PAST WEEK'S NEWS (JULY 31 – AUGUST 04, 2023)

Fitch Ratings recently downgraded the United States' credit rating from AAA to AA+, citing repeated debt-limit political standoffs, an inadequate fiscal framework, and a steady deterioration in standards of governance over the last 20 years. The downgrade comes after a partisan clash over the country's borrowing authority threatened a default earlier this year. In addition to the Bank of Japan's long term yield tweak, the move could push bond yields further, pushing annual interest repayment to $1 Trillion. The US Treasury Secretary, Janet Yellen, disagreed with Fitch's downgrade, calling it "arbitrary and based on outdated data". Biden administration officials also blasted the downgrade, saying that Fitch repeatedly raised the January 6th insurrection at the Capitol as a factor in its decision.

Niger's president was ousted in a military coup on July 26th, the latest in the country's coup-ridden history, sparking threats of military action and pro-coup unrest in the capital. West African bloc ECOWAS leaders imposed sanctions and threatened force, demanding the junta restore order amid a wave of power grabs across the politically unstable region. However, the coup leaders have found support from neighbouring Mali, Burkina Faso, and Guinea, who have warned they will defend Niger against outside intervention. The US has not formally called it a coup to avoid cutting aid but has evacuated diplomatic staff and ordered troops to pull back to base. French energy company EDF says it is confident in its diversified uranium supply strategy to maintain stable nuclear fuel supplies, despite rebel groups in Niger recently banning uranium exports that accounted for 15% of the EU's total imports.

INDICES PERFORMANCE

The global indices performance for the week ending August 4, 2023, was negative across the board. The S&P 500, DJIA, NASDAQ, FTSE 100, CAC 40, XETRA DAX, NIKKEI 225, and Hang Seng all experienced losses ranging from -1.13% to -3.45%. The Shanghai SSE was the only index that remained relatively unchanged, with a marginal increase of 0.03%.

The reason for the negative performance of the indices was the downgrade of the US credit rating by Fitch Ratings from AAA to AA+. This downgrade was due to the debt ceiling standoff that occurred earlier in the year. The downgrade caused a wave of selling in the US stock market, with the S&P 500, DJIA, and NASDAQ all experiencing significant losses. The downgrade also affected global stock markets, with Europe's XETRA DAX indices down 2.94% and Asian stocks down about 3%. The technology sector was particularly sensitive to the interest rate changes, with tech mega-cap stocks like Amazon, Meta, Microsoft, Tesla, Nvidia, and Apple leading market declines. The lack of movement in US Treasury Bonds and the dollar index suggests that the market has already largely quantified and assessed the damage done by recent fallouts.

In Europe, the FTSE 100 was lower by 2.13%, while France's CAC 40 traded by 2.11%, and Germany's DAX was lower by 2.94%. In Asia, Hong Kong's Hang Seng led losses in the region, falling 3.45%, and NIKKEI 225 also slipped 2.83% in its final hour, mainly due to health-care stocks.

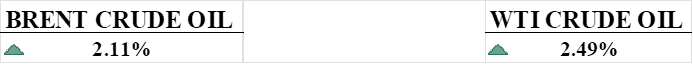

CRUDE OIL PERFORMANCE

Crude oil prices rose to 3-month highs this week after Saudi Arabia announced it would cut output further in September, but demand concerns remain as China's appetite may have peaked and US gasoline stockpiles fell recently. Key events that could impact oil prices include the Federal Reserve's September rate decision, the peak of Atlantic hurricane season in mid-September, and OPEC+'s October production quotas. While Saudi supply cuts lifted WTI to over $83 and Brent over $86, prices could see exhaustion if China's weak economy continues to limit fuel consumption.

OTHER IMPORTANT MACRO DATA AND EVENTS

The U.S. economy added fewer jobs than expected in July, but the unemployment rate fell back to 3.5% indicating continued tightness in the labour market. Wage gains remain solid though moderating recently, and job growth has slowed from earlier this year, suggesting some cooling in labour demand amid high inflation and interest rates. While signs point to a potential "soft landing," the path to sustained expansion remains precarious if inflation persists and more aggressive Fed policy triggers a downturn.

The U.S. services sector expanded at a slower pace in July as demand held up despite high inflation, indicating continued economic growth albeit at a more moderate rate. While new orders remained solid, prices paid by services firms for inputs increased further, suggesting persistent inflationary pressures, especially in sticky services costs.

German exports stagnated in June while imports fell, reflecting slowing trade momentum and weakening foreign demand, with exports to major partners like China dropping sharply. Surveys also indicate deteriorating export sentiment due to global headwinds like tighter monetary policy abroad, supply chain disruptions, and Germany's declining competitiveness.

What Can We Expect from The Market This Week

China Trade Balance: Exports and imports are expected to worsen as China suffered over $5 billion in economic losses from natural disasters in July 2023 alone, driven by severe flooding from powerful typhoons that affected millions and caused the worst rains in Beijing in 140 years.

German CPI: Inflationary pressure from Germany is expected to flatline after two consecutive months of growth at 0.3%. While German industrial orders unexpectedly increased in June, overall manufacturing activity remains weak, and high energy costs continue to put pressure on German industry and the economy.

EIA Short-Term Outlook: The report is expected to align with expectations that Crude oil prices will gradually increase over the forecast period to around $84/b in 2024, while growth in solar capacity and lower natural gas prices will reduce coal generation in the U.S. this year. Economic growth is now expected to be slower, reducing energy consumption.

US CPI: Inflation data is expected to come on Thursday at a slightly higher figure after it dropped to a satisfying 3% last month as interest rates keep climbing higher and the Fed is firm on lowering inflation. Producer inflation is expected to be reported on Friday as a leading indicator, with the same slight increment.

UK GDP Q2: Although the Bank of England is expecting economic growth to increase in the second half of the year and the IMF predicts that the UK economy will grow by 1% throughout 2023, The consensus for the second quarter points towards flat growth, and YoY is only at 0.2%, far below both organisations targets.