PAST WEEK'S NEWS (SEPTEMBER 04 – SEPTEMBER 08, 2023)

The wheels are turning for a seismic shift in global power dynamics at the 2-day G20 summit in India (now known as Bharat) next week. With China's and Russia's influence waning, Bharat is poised to assert itself as an economic juggernaut and champion of the developing world. However, tensions simmer with China over border disputes, while doubts linger over India's reluctance to condemn Russia. Yet Bharat's massive growth presents lucrative opportunities, as evidenced by its ballooning aviation sector and trailblazing private space industry. As the G20 host, Bharat aims to spearhead reforms in green energy and digital innovation while attracting foreign investment. But executing these ambitions requires deft geopolitical manoeuvring to align both emerging and advanced economies. Ultimately, the summit will gauge whether multipolar cooperation can prevail over bipolar confrontation.

The wildly popular discounted shopping app TEMU by Pinduoduo (PDD) has come under fire after independent research from Grizzly Research claims the app is "more dangerous than TikTok." The team claimed the TEMU app has software enabling extensive data exfiltration unbeknownst to users, granting bad actors full access to customers' mobile data. TEMU was built using the same malware-laden codebase as PDD's app, which was recently suspended from the Google Play Store, and aggressively collects invasive personal data on Western users that likely gets sold to Chinese authorities, raising national security concerns. Beyond the malware, PDD displays an attitude of impunity in their shady business practices and declining financials, according to the report. The report urges regulators to investigate TEMU as it poses more of a danger than TikTok, which is already under scrutiny.

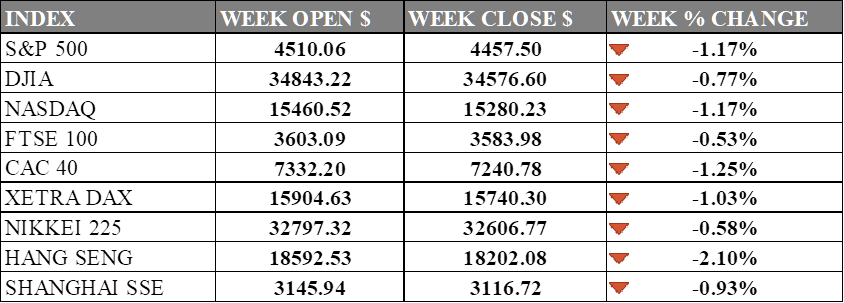

INDICES PERFORMANCE

The S&P 500 index closed 1.17% lower for the week ending September 15, 2023, at 4457.50. The index opened the week at 4510.06 but slid through the week on renewed China policy that saw its largest constituent fell. Similarly, the Dow Jones Industrial Average (DJIA) fell 0.77% week-over-week to close at 34576.60. The 30-stock index declined as the fear of potential market contraction hit as trade war tension grew. The tech-heavy NASDAQ composite dropped 1.17% for the week to finish at 15280.23. The index extended its losses on fiscal policy concern although market consensus point toward a pause.

Across the Atlantic, the UK's FTSE 100 index fell 0.53% to end at 3583.98 from opening at 3603.09. France's CAC 40 saw a loss of 1.25%, closing at 7240.78. Germany's XETRA DAX declined 1.03%. The DAX settled at 15740.30. The European indices pulled back as the energy crisis and inflation worries persisted as oil price grew on Saudi continuous supply cut create a void upward that could prompt the ECB to raise rate this week on Thursday.

In Asia, Japan's Nikkei 225 slipped 0.58% week-over-week, closing at 32606.77 after opening at 32797.32 on Monday as the yen weakened again. Hong Kong's Hang Seng index tumbled 2.10% for the week to end at 18202.08 on property developer woes. China’s Shanghai Composite also declined 0.93%. The index closed at 3116.72 after opening at 3145.94. Asian markets were pressured by growth concerns both domestically and abroad.

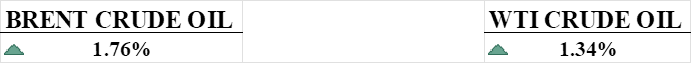

CRUDE OIL PERFORMANCE

U.S. crude inventories fell by 5.2 million barrels last week, the first drawdown in 3 weeks, challenging arguments that high inventory levels will soon cause crude prices to tumble. However, stockpile data remains a lagging indicator and it could take months to impact actual pricing, while the EIA has raised estimates of U.S. crude output to 3-year highs based on a new methodology showing higher rig productivity. Meanwhile, Saudi Arabia and Russia plan to remove a combined 1.3 million barrels per day from the market through year-end to support prices, with Saudi targeting $100+ oil, and this impending tightness is playing on traders' minds. Technical show room for further gains in WTI with key support at $86.75, initial resistance at $88, and price action is forming an ascending triangle pattern which set the price target close to $96.

OTHER IMPORTANT MACRO DATA AND EVENTS

New data released last Thursday indicates the U.S. job market remains strong despite the Federal Reserve's efforts to slow it down, with unemployment filings dropping to the lowest level since February and continued claims falling to the lowest since July. Though the moderation in labour costs and rebound in worker productivity are welcome news for the Fed, officials are still unlikely to relax their inflation fight anytime soon.

China's imports and exports declined less than expected in August, indicating some improvement in trade activity compared to sharp drops earlier this year, though demand remains sluggish both locally and abroad weighing further on the economic outlook. Despite the moderate rebound, China's trade surplus still hit its lowest level in two months as exports and imports continue to face headwinds from weakening global and domestic economic conditions.

Retail sales in the euro zone declined slightly in July compared to June due to reduced spending on automotive fuel, while revised figures show sales increased in June, according to data released Wednesday. Falling real incomes and higher costs are weighing on consumer demand in the euro zone, with retail sales registering year-over-year declines for 10 straight months.

What Can We Expect from The Market This Week

ECB Interest Rate Decision: The European Central Bank is unlikely to raise interest rates again at its upcoming meeting, although the current consensus is uncertain. Policymakers warned that the decision is still in the air, but the economy has already shown serious signs of slowing, with growth only at 0.5% YoY.

US Retail Sales: Monthly retail sales data will show if high inflation has started to significantly curb consumer spending. Expectations are for a modest rise, suggesting resilience so far. Still, many Americans are relentless in their spending, which saw personal savings dip while credit card balances rose to $1 trillion.

US CPI and PPI August: The upcoming CPI and PPI inflation reports will indicate if price pressures continue to ease in the US. Forecasts point to reinflation, suggesting the Fed's tightening actions may have run out of gas. Any upside surprise could alter rate hike expectations, as officials poll from months ago suggested one last hike.

UK Industrial and Manufacturing Production: Recent data has highlighted UK economic weakness, with GDP contracting in Q2 and expected to achieve negative growth. Industrial and manufacturing production reports, which are also predicted to decline, will provide further insight into the extent of the slowdown. Another contractionary reading would underscore recessionary concerns.

China Industrial Production: This monthly indicator will show the extent of growth in China's industrial sector and factories as more stimulus is carefully injected into the economy. The consensus sees a moderate rebound, but the key question is whether the $40 billion state fund for microchips will rebalance technological power that has been in America's reign for decades.