PAST WEEK'S NEWS (JULY 17 – JULY 21, 2023)

After a year of the UN-brokered deal allowing Ukraine to export grain through the Black Sea, Russia suspended its participation, hours after its bridge to Crimea was hit in a blast. The grain deal pause raises concerns about global food security and price inflation, especially in Africa. Ukraine said it would seek ways to continue exports without Russia, aided by the UN and Turkey. The bridge blast limits Moscow's ability to supply its forces in southern Ukraine, where Ukraine is pursuing a counteroffensive.

China announced measures to boost auto and electronics sales as part of its stimulus effort to support its slowing economy. These include increased car purchase quotas, used car sales support, and promoting domestic AI in electronics. However, investors voiced for stronger stimulus as consumer demand is weak amid recovery uncertainty. China's troubled auto industry has been targeted to lift growth despite falling demand and price wars after news broke of potential fraudulent sales in the EV industry. Markets were unfazed by the latest policies as investors focused on more forceful action from an upcoming Politburo meeting.

China's digital currency, the e-CNY, has seen huge growth, with transactions totalling 1.8 trillion yuan ($249 billion) by the end of June 2022, according to Yi Gang, governor of China's central bank. This is way up from just 100 billion yuan in 2021 used in the form of central bank digital currency (CBDC). So far, the e-CNY is mostly being used for domestic payments within China, where 120 million digital wallets have been set up so far. China is leading the way globally in creating government-backed digital money, though it's still early days. While there is increasing adoption of this technology in the east, there is a huge pushback in the west against the potential loss of freedom.

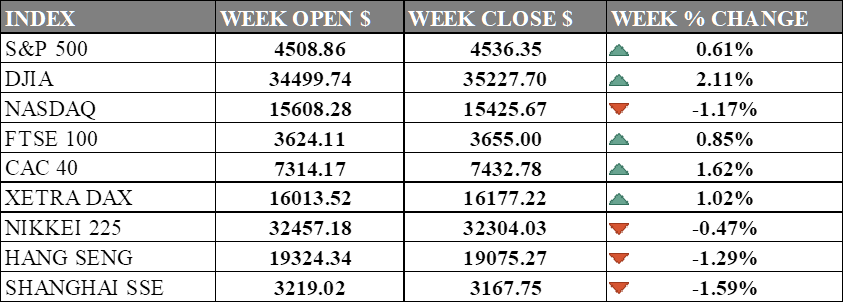

INDICES PERFORMANCE

The S&P 500 rose 0.61% over the past week, closing at 4536.35. This slight increase was driven by strong gain in healthcare and financial services especially Bank of America ($BAC) as a result of recovery from past banking turmoil while the launch of FedNow program has seen credit services in the same sector decline as it offers lower cost of transaction. The Dow Jones Industrial Average (DJIA) gained 2.11% this week to end at 35227.70. The index hit a record high, buoyed by robust economic data that saw gains in consumer defensive sector with expectations of lower cost as retails like Walmart spent around half of its customer service cost on transactional issues that will be resolved by the newly launched FedNow program. In contrast, the tech-heavy NASDAQ dropped 1.17% to 15425.67 ahead of its rebalancing after 67% of the index were dominated by top 10 of its constituent and later will only be 50% after rebalance.

Across the Atlantic, European indices were mostly higher. The UK's FTSE 100 added 0.85% to 3655.00 although UK retail stocks are lagging near the bottom of the FTSE 100 even after better-than-expected consumer spending data while the French CAC 40 performed even better, climbing 1.62% to 7432.78 on account of auto stocks rise on China's measures to increase car sales, offsetting a drop in tech after SAP's weak forecast. Germany's XETRA DAX advanced 1.02% over the week to 16177.22 as markets grew cautious ahead of next week's rate decisions although a hike is expected. Earnings misses from large companies also weighed on the index.

In Asia, Japan's Nikkei 225 slipped 0.47% to 32304.03 amidst Japan's consumer prices rose 3.3% in June, exceeding the central bank's 2% target for the 15th straight month ahead of the Bank of Japan's upcoming decision on interest rates. Hong Kong's Hang Seng fell 1.29% to 19075.27 pressured by Wall Street banks cutting China's 2023 GDP forecasts although stimulus and new measures were announced to boost auto and electronics sales. China's Shanghai SSE Composite followed suit after it declined 1.59% by the same reason.

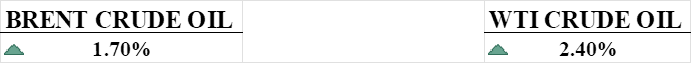

CRUDE OIL PERFORMANCE

Crude oil prices have been rising for the past month, gaining about 9% in July after a 4% increase in June. This is largely due to rhetoric from OPEC and Russia about potential production cuts as well as receding inflation that suggests the Fed may be less aggressive with interest rates going forward. However, oil has struggled to breach $80/barrel due to weak economic data from top importer China and spotty gasoline demand in the US. Still, oil bulls are growing more confident, with WTI moving above its 200-day moving average. If WTI can break through resistance around $78-85/barrel, it could target $90 or higher which OPEC desires. But the oil market remains tentative amid mixed signals on supply and demand.

OTHER IMPORTANT MACRO DATA AND EVENTS

British retail sales rebounded in June thanks to hot weather and a recovery in food spending after a drop in May, but longer-term consumption has stagnated due to high inflation eroding purchasing power. While the headline retail sales figures exceeded forecasts, the volume of goods purchased was below pre-pandemic levels as shoppers pay more for less amid soaring prices.

The Conference Board's Leading Economic Index fell for the 15th straight month in June, indicating continued deceleration in US economic activity in the months ahead due to factors like high inflation, tighter monetary policy, and weakening consumer outlook. The index's prolonged decline signals growing recession risks, with The Conference Board projecting the US economy will be in recession from Q3 2023 through Q1 2024.

New claims for US unemployment benefits unexpectedly fell last week to the lowest level in two months, defying Fed rate hikes aimed at cooling the labour market and suggesting recession risks may be overblown despite other weak data. The decline in jobless claims indicates many employers are holding onto workers amid ongoing labour shortages, though housing continues to struggle with low inventory and rising mortgage rates hurting sales.

What Can We Expect from The Market This Week

Federal Reserve Interest Rate Decision: The all-important determinant of market direction will be the anticipated action of the Fed this week on its policy stance. While the market is expecting another rate hike after a pause last week, a slurry of economic data keeps investors on their toes with narrative swings from one camp to another.

ECB and BoJ Interest Rate Decisions: The ECB is expected to hike another quarter basis point, while the BoJ isn't likely to change its loose monetary policy anytime soon. The Eurozone has seen a slowing CPI, but it is still way above target.

Purchasing Managers Index: Composite, Manufacturing, and Services PMI coming from both the U.S. and the UK will provide insight into the activity and performance of each sector and the economic output of the respective

US Building Permits and New Home Sales: The creation and transaction of property remained resilient, albeit in a high interest rate environment, with the expectation that the price would be higher later on when interest rates return to their normal range.

PCE Price Index: This inflation indicator is used to track purchase prices by consumers and is usually used to gauge the Fed's changes in monetary policy. It may set an expectation for its next interest rate decision in September.