PAST WEEK'S NEWS (NOVEMBER 13 – NOVEMBER 17, 2023)

The October CPI report showed inflation slowing, with headlines at 3.2% and cores at 4%, leading markets to believe the Fed is nearing the end of rate hikes. Energy prices fell over 4% with declining gas prices, while food rose 3.3% and shelter 6.7%. The Fed's own survey sees higher expected inflation than CPI, including 6% for college and 9% for healthcare and rent. With rates at 5.5%, the Fed is likely to pause hikes and could begin cutting rates in 2024, but this risks further inflating home prices that haven't crashed despite higher rates. The Fed faces a tricky balancing act between inflation and recession as economic and political pressures mount for an end to aggressive tightening.

President Xi Jinping scored public relations wins in his US visit, securing cooperation pledges on fentanyl, military talks, and easing bilateral tensions. This allows China to refocus on its slowing economy and political intrigues at home with the hope that chip sanctions will be slowly undone. However, sceptics question if China will follow through with trade tensions still tight in certain sectors. Despite differences, Blinken called US-China relations "consequential", stressing managing competition without conflict and finding areas of cooperation.

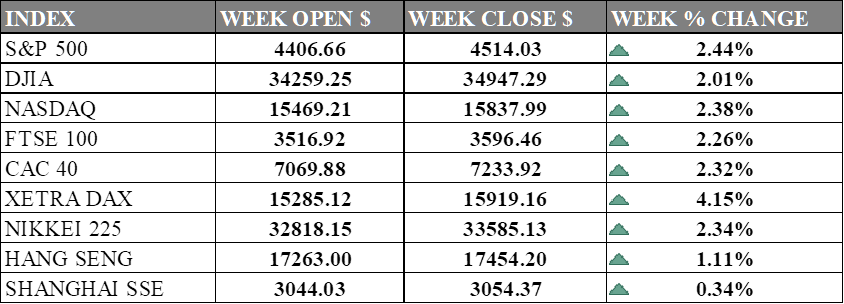

INDICES PERFORMANCE

The major U.S. stock indexes ended higher last week amid slowing inflation and expectation of earlier rate cut. The S&P 500 climbed 2.44% to close at 4514.03, up from its open of 4406.66. The Dow Jones Industrial Average rose 2.01% to finish at 34947.29 compared to its starting point of 34259.25. The tech-heavy NASDAQ posted the largest gain, surging 2.38% to 15837.99 after opening the week at 15469.21. The advance was fuelled by moderating inflation raised confidence the Fed will cut rates in 2024. Equity laggards like small-caps and value stocks outperformed, signalling a potential broadening in market leadership next year.

In Europe, the major indexes also moved higher. The UK's FTSE 100 gained 2.26% to close at 3596.46 compared to its open of 3516.92. France's CAC 40 advanced 2.32% to end the week at 7233.92 after opening at 7069.88. Germany's DAX ticked up 4.15% to settle at 15919.16 from its starting point of 15285.12. European stock benefitted from lower global yields and the potential for Fed easing next year that helped extend November's equity rally overseas.

Asian indexes were mixed on the week. Japan's Nikkei 225 gained 2.34%, closing at 33585.13 versus its open of 32818.15 driven by a strong domestic earnings season, a weaker yen, and a rally in U.S. stocks. Automakers and companies with pricing power, such as Toyota, performed well, while air transport emerged as the best-performing sector. Hong Kong's Hang Seng gained 1.11% to finish at 17454.20 from its starting level of 17263.00. China's Shanghai Composite eked out 0.34% to close at 3054.37 compared to its open of 3044.03. The Chinese equity market was mixed as Hong Kong shares, led by Alibaba Group, fell 2.1% after the company abandoned plans to spin off its cloud business. Despite weekly gains in the Hang Seng, concerns over Chinese growth persisted, though a potential improvement in US-China relations following a Biden-Xi summit could attract US investment back into Chinese assets.

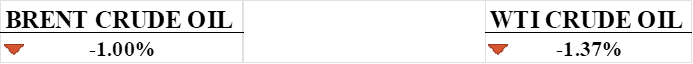

CRUDE OIL PERFORMANCE

Crude prices fell slightly last week on concerns about weakening demand, especially from China. Brent dropped 1% while WTI lost 1.37% for the week. The declines came despite upcoming OPEC+ supply cuts that aim to stabilize the market. Saudi Arabia and Russia are considering further output reductions at the November 26 meeting. Crude prices remain under pressure, but deeper OPEC+ cuts could offer renewed support.

OTHER IMPORTANT MACRO DATA AND EVENTS

Japan's core consumer inflation is expected to have risen in October, marking the 19th consecutive month above the central bank's 2% target, with the core CPI likely growing 3.0% year-on-year. The increase is attributed to reduced government subsidies on electricity and gas bills, while the Bank of Japan considers strategies to exit ultra-easy monetary policy amid economic concerns and a recent contraction in GDP.

U.S. home builder confidence declined for the fourth consecutive month in November, dropping to its lowest level since December 2022, with the National Association of Homebuilders' index falling from 40 to 34. Despite the recent fall, there is optimism for improvement as mortgage rates are expected to decrease, potentially boosting builder sentiment and market conditions in December.

U.S. retail sales fell in October for the first time in seven months, primarily due to reduced spending on vehicles and hobbies, signalling a slowdown in demand and strengthening the view that the Federal Reserve will not raise interest rates further. The decline in producer prices, the largest in three-and-a-half years, supports the belief that the Fed's current rate-hiking cycle has ended. Despite a milder-than-expected drop in October sales, economists anticipate a prolonged pause in Fed interest rate hikes amid signs of moderating consumer demand and a cooling labour market.

What Can We Expect from The Market This Week

FOMC Meeting Minutes: Detailed insights into the Federal Reserve's assessment of economic conditions and monetary policy decisions. Following the November 1, 2023, meeting, the Federal Reserve maintained the federal funds rate at 5.25% to 5.5%, reflecting their view on a strong economic expansion in the third quarter. These minutes are crucial for understanding the Federal Reserve's stance, interest rate trajectory, and economic outlook.

German GDP Q3: Declining consumer spending and weak demand from China are expected to drive Germany back into negative economic territory in Q3, following stagnant growth in Q2, which had been experiencing negative growth before that. The industrial sector is particularly affected as policymakers stay cautious on inflation and only foresee a recovery into 2025.

US Initial Jobless Claims: Weekly labour market indicator measures the number of individuals filing for unemployment insurance for the first time. The recent rise to 231,000 claims as of November 16, 2023, the highest since August, may indicate a loosening labour market, but caution is advised due to potential seasonal fluctuations influencing the data.

US Durable Goods Order: Its MoM is up to 4.7%, surpassing expectations and signalling a positive trend for the economy. This unexpected increase reflects resilience in business investment, stimulates manufacturing activity, and suggests a favourable outlook for the sector, contributing to cautious optimism about overall economic performance, although recent consensus was a significant drop to -3.2%.

Canada Retail Sales: Consumer spending in Canada recorded dramatically decelerating growth in August, implying that the surge in deferred shopping from prior months has largely tapered off. Data from Statistics Canada signals that retail activity is stabilising following the whipsaw of a steep decline and rapid recovery.