PAST WEEK'S NEWS (DECEMBER 04 – DECEMBER 08, 2023)

Prolonged inflation has eroded consumer purchasing power in Japan, causing the economy to contract 2.9% in Q3, exceeding initial estimates. Weak wage growth means the Bank of Japan wants to see 2% inflation before considering policy changes, though currency traders expect imminent rate hikes. With consumption accounting for over half of GDP, persistent spending weakness poses risks to Japan's growth and the central bank's plans to gradually withdraw stimulus. The stronger yen that could accompany tighter policy may hurt exporters and the Nikkei, highlighting the difficult balancing act the BoJ faces between lowering inflation and protecting growth.

The US economy is in a paradoxical situation, with financial institutions claiming it is booming on 5.2% GDP growth while the Federal Reserve is signalling a possible rate cut as soon as May next year, indicating a downturn. Goldman Sachs predicts slowing growth and a 15% recession chance in 2024, even as real disposable income rises, while JP Morgan's CEO warns of recession risk due to inflationary factors. It is uncertain whether the Fed's cutting rates soon will enable a soft landing or if a recession is more likely.

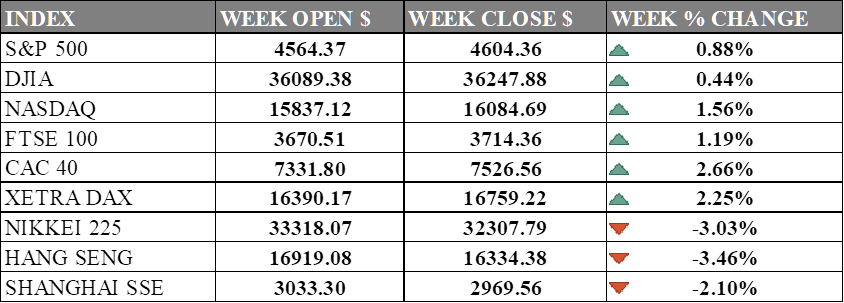

INDICES PERFORMANCE

The major U.S. stock indexes ended higher although mixed performance last week with the Nasdaq strong while the DJIA and SP500 edged up. The S&P 500 rose 0.88% to close at 4604.36, up from its open of 4564.37. The Dow Jones Industrial Average ticked up 0.44% to finish at 36247.88 compared to its starting point of 36089.38. The tech-heavy Nasdaq posted a gain of 1.56% to 16084.69 after opening the week at 15837.12. The U.S. stock market rally is spreading as strong employment report in the United States has boosted investor confidence in the likelihood of a smooth economic slowdown which was pointed by Treasury Secretary, Janet Yellen, that economist are wrong about the necessity of high unemployment to curb inflation.

In Europe, the major indexes also moved higher. The UK's FTSE 100 advanced 1.19% to close at 3714.36 compared to its open of 3670.51. France's CAC 40 rose 2.66% to end the week at 7526.56 after opening at 7331.80. Germany's XETRA DAX gained 2.25% to settle at 16759.22 from its starting point of 16390.17. The most recent data indicates a decline in German inflation to 3.2% in November, the lowest level since June 2021 which supports the viewpoint that Eurozone interest rates may have reached their peak.

Asian indexes declined on the week. Japan's Nikkei 225 lost -3.03%, closing at 32307.79 versus its open of 33318.07 driven by slow growth expectation post-Q3 decline after Japan's GDP in Q3 contracted by 2.9%. Hong Kong's Hang Seng fell -3.46% to finish at 16334.38 from its starting level of 16919.08. China's Shanghai Composite dropped -2.10% to close at 2969.56 compared to its open of 3033.30. The decline was influenced by cautious sentiment ahead of the US job report and Chinese CPI/PPI data that disappoint over the weekend. However, the index recovered some losses due to stronger-than-expected November trade data in China

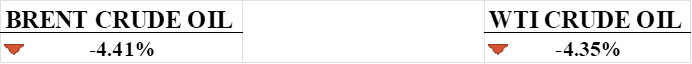

CRUDE OIL PERFORMANCE

Crude prices were on a seven-week losing streak due to OPEC's disappointing production cuts and concerns of demand from China. However, things looked up with strong U.S. job market data, suggesting a bright spot in the world's largest fuel consumer. While this tempered expectations for immediate Fed rate cuts, it sparked optimism for crude demand, especially if the U.S. economy has a soft landing. The Department of Energy's plan to buy 3 million barrels of oil for the Strategic Petroleum Reserve also added to the positive outlook, as the reserve hit a nearly 40-year low last year.

OTHER IMPORTANT MACRO DATA AND EVENTS

The U.S. economy added 199,000 jobs in November, exceeding expectations and showing continued strength in the labour market, which could impact the Federal Reserve's plans for future interest rate hikes. The better-than-expected jobs report led to a decrease in market expectations that the Fed would start cutting rates in the first quarter of 2024.

Chinese investments in Vietnam have surged this year to over $8 billion, more than doubling from last year, while U.S. investment has fallen to $500 million amid declining bilateral trade, as the two superpowers compete for influence in the strategic Southeast Asian nation. However, relations between China and Vietnam remain complicated by territorial disputes in the South China Sea and anti-Chinese sentiment among Vietnamese people.

The U.S. trade deficit widened more than expected to $64.3 billion in October, according to Commerce Department data, as exports fell 1.0% while imports edged up 0.2%, positioning trade to potentially drag on economic growth in the fourth quarter. The report shows exports declining across major categories like consumer goods and automotives while capital goods exports and imports rose to record highs, signalling softening domestic demand amid higher interest rates.

What Can We Expect from The Market This Week

Interest Rate Decision: There will be multiple central bank meetings this week, namely the Federal Reserve, ECB, BoE, SNB, and CBR. The focus, however, will be on any bank that breaks consensus, and the majority are expected to continue pausing rate changes except for Russia.

US Note Auction: 10-year and 30-year notes are expected to be on auction, which are strong predictors of future rates and confidence in fiscal policy and the economy. Yields have been plummeting since the top in October, suggesting a dovish outlook for maintaining rates at a higher level, which will be a clue ahead of the fed interest rate.

US CPI and PPI: key indicators of US inflation, published monthly by the Bureau of Labour Statistics. The CPI measures changes in the average American's consumption value, while the PPI tracks fluctuations in selling prices for domestic producers, both of which inform Federal Reserve decisions. The latest CPI stands at 3.2%, while the PPI is at 1.3%, nearing the target range set by the Fed.

US Retail Sales: The latest data showed a 0.1% decline from the previous month, following increases in September and October. The November jobs report also showed continued weakness in the retail sector, with 38,000 jobs lost—half in department stores—indicating retailers are already nervous about tepid sales growth over the past 6 months.

China Industrial Production: October data showed China's industrial output grew 4.6% year-on-year, beating expectations of a 4.4% increase, with an expectation of 5.7% coming on Thursday. However, the underlying economic picture has highlighted significant pockets of weakness, such as the crisis-hit property sector and slow global growth.