PAST WEEK'S NEWS (March 8 – March 14, 2021)

Stocks Performance (U.S. Stocks)

The market touched a new high last week as optimism over the economic recovery continues to fuel the rally. Lower-than-expected inflation readings in the U.S., a respite in the recent upward ascent in interest rates, and reassuring words from several central banks were among the contributing factors in the market's gains. Despite a renewed jump higher for yields on Friday, equities held on to most of their gains for the week.

Investor sentiment also boosted by the final passage and signing into law of the $1.9 trillion COVID-19 relief bill. Following the stimulus passage and the global rollout of vaccines, the OECD raised its global growth forecast for 2021.

A significant rise in the shares price of NLS Pharmaceutics began in the wake of positive news wherein NLS secured an exclusive license to Sanorex (mazindol) in the U.S. Meanwhile, the shares of AnaptysBio Inc. slipped on very discouraging news about its clinical study. The company’s potential treatment for skin condition palmoplantar pustulosis failed to meet a key goal.

The consumer discretionary sector led the gains in the S&P 500 as benchmark heavyweights Amazon.com Inc. and Tesla Inc. were especially strong. The communication services underperformed and the energy sector also losing momentum as oil prices dropped.

By sectors, the most outperformed weekly stocks were led by Consumer Durables sector at 8.53%, followed by Distribution Services at 5.41%, Process Industries (5.10%), and Producer Manufacturing at 4.43%. Meanwhile, the weakest sectors were from the Communications at 1.53%, Energy Minerals at 1.76%, Consumer Non-Durables (1.98%), and Electronic Technology sector (2.05%).

Indices Performance

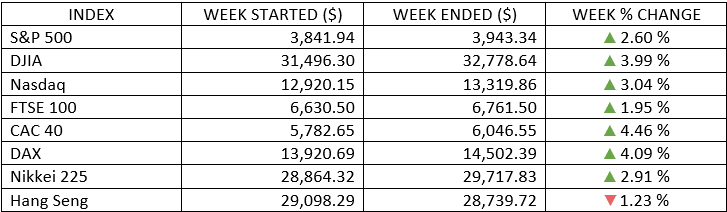

After posting mixed results the previous week, the major U.S. stock indexes recorded solid gains. The Dow gained nearly 4% while the S&P 500 and the NASDAQ both added more than 2%. The NASDAQ fell into a correction on Monday, before the technology-oriented index rebounded sharply, recording a cumulative gain of 6.3% over the course of Tuesday, Wednesday, and Thursday.

European stock markets were all higher, with gains accelerating after the ECB said that it will significantly increase the purchases of bonds under its pandemic quantitative easing program and ECB President Christine Lagarde said long-term inflation expectations were subdued.

UK stocks underperformed after industrial production fell more than expected and BoE Governor Andrew Bailey cautioned about downside risks to the economy.

Most Asian markets rose as concerns about higher bond yields receded. Although Hong Kong and Shanghai stocks finished the week lower after reports that China’s antitrust regulators were escalating a campaign to limit the influence of large technology and Internet companies such as Tencent Holdings Ltd.

Oil Sector Performance

A stronger dollar and receding fears of a supply disruption from Saudi Arabia after an attack on its export facilities capped price gains. Although prices were supported on the expectations of a recovery in the global economy after the U.S. Senate approved a $1.9 trillion stimulus bill.

Market-Moving News

Rally Resumes

The major U.S. stock indexes recorded solid gains amid a modest comeback for technology stocks that had recently declined. The Dow gained nearly 4% while the S&P 500 and the NASDAQ both added more than 2%.

Records Set

The Dow crossed the 32,000-point level for the first time on Wednesday, then pushed its record higher on Thursday as the S&P 500 and Russell 2000 also posted historic highs. It’s been a quick surge to 32,000 for the Dow, which eclipsed 31,000 in early January; in late November, it topped 30,000.

NASDAQ Roller Coaster

The NASDAQ fell into a correction on Monday, as its 2.4% decline that day left the index 10.6% below its record high set on February 12 of this year. However, the technology stock-oriented index rebounded sharply, recording a cumulative gain of 6.3% over the course of Tuesday, Wednesday, and Thursday.

Value Leads Growth

For the fourth week in a row, U.S. value stocks outperformed growth stocks. A value stock benchmark gained 3.2% while a growth benchmark added 2.5%; over four weeks, the value index rose 5.9% while its growth counterpart fell 5.5%.

COVID-19 Relief

The $1.9 trillion COVID-19 relief bill was signed into law on Thursday by President Biden. In addition to helping fund vaccinations, the measure will provide a $1,400 check to many Americans, extend a $300 weekly jobless-aid supplement, and expand the child tax credit for one year.

Yields Unsettled

The yields extended their rise. After closing the previous week at 1.55%, the yield of the 10-year note slipped as low as 1.50% on Thursday before surging on Friday to 1.63%—the highest in 13 months.

Euro Bonds Acceleration

Prices of eurozone government bonds rallied after the ECB on Thursday pledged to speed up its purchases of sovereign debt. The acceleration of the bond-buying stimulus program came in response to an increase in borrowing costs and bond yields.

Other Important Macro Data and Events

The week started out on a down note as the yield on the benchmark 10-year U.S. Treasury note stayed near 1-year highs. Bond yields retreated over the following days, which seemed to provide a lift to sentiment.

The ECB’s action to help dampen the rise in long-term interest rates helped U.S. yields turn lower by raising investors’ hopes that the Federal Reserve will eventually act as well.

The ECB pledged to buy more bonds to counter rising borrowing costs under its pandemic quantitative easing program, while ECB President Christine Lagarde said long-term inflation expectations were subdued. The ECB’s raises its 2021 GDP growth at 4%, an increase from the 3.9% expansion that the central bank forecast in December.

Meanwhile in economic data, the U.S. Labor Department reported that core CPI had increased only 0.1% in February, slightly below expectations, while the CPI rose 0.2%, in line with expectations and well below January’s 1.2% jump. Applications for US. jobless benefits fell to their lowest level since November, and higher-than-expected job openings signalled stronger job growth in the coming months.

The EU’s vaccination efforts suffered another setback when Italy banned the use of a batch of the Oxford-AstraZeneca vaccine, after reports of serious adverse effects. Denmark also suspended its use of the vaccine over concerns it might cause deadly blood clots. Meanwhile, the European Medicines Agency approved the Johnson & Johnson vaccine for use in the EU. The company said it expects to start delivering doses in April.

UK GDP shrinks less than forecast, a 2.9% sequentially in January due to a sharp slowdown in the services sector, official data showed.

What Can We Expect from the Market this Week

Investors seemed to remain focused on fluctuating longer-term bond yields and the discount they place on future earnings, resulting in substantial swings in the technology-oriented Nasdaq Composite Index.

The FOMC rate decision & press conference is awaited. The Fed is widely expected to keep its benchmark interest rate unchanged—and at a near-zero level—when it concludes a 2-day meeting on Wednesday. Fed statements will be closely watched in the wake of a recent rise in bond yields, driven in part by inflation concerns. All eyes are also on Bank of Japan’s March 18–19 monetary policy meeting.

Fiscal stimulus will continue to stoke bouts of anxiety over higher inflation, rising interest rates, and potentially less Fed help. We expect that anxiety to show up in periodic pullbacks in the equity markets, but history shows that even strong, durable bull markets have frequent setbacks. Avoid the temptation to shift your long-term strategy when short-term bumps emerge.

Among important U.S. economic data being released this week include the retail sales growth, housing market index, imports/ exports, housing starts, Fed Funds target rate, and the leading economic indicators index.