Stocks Performance (U.S. Stocks)

Stocks Performance (U.S. Stocks) Stocks ended mixed for the week, as investors weighed some hopeful developments in the battle against the coronavirus pandemic against poor economic news and a possible restart to the U.S.-China trade war. Small- and mid-caps outperformed for the week, as the major indexes rounded out their best monthly performance since 1987. Energy shares outperformed within the S&P 500 Index by a wide margin, helped by signs that crude oil consumption was recovering in some countries. Cruise line shares were also notable standouts, surging early in the week on growing optimism that they had the financial resources to survive the current no-sail orders. Health care and utilities shares lagged.

The week began on a positive note, with investors seemingly encouraged by the partial lifting of lockdown orders in some states and the gradual reopening of major economies overseas.

It also the market’s busiest week of earnings season, with roughly one-third of S&P 500 companies expected to report first-quarter results. Two of the most heavily weighted firms in the index, Facebook and Amazon.com, reported after the close of trading Thursday and beat consensus revenue expectations. Amazon’s earnings fell as the company spent heavily to keep up with booming demand.

The most outperformed weekly stocks by sectors was led by Consumer Services at 4.54%, followed by Commercial Services at 3.71%, Process Industries (2.62%) and Finance (2.50). Meanwhile, the weakest sectors were the Retail Trade sector (-2.99%), Health Technology (-2.68%), Utilities (-2.38%) and Health Services sector (-1.26%).

A slowdown in new coronavirus cases and synchronized stimulus initiatives globally improved sentiment from the March stock-market bottom. Although stocks remained down sharply year to date, April was one of the best months in decades, with the S&P 500’s total return of nearly 13% stacking up as the market’s best monthly result since January 1987.

U.S. oil prices climb by nearly 45% for the week as OPEC+ production cuts begin. Oil prices are defying current oversupply and instead are focused on the start of the most significant oil production cut in history. OPEC+ were due to start cutting production after agreeing in April to reduce output by 9.7 million barrels a day in May and June. The move was meant to offset a severe drop in global demand on the back of travel restrictions tied to preventing the spread of COVID-19 pandemic.

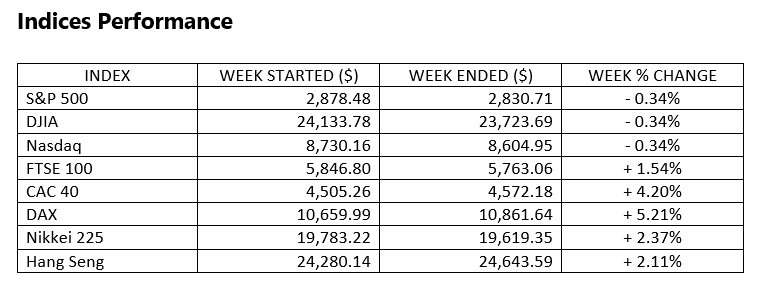

Market-Moving News April BloomsAlthough stocks remained down sharply year-to-date, April was one of the best months in decades, with the S&P 500’s total return of nearly 13% stacking up as the market’s best monthly result since January 1987. The Dow added 11% and the NASDAQ gained more than 15%—that index’s biggest monthly increase since June 2000.

Stocks Staying in Place

The major U.S. stock indexes posted small declines for the second week in a row, although there were again some big daily moves. The market’s recent shift to a slight downward track was a big departure from mid-February to mid-April, a period of extreme volatility.

Earnings Halfway Mark

Analysts’ overwhelmingly negative expectations for first-quarter earnings results improved marginally over the latest week. With earnings reports in from more than half of the companies in the S&P 500 Index as of May 1, analysts expected a 13.7% decline by the time all first-quarter results have been released, according to FactSet. That’s better than the 16.1% decline that had been projected a week earlier.

Shrinking Economies

An initial estimate showed that U.S. GDP shrank 4.8% in this year’s first quarter compared with the previous quarter—the first contraction since early 2014 and the worst result since late 2008. Initial GDP figures in many other major economies also turned negative, with a 3.8% overall decline across the 19 European countries that use the euro as their currency.

Tech Trouble?

Major technology companies have been among the strongest performers amid the stock market’s comeback in recent weeks, but that storyline shifted somewhat on Friday after Amazon.com and Apple reported quarterly earnings. Shares of both companies declined as the impact of coronavirus-related restrictions weighed on their results.

Other Important Macro Data and Events

News of a possible treatment for patients ill with the virus helped spark another leg up for markets on Wednesday. Gilead Sciences announced that its drug remdesivir had performed well in a large trial in reducing the severity of the disease in patients suffering from COVID-19.

Small-cap stocks rose around 2% for the week, but that modest gain belied the market segment’s choppy return profile. As measured by the Russell 2000, a small-cap benchmark, there was a gap of nearly 11% between the index’s weekly high point on Wednesday and its low on Friday.

The U.S. Federal Reserve Board kept currently ultralow interest rates unchanged. At the close of Wednesday’s meeting, Chairman Jerome Powell pledged to keep rates low, and he warned that it’ll take time for the economy to heal even after businesses begin to reopen amid continuing efforts to contain the coronavirus.

European equities rose as investors welcomed announcements that lockdown measures will soon start being lifted. However, the European Central Bank’s decision not to inject more stimulus into the economy eroded some markets gains.

What We Can Expect from The Market This Week

In contrast to the previous month, May is likely to be marked by a historic reopening of the global economy, from a sudden stoppage to a new normal, reflecting the still present, though receding, risks of the viral contagion.

Analysts said the supply overhang is likely to keep a lid on crude prices in coming weeks and months, though some see scope for a recovery later in the year as producers slash output and reduce investment in response to the collapse in prices.

April jobs report likely to show highest unemployment rate on record. Millions of lost jobs may push unemployment rate to highest since Great Depression. It is expected to drive U.S. unemployment to 15% or higher, as a broader picture of the nation’s troubled labour market will emerge on May 8, when the government reports monthly job.

The earnings season continues this week, with about one-third of the companies in the S&P 500 reporting first-quarter results. Important economic data being released include factory orders on Monday, the non-manufacturing Purchasing Managers' Index (PMI) on Tuesday, and April's jobs report on Friday.