Stocks Performance (U.S. Stocks)

Stocks climbed in most major markets as vaccine rollouts broadened, and optimism grew that deals for Brexit and U.S. stimulus will soon be finalized. Stocks pulled back on Friday, however, on reports that Republicans were demanding a provision barring the incoming Treasury secretary from providing the Federal Reserve with more emergency lending funds in 2021.

The rollout of the Pfizer-BioNTech coronavirus vaccine on Monday seemed to bolster sentiment. On Thursday, a U.S. FDA advisory panel gave its approval to Moderna’s similar mRNA vaccine, which would nearly double the expected number of total doses available by the end of the year.

Consumer durables sector advanced on anticipation of economies reopening and holiday/ Christmas sales. The materials/minerals sector was strong on higher gold prices. Information technology stocks outperformed, helped by gains in Apple and Microsoft. The energy sector led declining sectors despite higher oil prices, after the OPEC cut its demand forecast.

By sectors, the most outperformed weekly stocks were led by Consumer Durables sector at 7.56%, followed by Commercial Services at 3.46%, Non-Energy Minerals (2.96%), and Technology Services at 2.55%. Meanwhile, the weakest sectors were from the Energy Minerals at -2.64%, Industrial Services at -2.22%, Communications (-0.45%), and Transportations sector (0.23%).

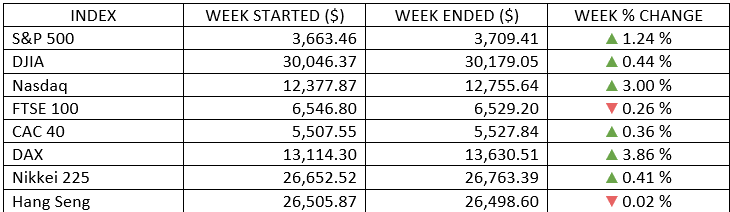

Indices Performance

Major U.S. indexes rose hitting fresh all-time highs on optimism over the stimulus relief, though then lost some ground Friday as the optimism faded.

Most major European and Asian markets were also higher. However, the UK posted a slight decline as investors waited for news of a Brexit agreement. The Bank of England also stood on the sidelines amid the uncertainty about the potential need for action.

Germany’s DAX index was especially strong, after manufacturing data in that country was higher than expected. Japanese stocks received support from the Tankan Survey of business sentiment, which rose at its fastest pace in 18 years.

Oil Sector Performance

Oil prices logged its seventh straight weekly gain and rose to their highest level since February. While OPEC and IEA cut its demand forecast.

Market-Moving News

Mixed Indices

The S&P 500 and the Dow recorded modest gains that offset the previous week’s small declines, while the NASDAQ recorded a solid rise of more than 3%. The major indexes rallied to record highs earlier on the week amid optimism over stimulus relief, then lost some ground Friday as the outlook faded.

Small Cap

Small-cap stocks outperformed their large-cap peers by a wide margin, as the Russell 2000 Index, a small-cap benchmark, climbed around 3% for the week. The gain left the index just 30 points shy of the 2,000-point level.

Sticks Buyback Rebound

Stock buyback activity rose nearly 15% in the third quarter compared with this year’s second quarter, when the impact of the pandemic weighed on share repurchases. Buybacks at companies in the S&P 500 rose to nearly $102 billion, according to S&P Dow Jones Indices, which expects a further increase in the Q4.

Stimulus Negotiations

Investors kept close watch on the shifting prospects in Congress for the economic relief package. House and Senate leaders struggled to reach an agreement as they also faced a deadline over a spending measure to avoid a government shutdown.

Fed's Latest Policy Statement, Bond Buying

The U.S. Federal Reserve Board kept interest rates unchanged while committing to continue buying about $120 billion in government bonds each month to help fuel economic recovery.

Economic Data

U.S. retail sales were soft entering the holidays, declining in November after slipping in October as well. November sales fell by a bigger-than-expected 1.1% as spending on categories such as automobiles, electronic stores, clothing, and restaurants and bars.

Labor Weakness

For the second week in a row, initial claims for unemployment benefits unexpectedly rose, with 885,000 claims in the latest report compared with 862,000 the previous week.

Bitcoin Surge

Bitcoin accelerated its recent rally and jumped more than 25% and crossed $23,000 on Thursday for the first time. It was the biggest weekly rally for bitcoin since May 2019, lifted its YTD above 200%.

Other Important Macro Data and Events

Economic data were mixed, revealing that the economic recovery is losing some momentum amidst rising virus cases and renewed restrictions in activity. Overall November retail sales fell short of estimates, the Empire State Manufacturing Survey slipped lower, and applications for unemployment benefits unexpectedly jumped to the highest level in three months.

At its final policy meeting of the year, the Federal Reserve kept interest rates steady near zero and promised to maintain its massive asset purchase program until it sees “substantial further progress” in employment and inflation. While will continue to buy more than $100 billion in assets per month, which will keep rates low and inject money into the economy.

The U.S. 10-yr yield increased six basis points to 0.95% amid increased selling interest in part due to the Fed's dovish policy and expectations for new supply of Treasuries needed to finance a potential stimulus deal.

The U.S. dollar fell to a new 2-1/2-year low versus other major currencies. The weaker greenback, in turn, lifted prices of commodities, including gold and oil.

Electric carmaker Tesla was set to join the S&P 500 on Monday.

Current coronavirus trends remained to be overwhelming, with the U.S. setting records for daily deaths. The heavily populated southern part of California emerged as the new epicenter of the crisis, despite stricter lockdown measures.

What We Can Expect from the Market this Week

Fiscal stimulus optimism, along with a brighter longer-term outlook driven by the rollout of vaccines, continues to support sentiment.

This week seems to head for brighter outlook as a U.S. compromise stimulus package was being finalize on the weekend. The deal including an increased unemployment benefits, household stimulus checks, PPP funding and state and local aid.

Investors also bidding up asset prices, focused on an expected economic acceleration some time in 2021, as vaccine deployments allow economies to reopen.

Important economic news released this week including GPD, CPI and existing home sales on Tuesday, new home sales, and personal income and spending on Wednesday, unemployment claims and durable on Thursday, and major Christmas holiday observed on Friday.