PAST WEEK'S NEWS (AUGUST 21 – AUGUST 25, 2023)

The shocking death of Yevgeny Prigozhin, head of the controversial Russian mercenary group Wagner, has created uncertainty over the future of the shadowy conglomerate. With its chief patron and strategist gone, Wagner may struggle to maintain cohesion and funding for its global operations supporting Russian foreign policy. Prigozhin's loss deals a blow to President Putin's ambitions, as the oligarch had acted as an instrumental proxy, advancing Russian interests in conflicts globally, from Ukraine to Africa. The plane crash that killed Prigozhin seems likely to cripple, though not completely dissolve, the infamous Wagner Group, depriving the Kremlin of a valuable tool for projecting power. As Russia mourns one of its most powerful behind-the-scenes operators, the ripple effects of Prigozhin's demise will reveal how much the country relied on him to secretly extend its global reach.

The BRICS bloc, composed of major developing economies, have decided to expand membership for the first time in 13 years by admitting Saudi Arabia, Iran, Ethiopia, Egypt, Argentina, and the United Arab Emirates. This expansion adds economic strength to the group and supports its goal of reshaping the global order into one more favourable to developing nations. However, tensions may arise between members wanting to counter Western dominance, like China and Russia, and those maintaining ties with the West. While the bloc has lofty ambitions, its impact has been limited by economic differences between members and a lack of consensus. The admission of Iran, however, shows a desire to include influential developing nations, even those at odds with the West.

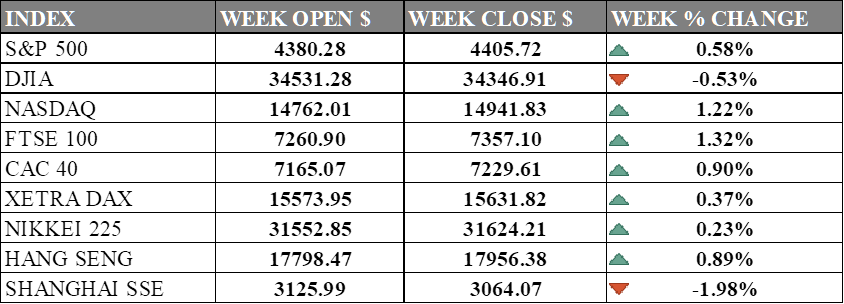

INDICES PERFORMANCE

The S&P 500 index closed 0.58% higher for the week ending August 25, 2023 at 4405.72. The index opened the week at 4380.28 and climbed to 4458.30 but gains tempered after concerns over higher interest rates after Fed chair Powell's speech at Jackson Hole reinforced a data-dependent approach. Similarly, the Dow Jones Industrial Average (DJIA) rose 0.53% week-over-week to close at 34346.91. The 30-stock index started the week at 34531.28 but managed to gain momentum due to bond markets relentless sell-off eased up while housing and economic data showed signs of cooling, supported the Dow Jones Industrial Average. The tech-heavy NASDAQ composite gained 1.22% for the week to finish at 14941.83. The index began trading at 14762.01 on Monday but rebounded due to a recovery in technology stocks, especially Nvidia which hit a record high and Tesla recovering 10%.

Across the Atlantic, the UK's FTSE 100 index was the strongest gainer, surging 1.32% to end at 7357.10 from opening at 7260.90. However, The Bank of England expects UK interest rates to remain high for some time to combat stubbornly high inflation, even as headline inflation shows signs of easing. France's CAC 40 and Germany's XETRA DAX saw more modest gains of 0.90% and 0.37% respectively. The CAC 40 closed at 7229.61 while the DAX settled at 15631.82. The CAC40 and DAX are being lifted by broad gains led by the tech sector, strong luxury stocks, upbeat corporate news, and optimism stemming from new pro-market measures in China. Major European indices are also receiving a boost from rising futures markets anticipating a positive open.

In Asia, Japan's Nikkei 225 rose 0.23% week-over-week, closing at 31624.21 after opening at 31552.85 on Monday after a volatile trading week that saw it touching highs of 2% above opening before gain slumped on lower CPI. Hong Kong's Hang Seng index jumped 0.89% for the week to end at 17956.38. The gains came as Hong Kong rebounded as environment and property shares rose although there is concerns about US monetary policy and China's economic health. China’s Shanghai Composite fared slightly worse than its regional peers, falling 1.98%.

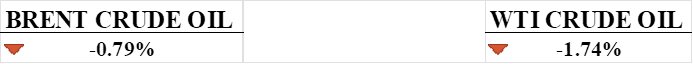

CRUDE OIL PERFORMANCE

After rallying for seven straight weeks, oil prices have retreated over the past two as concerns grow that aggressive Fed rate hikes will curb demand even as supplies tighten. While prices rebounded slightly on Friday, WTI still ended 1.7% lower for the week and remains stuck below the key $81 resistance level amid bearish momentum. With volatility expected to continue as the market weighs macroeconomic headwinds against bullish supply factors, oil is at an inflection point. Though risks of production-disrupting storms persist, the near-term direction will hinge on whether demand can withstand further rate rises. If the Fed signals more hikes ahead, oil could break below support at $78 and test the $75 zone. Upside recovery looks limited barring a shift in Fed policy.

OTHER IMPORTANT MACRO DATA AND EVENTS

Germany's economy showed zero growth in the second quarter, cementing its position as one of the world's weakest major economies due to weak industrial activity, reduced exports, and low consumer spending. The outlook remains gloomy due to high inflation, aggressive interest rate hikes, supply chain issues, and slowing growth in China and other trade partners.

The number of Americans filing new unemployment claims fell for the second straight week, defying expectations of rising claims after the Yellow trucking bankruptcy, signalling ongoing labour market strength. Orders for capital goods excluding aircraft rose slightly in July, suggesting business spending on equipment may keep growing after rebounding last quarter.

Mortgage rates hit a 22-year high last week, driving mortgage applications to a 28-year low as rising Treasury yields made borrowing more expensive. Applications for home purchases and refinancing both fell to multi-decade lows due to high 30-year mortgage rates of 7.23% and home affordability index plummeted, signalling ongoing struggles in the housing market.

What Can We Expect from The Market This Week

CB Consumer Confidence: The data is a monthly survey of US consumer attitudes, spending plans, and expectations for inflation, stock prices, and interest rates that is a leading indicator as it can predict consumer spending, which plays a major role in overall economic activity. The latest data shows continuous improvement since May 2023.

US Labour data: JOLT job openings, average hourly earnings, and nonfarm payroll are among the data in focus as forecasts for the upcoming FOMC September policy meeting will be adjusted according to the labour data.

German CPI: The key measure of inflation and is used as a reference in wage negotiations and contracts with payments tied to inflation. Inflation fell to 6.2% from 6.4% in June, driven by a stronger euro and falling energy prices. However, fuel prices peaked at $88 in August, possibly driving up consumer prices.

US GDP Q2: GDP rose at a 2.4% pace in Q2 2023, faster than Q1 and above expectations. Increases in business investment, government spending, and inventories all contributed to a strong quarter for consumer spending.

China (Non-)Manufacturing PMI: The focus is more on manufacturing, whose PMI was at 49.3, higher than the forecast of 49.2. This indicates a continued expansion in manufacturing activity, with the market expecting the trend to continue.