PAST WEEK'S NEWS (June 17 – June 21, 2024)

There is seemingly no end to the AI bull run after the shovel vendor, Nvidia topped Microsoft and Apple to become the biggest company in the world by market capital, thanks to the endless demand for its artificial intelligence chips. The company's revenue in its latest quarter tripled year-over-year, reaching a staggering $26 billion, beating its already inflated estimates. A partnership between Dell Technologies and Nvidia to build an AI factory to power Elon Musk's xAI supercomputer and its generative AI chatbot, Grok, further excites competition. However, Nvidia's success has also led to employees operating in "semiretirement" mode from inflated stock options and appreciation, while experts express concern over potential bubbles with news rhyming Cisco's success during the dotcom.

Bank of America economists are increasingly predicting a "no landing" scenario for the U.S. economy, expecting GDP growth to slow but remain at trend through 2026 with low unemployment. They anticipate inflation will decelerate but remain sticky, with the Federal Reserve likely to begin gradual rate cuts in December. Federal Reserve Bank of Richmond President Thomas Barkin stressed the need for more clarity on inflation before considering rate cuts, highlighting the necessity of sustained progress toward the 2% target. The Fed recently kept interest rates steady at 5.25% to 5.5%, the highest in over two decades. Fed Governor Adriana Kugler expressed optimism about inflation reaching the 2% goal, believing current monetary policy is sufficiently restrictive. She anticipates that easing policy may become appropriate later this year if the economy evolves as expected, noting encouraging recent data on consumer prices.

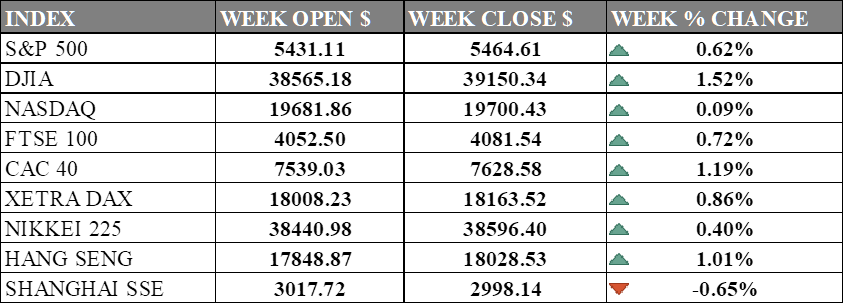

INDICES PERFORMANCE

The major U.S. stock indexes rose last week. The S&P 500 gained 0.62% to close at 5464.61 from its open of 5431.11. The Dow Jones Industrial Average (DJIA) increased 1.52% to finish at 39150.34 compared to its opening level of 38565.18. The Nasdaq also climbed, but more modestly, with a 0.09% increase to close at 19700.43 after opening the week at 19681.86. The index was supported by technology and communication service sector like google and Accenture while big name like Nvidia saw losses just a week after stock split. Soft economic data limited gain, with increasing bets by investors toward September rate cuts.

In Europe, results were positive across the board. The UK's FTSE 100 rose 0.72% to close at 4081.54 compared to its open of 4052.50. Germany's XETRA DAX increased 0.86% closing at 18163.52 from its starting point of 18008.23. France's CAC 40 showed the strongest performance among the European indexes mentioned, gaining 1.19% to end the week at 7628.58 after opening at 7539.03. Germany reported a slowdown in business activity while the wider eurozone reported declining business activity, with both the services and manufacturing sectors affected.

Asian markets saw mixed performances. Japan's Nikkei 225 gained 0.40%, closing at 38596.40 versus its open of 38440.98 weaker yen supported export industry. Hong Kong's Hang Seng posted a solid increase of 1.01%, finishing off at 18028.53 from its starting level of 17848.87. In contrast, China's Shanghai SSE was the only index in the table to post a loss, declining 0.65% to end the week at 2998.14 compared to an opening figure of 3017.72. China’s domestic investors are shifting away from their home markets due to a sliding yuan and capital outflows into Hong Kong, seeking better yields through offshore investment channels.

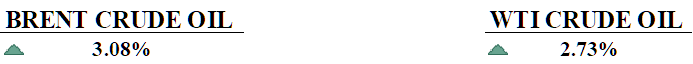

CRUDE OIL PERFORMANCE

Oil prices fell Friday but posted a strong second weekly gain, supported by signs of improving U.S. demand even with pressure from a stronger dollar. U.S. crude inventories dropped more than expected, while product supplied increased, indicating rising consumption as the summer driving season progresses. The U.S. oil rig count decreased, contrasting with the EIA's upward revision of its 2024 production forecast. Geopolitical tensions added support, with Ukraine attacking Russian refineries and escalating threats between Israel and Hezbollah raising concerns about potential supply disruptions. Israel's continued bombing of Gaza and warnings of possible war with Hezbollah, coupled with the militant group's threats against Israel and Cyprus, heightened risks in the oil-rich region. These factors combined to create a complex market environment, balancing demand growth against production increases and geopolitical uncertainties.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. retail sales rose only slightly in May, with downward revisions to previous months suggesting sluggish economic activity in the second quarter. While some sectors showed strength, overall consumer spending appears to be moderating due to inflation and higher interest rates, potentially influencing the Federal Reserve's decision on future rate cuts.

U.K. inflation dropped to 2.0% in May 2024, reaching the Bank of England's target for the first time in nearly three years. This decline in inflation, along with a decrease in core inflation to 3.5%, strengthens the case for potential interest rate cuts in the near future, although the Bank of England is expected to maintain current rates in its upcoming decision.

What Can We Expect from The Market This Week

PCE Price Index: The preferred gauge by the Fed to measure price inflation increased by 2.7% from the previous year, excluding food and energy costs. It is close to target, although progress has been halted since January.

US GDP Q1: Last figure reporting for first quarter economic growth, averaging 1.4% compared to last quarter 3.4%. Slowing growth may prompt economic stimulus in the form of a rate cut, even as the equity market sees endless growth.

UK GDP June: The UK economy dug itself out of a technical recession, with preliminary GDP growing by 0.6% in the first quarter. The CBI forecasts UK GDP growth of 1.0% for 2024.

Chicago PMI: The economic health of the manufacturing sector in Chicago, which serves as a leading indicator, dropped to 35.4 in May, marking the strongest contraction since the pandemic-induced crash in 2020.

Fed Monetary Policy Report: The report serves as a comprehensive assessment of the U.S. economy, monetary policy, and financial conditions. It provides insights into the Federal Reserve’s outlook, risks, and policy decisions. The Committee aims to return inflation to its 2 percent objective, while Fed Chair Powell expects only one rate cut late this year.