PAST WEEK'S NEWS (DECEMBER 25 – DECEMBER 29, 2023)

In a major shakeup, United Launch Alliance (ULA), a joint venture between Boeing and Lockheed Martin, has slashed launch prices to match rival SpaceX, potentially ending years of dominance by Elon Musk's company. ULA's new Vulcan Centaur rocket boasts a $100 million price tag, narrowly edging out SpaceX's $110 million average across its Falcon 9 and Falcon Heavy offerings. However, direct comparisons are tricky due to differences in payload capacity and mission specifics. While this price parity is a win for Boeing and Lockheed Martin, it's too early to call it a complete victory. Clarity remains vague on future profitability under the new pricing structure, especially with potential ULA sale talks looming.

The chip war between the US and China heats up as Nvidia dances a delicate two-step. Facing US export restrictions, the tech giant rolls out a China-compliant RTX 4090 chip, the RTX 4090 D, sacrificing 11% performance to stay in the game. This gambit targets China's $7 billion AI market, where Nvidia holds a 90% share, but navigating geopolitical hurdles is tricky. Past workarounds have landed on the banned list, and China's AI ambitions, bridged by a $41 billion war chest, pose long-term threats to US dominance. While Nvidia's recent financial performance is stellar, the tightrope act continues, leaving the future of its China dominance hanging in the balance.

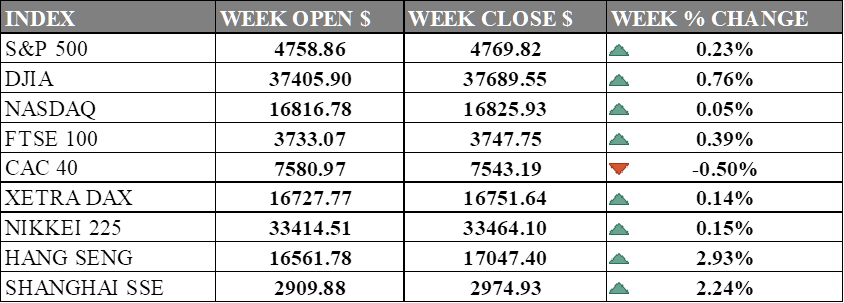

INDICES PERFORMANCE

The major U.S. stock indexes ended higher but weaker last week with the Nasdaq barely moving while the DJIA and S&P 500 edged up slightly. The S&P 500 rose 0.23% to close at 4769.82, up from its open of 4758.86. The Dow Jones Industrial Average ticked up 0.76% to finish at 37689.55 compared to its starting point of 37405.90. The tech-heavy Nasdaq posted a gain of 0.05% to 16825.93 after opening the week at 16816.78. Declining interest rates contributed to a notable rally at the end of the year, which accelerated in December when the Federal Reserve indicated the possibility of U.S. interest rate cut in 2024 following a series of rate hikes that assisted in bringing inflation closer to the central bank's 2% annual goal.

In Europe, the major indexes were also mixed. The UK's FTSE 100 advanced 0.39% to close at 3747.75 compared to its open of 3733.07. France's CAC 40 fell -0.50% to end the week at 7543.19 after opening at 7580.97. Germany's XETRA DAX rose 0.14% to settle at 16751.64 from its starting point of 16727.77. European stocks look set to jump at the open on the first trading day of 2024, as traders stay hopeful for coming Fed rate cuts. Meanwhile, ASML's shares will draw eyes after the Dutch government partly banned the company from exporting some chip-making gear to China following US recent ban.

Asian indexes were mostly higher on the week. Japan's Nikkei 225 gained 0.15%, closing at 33464.10 versus its open of 33414.51 closing with its biggest yearly gain in a decade, rising 28% to post its best performance since 2013 amid expectations for better governance and corporate policies. Hong Kong's Hang Seng advanced 2.93% to finish at 17047.40 from its starting level of 16561.78. China's Shanghai Composite rose 2.24% to close at 2974.93 compared to its open of 2909.88. Chinese and Hong Kong stocks were among the world's worst performers in 2023, with losses exceeding 10% amid China's struggling economy and geopolitical tensions, though some investors see opportunities in the battered shares.

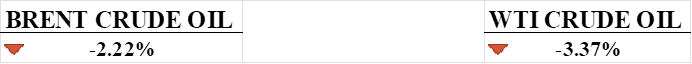

CRUDE OIL PERFORMANCE

A tumultuous 2023 saw crude futures nosedive over 10%, closing the year at their lowest since 2020. Geopolitical turmoil, particularly the Middle East conflict triggered by multi-faction aggression, while concerns about producer output and weakening global growth cast a bearish shadow. Yet, glimmers of optimism emerged with strong U.S. demand and hints of rising production. As 2024 unfolds, navigating the interplay of geopolitical risks, OPEC+ decisions, and economic headwinds will be crucial for the oil market's fate. Expect continued volatility, with potential price spikes, as the world navigates these choppy waters.

OTHER IMPORTANT MACRO DATA AND EVENTS

The average 30-year fixed mortgage rate fell for the ninth straight week to 6.61% at the end of December, reaching its lowest level since May according to Freddie Mac data continuing a decline from a 22-year high in late October, correlating with signals from the Federal Reserve that it is nearing the end of its aggressive interest rate hiking campaign to control inflation.

Unemployment claims increased last week in lieu of ongoing labour market cooling in Q4 as hiring slows and inflation moderates, leading the Fed to halt rate hikes. The rise in continued claims since September also indicates the unemployed are struggling to find jobs.

What Can We Expect from The Market This Week

FOMC Meeting Minutes: Minutes of the December 13th meeting are awaited for clues on the Fed's path amidst moderating growth, persistent inflation, and tighter financial conditions. While job gains remain strong, the committee's cautious tone hints at potential policy adjustments if economic risks escalate. Expect markets to scrutinise every word for their next move.

JOLTs Job Openings: The recent plunge in US job openings signals a cooling labour market that could prompt the Fed to ditch rate hikes and pivot towards cuts by mid-2024. While construction remains a bright spot, the broader decline suggests higher interest rates are finally dampening demand for workers, potentially bringing wage inflation under control and paving the way for a policy reversal.

ISM (Non)Manufacturing PMI: Market fears persist as the US manufacturing sector sputters, with the November ISM PMI remaining unchanged at 46.7, representing 13 months of contraction. While rising new orders provided a ray of hope, the overall situation remains bleak.

Eurozone CPI: Eurozone inflation surprised markets by falling further in November, hitting a two-year low, and casting doubt on the ECB's inflation projections. With unemployment holding steady and a gradual economic recovery on the cards, the Eurozone seems poised for a soft landing, but the ECB's hawkish stance may face growing headwinds from this unexpectedly dovish data.

US Nonfarm Payrolls: Soaring healthcare and government jobs propelled US nonfarm payrolls to a surprise 199,000 gain in November, exceeding forecasts and hinting at a robust labour market despite inflation worries. While wage growth remained steady, the dip in unemployment added pressure on the Federal Reserve.