PAST WEEK'S NEWS (AUGUST 28 – SEPTEMBER 01, 2023)

China's economy is flashing warning signs. To restore investor confidence, authorities have unveiled measures including tax cuts, eased curbs on property markets, and support for consumers and businesses. However, western investors remain sceptical as China grapples with real estate woes, weak spending, and softening investment that have encouraged outflows from the country. While interest rates were lowered to boost borrowing, banks held mortgage rates steady, underscoring Beijing’s balancing act. Tough challenges persist in reviving growth and stabilising markets despite pledges to boost consumption and support private firms. Overall, China faces an uphill battle to revive the economy and steady markets amid conflicting pressures.

After weeks of discord, Germany's coalition government has agreed to a 32-billion-euro corporate tax cut plan aimed at boosting its stagnant economy. The "Growth Opportunities Law" aims to stimulate growth by incentivizing climate-friendly investments, spurring research through tax incentives, and allowing greater loss offsetting. The Greens agreed to a reduced 2-billion-euro child benefit programme after initially seeking more funding. The business tax cuts are urgently needed to jumpstart the economy amid the recession, but public dissatisfaction persists over the coalition's leadership and delays. If passed, the tax cuts could provide a timely stimulus to reignite growth and recovery in Germany's struggling economy. However, some experts question if the modest package will be enough to boost Germany's $4 trillion economy.

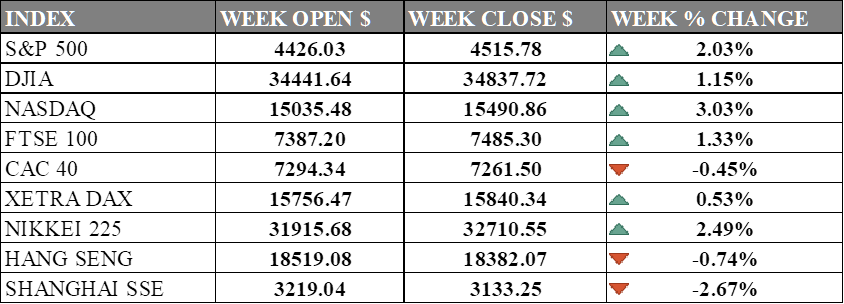

INDICES PERFORMANCE

The S&P 500 index closed 2.03% higher for the week ending September 1, 2023, at 4515.78. The index opened the week higher and keep climbing until the last two days where gains were hindered by expectations of another rate hike although cooling jobs market points to rate pause. Similarly, the Dow Jones Industrial Average (DJIA) rose 1.15% week-over-week to close at 34837.72. The 30-stock index have the lowest gain among its peer as treasury yield continue to increase. The tech-heavy NASDAQ composite gained the most by 3.03% for the week to finish at 15490.86. The index gained the most as apple rebounded by 6% while being the biggest constituent.

Across the Atlantic, the UK's FTSE 100 index was the strongest gainer, surging 1.33% to end at 7485.30 from opening at 7387.20. Heavy rise in energy sector is the main reason for the gain. France's CAC 40 saw a modest loss of -0.45%, closing at 7261.50. Germany's XETRA DAX saw more modest gains of 0.53%. The DAX settled at 15840.34. The CAC40 and DAX are optimistic after Novo Nordisk launched its weight loss drug Wegovy in the UK, which helped boost healthcare stocks in Europe while auto stocks may get a boost this week from the IAA mobility show kicking off in Munich.

In Asia, Japan's Nikkei 225 rose 2.49% week-over-week, closing at 32710.55 after opening at 31915.68 on Monday after corporate profits hit a record high in Q2. Hong Kong's Hang Seng index fell -0.74% for the week to end at 18382.07. The losses came albeit broad optimism that China's economy may be stabilizing given the government's incremental stimulus steps. Investor seem to call China’s effort a bluff as the country outright stop publishing unemployment figures. China’s Shanghai Composite fared slightly worse than its regional peers, falling 2.67%. The index closed at 3133.25 after opening at 3219.04.

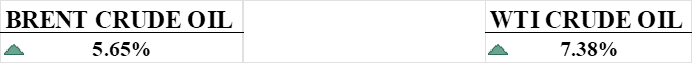

CRUDE OIL PERFORMANCE

Hurricane Idalia caused less damage than expected, sparing Gulf refineries and limiting impact on fuel prices, but WTI and Brent still rose over 4% on the week as crude inventories declined for a third straight week. Though summer gasoline demand remains below pre-pandemic levels, Saudi production cuts and refinery issues have kept fuel margins strong, however distillates and gasoline futures fell last week on higher-than-expected stockpile builds. While hurricane threats remain a concern that could disrupt output and boost prices, reduced offshore production shutdowns in recent years have mitigated storms' impact, but risks still exist as peak hurricane season continues through November.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. consumer spending increased sharply in July as Americans bought more goods and services, but inflation pressures continued easing which supports the Federal Reserve's plans to keep interest rates steady. Separate data showed jobless claims declined last week and the tight labour market remains intact even as conditions start cooling.

Euro zone inflation remained stubbornly high in August although underlying price pressures eased slightly, providing mixed signals on whether the ECB should deliver another interest rate hike next month. While overall inflation held steady, a key core measure declined which supports pausing tightening, but services inflation barely fell and the labour market stays tight, arguing for further hikes to control price pressures.

U.S. inflation accelerated in July, providing a mixed signal on whether the Federal Reserve will pause interest rate hikes at its September meeting. While the monthly pace of price increases was unchanged, the annual rate of inflation rose despite the Fed's campaign of rate hikes intended to cool runaway prices.

What Can We Expect from The Market This Week

German factory orders: The monthly report from the Census Bureau shows new orders for durable and nondurable goods. Indicates manufacturing sector demand. Germany's manufacturing and economic growth have stagnated since 2018 due to weak demand, leading to the worst factory activity and GDP performance in years in 2023.

ISM Non-Manufacturing Index: A monthly gauge of service sector activity from ISM signals expansion or contraction in services. It is expected to show a slight increase from July but remain in contraction territory below 50, suggesting the services sector continues to shrink, albeit at a more modest pace.

US Trade Balance: Monthly Measure of Exports and Imports from the Census Bureau signals demand for US goods and services abroad. The consensus for the trade deficit is higher than the previous month, although a higher dollar may report a lower trade deficit.

Bank of Canada Interest Rate Decision: The unexpected contraction in Canada's Q2 GDP and flat July growth foreshadow that the Bank of Canada will likely hold interest rates steady at its upcoming meeting, as the data signals mounting economic weakness that diminishes the impetus for further rate hikes after aggressive increases earlier to curb high inflation.

Weekly jobless claims: a weekly report on new claims for unemployment insurance is a timely signal of layoffs and labour market health. The figures have been steadily dropping, an indicator of an improving labour market and a catalyst for a higher interest rate.