysts predict ECB rates could rise to 4% by September based on ECB President Christine Lagarde's hawkish remarks and the strong euro area labour market.

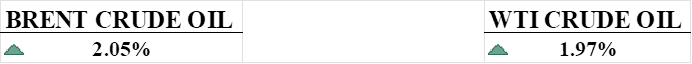

CRUDE OIL PERFORMANCE

Oil prices rose and posted weekly gains, buoyed by strong Chinese demand, OPEC+ supply cuts, and expectations of higher prices. Chinese refinery throughput surged, and Russian officials foresee prices hitting $80 per barrel. Iran's oil output rose despite sanctions. However, concerns over rising interest rates and reduced net long positions in U.S. crude futures added some caution to the market.

OTHER IMPORTANT MACRO DATA AND EVENTS

The Bank of England is expected to raise interest rates to 4.75%, its 13th consecutive rate rise, in response to stubborn inflation. While investors speculate that rates could reach as high as 6%, some economists believe that the bank may not increase rates as much as anticipated due to the unique challenges faced by the UK economy.

Major banks, including Nomura, UBS, Standard Chartered, Bank of America, and JPMorgan, have reduced their GDP growth forecasts for China in 2023 due to a faltering post-COVID recovery. The banks now expect China's GDP growth to range between 5.1% and 5.7% this year, down from the previous range of 5.5% to 6.3%, and additional policy support is anticipated to be implemented to stimulate the economy.

The Bank of Japan (BOJ) maintained its ultra-low interest rates and yield curve control while predicting an improvement in the economy and a decrease in inflation. The BOJ also signalled its commitment to quantitative easing and the purchase of exchange-traded funds and real estate investment trusts. The dovish stance of the BOJ contrasts with other central banks' tightening policies, causing the yen to weaken and Japanese stocks to rally.

What Can We Expect from The Market This Week

US Building Permits: approvals required for new or existing building construction are a leading indicator of housing activity, demand, business confidence, and investment.

Interest Rate Decision: Both the Bank of England and the Swiss National Bank are holding policy meetings on Thursday, with the BoE expected to increase rates by a quarter of a basis point and the SNB uncertain, with some saying a half percent hike.

German PPI and Manufacturing PMI: PPI measures the change in the price of goods sold by manufacturers, while Manufacturing PMI measures the business activity and sentiment of the manufacturing sector.

US Existing Home Sales: High interest rate environment and expectation of further hike are expected to hold existing home sales steady as consensus expecting slight decrease.

US Services PMI: It's a survey-based indicator that measures the business activity and sentiment of the services sector. The consensus for June data stays above the 50 level at 54, indicating slowing expansion.