PAST WEEK'S NEWS (July 22 – July 26, 2024)

In a curious move, China's five biggest state-owned banks have cut their deposit rates. It is the first major cut since late 2022, following recent surprise cuts in lending rates by China's central bank. The goal is to help banks deal with their shrinking profit margins and boost the slowing economy. More banks are likely to follow with similar cuts, as experts think China might cut lending rates further if the economy doesn't improve soon. It is in line with its continuing stimulus effort, where China is spending 300 billion yuan on a new economic stimulus programme. Most of this money will go towards upgrading equipment and encouraging people to trade in old consumer goods. For example, they're offering up to 20,000 yuan for car trade-ins. This is part of a bigger 1 trillion yuan plan to help struggling parts of the economy.

Home prices have reached a new record high, with a 4% year-over-year increase. Low inventory levels and sustained high prices even in areas with increased listings where inventory remains 25% lower than pre-pandemic levels, which is propping up prices. Mortgage rates are currently around 6.8% and are expected to stay between 6.5% and 7.5%. The Federal Reserve projects one rate cut in 2024, likely in September, with more cuts in the year after that. Mortgage rates may drift down to the 6% range by Q4 2024 if September cuts become a reality. However, affordable housing remains a distant goal, requiring lower home prices, higher wages, and lower interest rates.

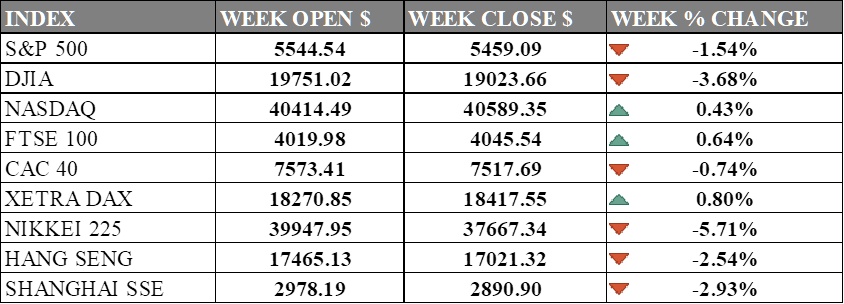

INDICES PERFORMANCE

Wall Street wrapped up a rather mixed week, with the Nasdaq being the only major U.S. index to end in positive territory. The tech-heavy index climbed 0.43%, closing at 40,589.35. However, both the S&P 500 and the Dow Jones Industrial Average ended down significantly. The S&P 500 fell 1.54% to 5,459.09, while the blue-chip Dow saw a sharp drop of 3.68%, finishing at 19,023.66. These declines reflect a shift in investor sentiment, possibly due to concerns over rate cut prospects and corporate earnings reports.

Across the pond, European markets experienced a mixed performance. Germany's DAX rose 0.80%, closing at 18,417.55. The UK's FTSE 100 saw a modest gain of 0.64%, ending at 4,045.54, while France's CAC 40 dropped 0.74% to close at 7,517.69. These mixed results suggest varying responses to economic indicators and central bank policies across different European markets.

Asian markets have presented a predominantly negative picture. Japan's Nikkei 225 saw the most significant drop, plummeting 5.71% to 37,667.34. This substantial decline in the Japanese market could be related to various factors, including global market trends and domestic currency concerns. Hong Kong's Hang Seng Index also fell considerably, dropping 2.54% to 17,021.32. The Shanghai Composite in mainland China similarly declined, falling 2.93% to close at 2,890.90, aligning with the downward trend seen in other major Asian markets.

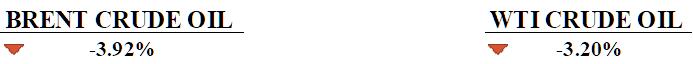

CRUDE OIL PERFORMANCE

Oil prices dropped again this week, marking the third straight week of losses. Brent crude fell to $79.61 a barrel, while U.S. oil (WTI) ended at $76.41, both down over 3% for the week. The main reasons for the decline were China's weakening oil demand and hopes for a ceasefire in Gaza. China's slowing economy and lower fuel imports have spooked the market, while a potential Gaza deal could ease supply fears in the Middle East. In the U.S., refineries are preparing to cut production as summer driving winds down, adding to the bearish outlook. However, strong U.S. economic data and signs of cooling inflation provided some support, hinting at possible earlier interest rate cuts.

OTHER IMPORTANT MACRO DATA AND EVENTS

U.S. inflation cooled as expected in June, with the PCE price index dropping to 2.5%, supporting the idea that the Federal Reserve might start lowering interest rates soon. This news, along with recent GDP growth and a drop in consumer prices, has strengthened market beliefs that the Fed will cut rates in September, potentially ending the period of high interest rates.

New U.S. home sales dropped to a seven-month low in June, with higher mortgage rates and prices slowing demand. The decline affected most regions, with only slight increases in the West and South, while the inventory of new homes grew, indicating a cooling market.

What Can We Expect from The Market This Week

JOLTs Job Openings: job openings increased to 8.14 million in May 2024, surpassing expectations. However, the stable rates of hires and total separations suggest that while businesses are eager to hire, it's harder to find suitable candidates.

CB Consumer Confidence: The index dropped slightly to 100.4 from 101.3, showing that people are more worried about the future and not spending as much. However, they still feel relatively good about the current economic situation, not as bad as in April.

BoE Interest Rate Decision: BoE maintained the bank rate at 5.25% in its last meeting, even with a 2% inflation rate that aligns with its target. The next interest rate decision is scheduled for August 1, with investors closely watching for any narrative shifts while the market is pricing in a cut as prices fall sharply from mid-July.

BoJ Interest Rate Decision: BoJ maintained its key interest rate at 0% during its July 2024 meeting since its hike in March, with rumours going around that it is going for another rate hike in the next meeting with USDJPY already falling 5% since July 11.

Nonfarm Payrolls: Payrolls revealed that the job market showed an increase of 206,000 jobs, surpassing expectations while being lower than previous data. Investors will be watching for any revisions to the prior month’s data.