PAST WEEK'S NEWS (OCTOBER 02 – OCTOBER 06, 2023)

Kevin McCarthy, the Speaker of the U.S. House of Representatives, was removed from his position in a historic vote on January 3rd, 2023. This was the first time a speaker had been ousted by members of their own party since McCarthy angered some Republicans by striking a deal with Democrats to avoid a government shutdown. Congressman Matt Gaetz filed the motion to eject McCarthy after months of infighting between McCarthy and far-right Republicans. The House must now begin the process of selecting a new speaker, with Rep. Patrick McHenry named as interim speaker.

Congress recently passed a short-term funding bill just hours before a government shutdown, buying more time to negotiate a deal on the federal budget by mid-November. The massive national debt continues to grow to $33 trillion, but bipartisan cooperation is needed to make difficult decisions on taxes and spending. Entitlement programmes like Social Security face shortfalls in the coming years while interest repayment surpasses military spending. Some experts advocate forming a bipartisan commission to address the debt and make recommendations, as Congress must ultimately compromise because inaction risks severe economic impacts.

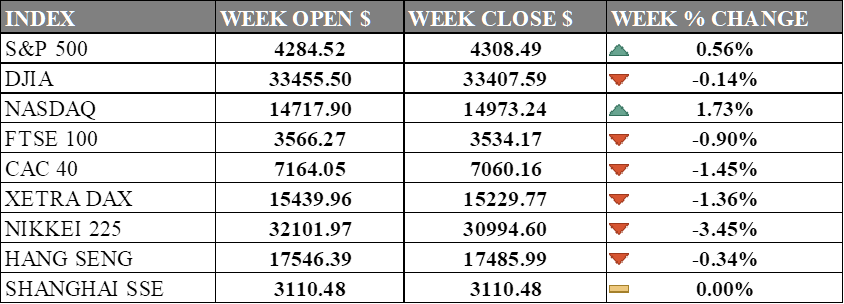

INDICES PERFORMANCE

In the week ending October 6, 2023, the U.S. stock market ended up mixed on varying views on interest rate roadmaps. The S&P 500 index opened the week at 4284.52 but ultimately closed at 4308.49, marking a 0.56% increase. This gain was attributed easing dollar bullish movement, even as concerns over inflation and interest rates remained. The Dow Jones Industrial Average (DJIA) however experienced a slight decline of 0.14%, closing at 33407.59. The DJIA's decline was driven by losses in energy sector. The tech-heavy NASDAQ composite fared better, rising 1.73% during the week to finish at 14973.24. The index extended its gains due to strong performance by technology stocks mainly the big 7.

Meanwhile, European markets mostly declined. The UK's FTSE 100 index fell by 0.90% to close at 3534.17, down from its opening level of 3566.27. France's CAC 40 experienced a 1.45% decline, closing at 7060.16. Germany's XETRA DAX decreased by 1.36%, settling at 15229.77. These European indices were weighed down by concerns that central banks may keep higher interest rates for longer than initially anticipated.

In Asia, markets were mixed. Japan's Nikkei 225 dropped by 3.45% week-over-week, closing at 30994.60, down from its opening level of 32101.97, as electronics and energy stocks were down significantly, which offset gains by utility and food stocks. Hong Kong's Hang Seng index fell 0.34%, closing at 17485.99. China’s Shanghai Composite was flat, closing at 3110.48, the same as its opening level as the China market closed during the whole week. Although Asian markets were mostly lower, the declines moderated from the prior week.

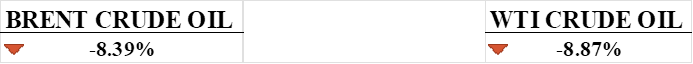

CRUDE OIL PERFORMANCE

The crude oil market experienced significant volatility last week, with prices dropping as low as 9-11% due to economic concerns lowering demand. However, geopolitical factors like the Israel-Hamas conflict may push prices back up this week by threatening supply. Iran's role and potential US sanctions on Iranian oil exports could also reduce supply. Meanwhile, Saudi Arabia is unlikely to increase production to ease any supply shortages given their strategy of limiting output to keep prices high. Although the current Israel-Hamas crisis differs from past Middle East conflicts, its impact on the sensitive oil production region means crude prices will likely rise in the short-term, albeit unpredictably.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. employment surged in September, signalling a robust labour market and potential for further interest rate hikes by the Federal Reserve, despite slowing wage growth. The report also highlighted strong economic activity in the third quarter, with financial conditions tightening due to rising bond yields and increased market volatility.

The euro zone economy likely contracted last quarter as demand decreased in September at the fastest rate in almost three years due to rising borrowing costs and higher prices. The Composite Purchasing Managers' Index (PMI) in September was 47.2, just above the growth-contraction threshold of 50, and coupled with a significant drop in retail sales in August, it suggests the possibility of the euro zone entering a recession in the latter half of 2023.

U.S. factory orders rebounded by 1.2% in August, surpassing expectations and indicating stronger economic growth in the third quarter. Shipments of manufactured goods also increased by 1.3%, supporting the view of a strengthening economy, with third-quarter growth estimates reaching as high as a 4.9% annualized rate.

What Can We Expect from The Market This Week

FOMC Meeting Minutes: Investors digested the interest rate movement at the September meeting, where the Fed paused for the third meeting after raising the interest rate to 5.25%–5.50% at its July meeting. The meeting minutes aren't likely to be of much significance, although any clues on future interest rate movements may move the market, which is sitting at 78% expectation of another pause in November. Historically, there have been only 5 months of pause before the Fed pivots and cuts the interest rate, which would be the start of 2024.

US CPI: Underlying inflation is expected to rise 0.3% in September, corroborating the Federal Reserve's view that interest rates will need to stay higher for longer to get inflation down. While cooling from the pace in September 2021, resilient economic demand and persistent job growth have complicated the Fed's efforts to curb inflation. Sticky price pressures and the prospect of another significant core CPI gain suggest the Fed will likely raise rates further, a message that has driven up Treasury yields.

UK GDP: The UK economy is barely growing, with GDP growth at -0.5% in July. This negative growth, along with high inflation of 6.7%, is contributing to the economic challenges the UK currently faces. High inflation further dampens growth by reducing consumer spending power. The stagnant GDP growth, combined with rising interest rates and a falling pound, paints a concerning picture for the overall health of the UK economy.

EIA Short-term Energy Outlook: monthly forecasts for various energy sectors The latest report released on September 12, 2023, predicts declines in liquid fuel use, growth in natural gas, record levels for gas-fired electricity generation, and decreased CO2 emissions for 2023. It incorporates recent major production announcements and reduces the gasoline consumption forecast.

US Initial Jobless Claims: The latest report for the week ending September 30 showed claims rising by 2,000 to 207,000, slightly below estimates of 210,000, indicating a gradual cooling in the tight labour market. Continuing claims were little changed at 1.664 million. Job openings still exceed unemployed workers, but layoffs rose 58% in September compared to last year as the Federal Reserve continues raising interest rates to slow demand and ease inflationary pressures.