Japan took centre stage in uncertainty as Prime Minister Sanae Takaichi's cabinet approved a $135 billion stimulus package, kicking off her administration's aggressive expansionary fiscal policy debut. Risk exploded as Japan's deteriorating fiscal sustainability pushed the yen to 10-month lows and sent super-long government bond yields to record highs, once again threatening the foundations of the decades-long yen carry trade. Takaichi's fiscal profligacy might induce a dangerous feedback loop: the massive stimulus requires additional bond issuance beyond last year's 6.69 trillion yen, weakening the yen and forcing the Bank of Japan toward tighter monetary policy to control inflation and restore credibility. This policy collision between expansionary fiscal measures and monetary tightening has transformed the Japanese yen from a traditional safe-haven currency into a barometer of global market nightmare, with each equity market dip strengthening the yen as carry trades unwind.

Japan took centre stage in uncertainty as Prime Minister Sanae Takaichi's cabinet approved a $135 billion stimulus package, kicking off her administration's aggressive expansionary fiscal policy debut. Risk exploded as Japan's deteriorating fiscal sustainability pushed the yen to 10-month lows and sent super-long government bond yields to record highs, once again threatening the foundations of the decades-long yen carry trade. Takaichi's fiscal profligacy might induce a dangerous feedback loop: the massive stimulus requires additional bond issuance beyond last year's 6.69 trillion yen, weakening the yen and forcing the Bank of Japan toward tighter monetary policy to control inflation and restore credibility. This policy collision between expansionary fiscal measures and monetary tightening has transformed the Japanese yen from a traditional safe-haven currency into a barometer of global market nightmare, with each equity market dip strengthening the yen as carry trades unwind.

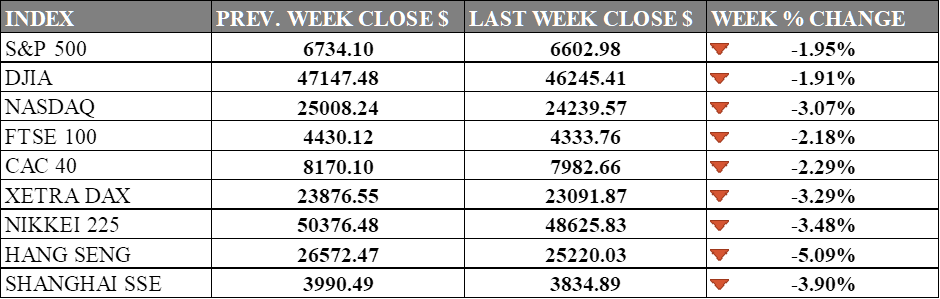

INDICES PERFORMANCE

Wall Street's major indices fell this week, with losses across all major benchmarks. The S&P 500 declined 1.95% to 6,602.98, while the Dow Jones Industrial Average dropped 1.91% to 46,245.41. The Nasdaq posted the steepest U.S. decline, falling 3.07% to 24,239.57, as technology stocks pulled back from recent highs. This weakness was driven by concerns over elevated technology sector valuations, doubts about the sustainability of the AI boom, and uncertainty over the timing of potential U.S. interest rate cuts, all of which pressured investor sentiment throughout the week.

European markets also showed broad weakness. The UK's FTSE 100 fell 2.18% to 4,333.76. Germany's XETRA DAX was down 3.29% to 23,091.87, extending the previous week's losses. France's CAC 40 retreated 2.29% to 7,982.66. European benchmarks suffered as investors grew increasingly wary of weak economic data, slowing business activity surveys, and continued caution regarding global growth prospects and possible central bank policy shifts.

Asian markets continued to struggle. Japan's Nikkei 225 dropped 3.48% to 48,625.83, one of the region's sharpest declines. Hong Kong's Hang Seng Index led losses in Asia with a drop of 5.09% to 25,220.03. China's Shanghai Composite also finished lower, down 3.90% to 3,834.89. These declines were fueled by worries over global demand, softness in tech and manufacturing sectors, continued property sector stress in China, and concerns about regional economic momentum.

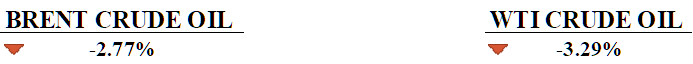

CRUDE OIL PERFORMANCE

Crude oil benchmark prices slipped around 3% for the week as hopes for a Ukraine peace deal clashed with fresh U.S. sanctions on Rosneft and Lukoil applied on 21st November, creating a tug of war between supply fears and geopolitical optimism. Any breakthrough in peace talks could unleash more Russian barrels into the market, while stricter sanctions risk tightening supply instead. Tanker markets exploded, with Middle East to China supertanker rates hitting a five-year high as buyers scrambled for non-Russian cargoes. Floating storage exploded across Asia and beyond due to sanction-driven disruptions, squeezing vessel availability and pushing freight costs even higher. Venezuela added another twist by extending its Russian oil joint ventures to 2041, reinforcing a strategic alliance that deepens the global reshuffling of crude flows.

OTHER IMPORTANT MACRO DATA AND EVENTS

Nonfarm Payrolls jumped to 119,000, more than twice the forecast and a clear reversal from last month’s decline, a sign of stronger U.S. job market and a bullish outlook for the dollar.

British consumer confidence just suffered its steepest drop since April as rising bills, tariff shocks, tax hike fears, and weakening expectations for both the economy and personal finances ahead of the Christmas season.

What Can We Expect from The Market This Week

PCE Price Index: Personal consumption is elevated at 2.7% annually and core PCE at 2.9%, above the Fed's 2% target, doubting the real target as the Fed is undergoing easing measures.

Chicago PMI: Chicago's manufacturing sector index stands at 43.8 in October, up from 40.6 in September, but remained below the expansion threshold of 50 for the 23rd consecutive month. Consensus forecasts are around 44.3 for November, suggesting continued weakness in regional manufacturing activity.

US GDP Q3: Preliminary data for US third-quarter economic growth estimates range between 2.8% and 4.2% annualised growth rate. The Atlanta Fed's GDPNow model projects 4.2% growth. However, the official Q3 GDP data release was delayed due to a government shutdown in late October. Q2 2025 saw strong growth of 3.8%, marking the strongest performance since Q3 2023.

German GDP Q3: Germany's economy stagnated in Q3 according to preliminary data, following a revised -0.2% contraction in Q2. In annual terms, GDP grew just 0.3% year-over-year with declining exports and weak domestic demand. This flat performance raises renewed recession concerns and highlights Germany's struggle with industrial weakness, particularly in the manufacturing and automotive sectors.

RBNZ Interest Rate Decision: The Reserve Bank of New Zealand is widely expected to cut the Official Cash Rate (OCR) by 25 basis points to 2.25%, continuing the easing cycle that began in February, with rates cut from 3.75% down to the current 2.50% to support New Zealand's stalled economic recovery.