PAST WEEK'S NEWS (SEPTEMBER 25 – SEPTEMBER 29, 2023)

The rapidly accumulating US debt and hawkish Fed interest rate paths paint a concerning picture for markets. With the government adding over $17 billion per day to the debt since crossing $33 trillion, fiscal policymaking appears ineffective at reining in unsustainable deficits. Meanwhile, the Fed's hawkish stance has driven Treasury yields to fresh multi-year highs, tightening financial conditions. This backdrop of surging debt, higher borrowing costs, and partisan brinkmanship raises the spectre of a potential downgrade that could roil markets. Though a government shutdown may only briefly dent growth, recurring fiscal crises erode confidence and increase uncertainty. Markets seem primed for volatility as economic headwinds strengthen and policy responses falter.

OpenAI's ChatGPT is gaining new voice and image capabilities that will allow Plus and Enterprise users to have more natural conversations by speaking to the AI or showing it photos, providing a more intuitive interface through real-time voice interactions and visual examples. It can now also access live internet data to provide up-to-date information, strengthening ChatGPT's capabilities and Microsoft's position in the competitive AI field against rivals like Google's Bard and Amazon-backed Anthropic.

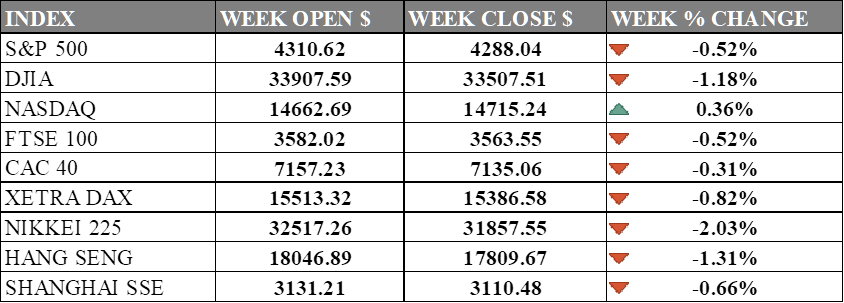

INDICES PERFORMANCE

In the week ending September 29, 2023, the U.S. stock market faced notable challenges. The S&P 500 index opened the week at 4310.62 but ultimately closed at 4288.04, marking a 0.52% decline. This decline was attributed to mounting reinflation concern, hawkish fed, rising bond yields, and quarter-end technical selling. Similarly, the Dow Jones Industrial Average (DJIA) experienced worse decline at 1.18%, closing at 33507.51. The DJIA's decline was driven by the same fears and Apple dragging the market down as new iPhone releases failed to impress. The tech-heavy NASDAQ composite fared better, rising 0.36% during the week to finish at 14715.24. The index extended its gains due to semiconductor faring better than most sectors.

Meanwhile, European markets faced their own challenges. The UK's FTSE 100 index fell by 0.52% to close at 3563.55, down from its opening level of 3582.02. France's CAC 40 experienced a 0.31% decline, closing at 7135.06. Germany's XETRA DAX decreased by 0.82%, settling at 15386.58. These European indices were weighed down primarily due to the decline across the heavyweight luxury names that dominate the index. Germany exposure to China, Italy, and Spain did better although weakness in US market dragged it along for the downfall last week.

In Asia, market dynamics were shaped by various factors. Japan's Nikkei 225 dropped by 2.03% week-over-week, closing at 31857.55, down from its opening level of 32517.26, partly due its deteriorated manufacturing sector. Hong Kong's Hang Seng index fell 1.31%, closing at 17809.67. China’s Shanghai Composite however rose by 0.66%, closing at 3110.48 after opening at 3131.21. Although Asian market were underperformed, China’s Hang Seng managed to recover on its last day to close above Japan market in term of % change on its re-expansion of manufacturing activity.

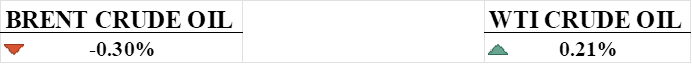

CRUDE OIL PERFORMANCE

Crude oil prices were mixed last week but fell on the last day for September, with WTI settling down 0.21% at $90.71 per barrel and Brent settling down 0.3% at $92.07 for the week. However, oil prices still posted gains for the week, month, and quarter due to production cuts by OPEC+ and restrained output from U.S. producers. Prices have rallied $25-$30 from May lows largely due to Saudi Arabia and Russia cutting output by over 1 million bpd. However, oil's rally may cool as the global economy slows and the market is seen as overcrowded on the bullish side although pullback already happened and next rally is expected in the near term if fundamentals allow it.

OTHER IMPORTANT MACRO DATA AND EVENTS

China's factory activity expanded in September for the first time in 6 months, according to an official survey, suggesting the world's second-largest economy has begun to recover after slowing down earlier in the year due to strict COVID-19 policies. The purchasing managers' index rose to 50.2 in September from 49.7 in August, beating forecasts and crossing above the 50 threshold that indicates economic expansion.

U.S. consumer spending increased in August, though underlying inflation moderated with annual price rises excluding food and energy slowing below 4%. Gasoline prices surged helping lift inflation as measured by the PCE price index, though the rise was aided by a lower base of comparison to last year.

After declining for 5 months, U.S. home prices saw their first year-over-year increase in July since February with a potential end to the downturn as high mortgage rates curb seller enthusiasm and reduce inventory. While the housing market remains below peak pandemic-era prices, positive monthly gains in July and August indicate stabilization rather than a prolonged decline.

What Can We Expect from The Market This Week

RBA Interest Rate Decision: The Reserve Bank of Australia held its key interest rate steady at 4.10% on September 20, 2023, but is expected to deliver one more 25 basis point hike by the end of 2023 to a peak of 4.35% based on economist forecasts and upcoming inflation and jobs data. However, it would not be expected to be this October.

RBNZ Interest Rate Decision: The market expects the Reserve Bank of New Zealand to keep interest rates unchanged at its upcoming meeting after three consecutive meetings of pause due to concerns about the impact on the New Zealand economy, which is already facing headwinds. However, some analysts think further hikes may still occur to address inflationary pressures and momentum in the housing market.

ADP Nonfarm Employment Change: September figures that will be released on Wednesday are closely watched as a precursor to the government's monthly jobs report, with expectations that 155,000 new private sector jobs will be added in September.

ISM (non-)manufacturing PMI: The manufacturing PMI registered 47.6 in August 2023, indicating a contraction in manufacturing, although it is improving from a low of 46 in June data. While there are some positive signs for US manufacturing, such as fiscal largesse and stabilising levels, there are also concerns about the sector contracting and the possibility of a recession.

US Nonfarm payrolls: Early indicators suggest another solid month for the US labour market in September, with expectations of around 155,000 new jobs added and the unemployment rate edging down to 3.7% from 3.8% in August. However, the nonfarm payrolls report will be scrutinised for signs of the labour market weakening amid strike actions and other potential factors, with expectations of a significant decline to 163K from 187K.