Stocks Performance (U.S. Stocks)

Stocks jumped at early trading week, with many attributing the strength to China’s rally. Many Asian markets advanced after investors were encouraged by a front-page editorial in the state-run China Securities Journal that talked up the country’s recovery and appeared to officially endorse the rally in equities.

The major indexes ended mixed for the week, with large-caps outperforming small-caps. Technology-heavy Nasdaq fared best and reached new record highs, thanks in part to strong gains for “work from home” shares, such as Amazon, Apple, Facebook, and Netflix. The latter two also boosted the communication services sector, which outperformed within the S&P 500 Index.

On Friday, many of the mega-cap technology stocks take a breather, as investors rotated back into cyclical/value stocks following some positive remdesivir news, as Gilead Sciences said new data showed an improvement in severely-ill COVID-19 patients and a 62% reduction in the risk of mortality compared to the standard of care.

By sectors, the most outperformed weekly stocks were led by Consumer Durables at 9.49%, followed by Retail Trade at 7.90%, Non-Energy Minerals at 3.97%, and Technology Services (3.83%). Meanwhile, the weakest sectors were from the Energy Minerals sector (-3.10%), Industrial Services (-2.67%), Health Services (-2.27%), and Distribution Services (-2.12%).

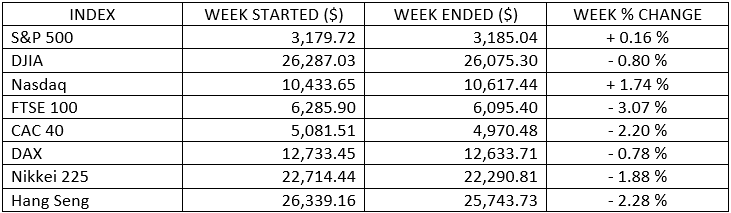

Indices Performance

Stocks jumped at the start of trading Monday, with many attributing the strength to China’s rally, before ended mixed at the end of the week.

Most world equity markets struggled as investors grew concerned that rising coronavirus cases could set back the pace of economic recovery. There were big gains in the shares of large technology and Internet companies, which have proven resilient to economic lockdowns.

Oil Sector Performance

Crude prices weakened as crude oil prices fell back below USD40 per barrel, simultaneously lowers energy shares.

Market-Moving News

Stocks Edge Higher

Stocks couldn’t quite match the previous week’s strong performance, though nevertheless recorded their second positive result in a row. Dow and S&P 500 rose around 1% to 2% and the NASDAQ added 4%.

NASDAQ Records

The NASDAQ’s weekly outperformance lifted to new record heights. NASDAQ surged nearly 59% since a recent low on March 23, owing in part to strong results from a handful of big technology stocks that have a large weighting in the index.

China's Rally

A Chinese stock index climbed for eight trading days in a row, rose 17% - the biggest percentage gain over an eight-day stretch since 2008. Though, momentum shifted on Friday, when the index dropped nearly 2%.

Crude Awakening

After touching $40 per barrel two weeks earlier, U.S. crude oil prices returned to that level and stayed above it for the first time since early March. Prices have nearly doubled since late April.

Stimulus 2.0

U.S. Treasury Secretary said on Thursday that he expects the Senate will approve another coronavirus-related stimulus initiative late this month. Leaders are considering another round of payments to Americans, as enhanced unemployment benefits are due to expire soon unless Congress acts to extend them.

Earnings Drought

Expectations are low as we head into earnings season, which opens this week. Earnings of companies in S&P 500 are expected to drop 44% compared with last year’s second quarter - the biggest decline since the Q4 of 2008, according to FactSet. Major banks will start to report quarterly results on Tuesday.

Coronavirus Catalyst

The pandemic continued to outweigh U.S. stocks. Record numbers of new cases in several Southern and Western states drive on stocks, while headlines about vaccine development provided a positive catalyst.

Other Important Macro Data and Events

Coronavirus bringing record US$1trillion of new global corporate debt in 2020. The unprecedented increase will see total global corporate debt jump by 12% to around $9.3 trillion, adding to years of accumulation that has left the world's most indebted firms owing as much as many medium-sized countries.

Meanwhile, last year also saw a sharp 8% rise, driven by mergers and acquisitions, and by firms borrowing to fund share buybacks and dividends. But this year's jump will be for an entirely different reason - preservation as the virus saps profits.

U.S.’s job openings in May rose more than expected, while weekly initial and continuing jobless claims fell more than anticipated.

Diminishing economic enthusiasm pushed gold prices to their highest level since 2011, and pressed oil prices and government bond yields lower.

What We Can Expect from the Market this Week

Investors appeared to be particularly concerned that the impact of the resurgence in the virus seemed to be showing up in economic data.

Important economic news coming out this week includes the Federal budget on Monday, consumer price index on Tuesday, export/import prices and industrial production/capacity utilization on Wednesday, retail sales/business inventories and weekly unemployment claims on Thursday and consumer sentiment index and housing starts data on Friday.