PAST WEEK'S NEWS (May 3 – May 9, 2021)

Stocks Performance (U.S. Stocks)

Global equities produced mixed returns across a wide range as a Friday rally erased some losses from early in the week. Stocks optimism came amid solid corporate earnings reports, plans for massive additional U.S. policy stimulus, accelerating economic growth and a renewed pledge by the Fed to remain accommodative despite a pickup in inflation pressures.

Inflation seemed to be a major driver of sentiment during the week, after Treasury Secretary and former Fed Chair Janet Yellen on Tuesday acknowledged that rates may have to rise somewhat to prevent the economy from overheating. She however, later clarified that her remarks were not intended to be a prediction or a recommendation for the central bank to raise rates.

Stronger growth also lifted government bond yields and oil prices, and high demand buoyed lumber prices to an all-time high and copper to its highest in nearly a decade on Wednesday. The rally in resource prices however weighted on the U.S. dollar.

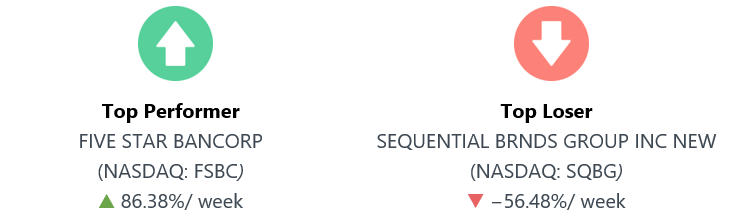

The week’s best performer, Sacramento bank Five Star Bancorp priced at the high end after its successful IPO last week. Sequential Brands Group was the biggest laggard among the bunch following a pending lawsuit for certain investors and the resignation of Chair William Sweedler.

Advancing sectors were led by Non-Energy Minerals sector at 10.21%, followed by Energy Minerals at 8.28%, Industrial Services (4.98%), and Process Industries at 4.45%. Meanwhile, the weakest sectors were from the Technology Services sector at -2.07%, followed by Retail Trade at -0.97%, Consumer Services (-0.59%), and Utilities sector (-0.37%).

Indices Performance

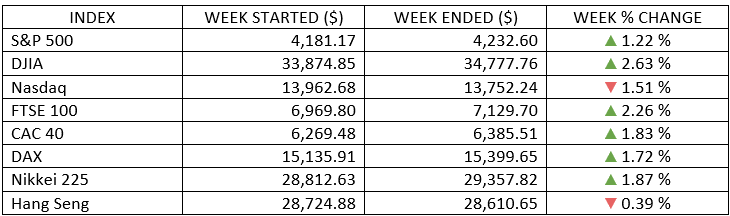

It was a mixed week for the major U.S. stock indexes. The Dow Jones Industrial Average fared best, while the technology-heavy Nasdaq Composite Index recorded its worst weekly loss in two months. The S&P 500 ended the week on a high note as the gains broadened out to the battered technology stocks.

Shares in Europe climbed on stronger-than-expected earnings results and growing confidence in an economic recovery.

In a holiday-shortened week, Japanese equities shrugged off concerns about the coronavirus and associated containment measures to register a gain.

Oil Sector Performance

WTI crude prices crept toward a 3-1/2-year high after the OPEC+ signaled confidence in the demand outlook. Global economic recovery and easing travel curbs in the U.S. and Europe buoyed the fuel demand outlook, although the surging pandemic in India, Japan, and Brazil capped prices.

Market-Moving News

Mixed Directions

It was an uneven week for the major U.S. stock indexes, as the Dow climbed nearly 3%, the S&P 500 added more than 1%, and the NASDAQ fell more than 1%, with most of its weekly decline coming on Tuesday. The Dow and the S&P 500 both set records, eclipsing highs set less than a month earlier.

Divergent Market

Large-cap U.S. value stocks added to their run of year-to-date outperformance versus their large-cap growth counterparts, beating them by a wide margin for the week. A value stock benchmark climbed more than 2% while a growth benchmark fell nearly 1%.

Yield Volatility

The yield of the 10-year U.S. Treasury bond briefly fell below 1.50%—the lowest in nearly two months—before recovering to around 1.56%. Friday’s jobs report reinforced recent Fed comments suggesting that policymakers are in no rush to raise interest rates, and that sentiment helped to support bond prices, sending yields lower.

Jobs Setback

Friday’s jobs report fell far short of expectations as the recent rollback of pandemic-related restrictions failed to provide much lift to the labor market. The economy generated 266,000 new jobs in April. The unemployment rate rose from 6.0% to 6.1%.

Earnings Surge

First-quarter earnings continued to improve, and S&P 500 companies are now expected to report a cumulative 49% increase over last year’s first-quarter results, according to FactSet. That’s up from the roughly 25% gain that analysts had forecast at the start of earnings season. As of Friday, results were in from around 90% of S&P 500 companies.

Manufacturing Disappointment

The ISM index of manufacturing activity came in at 60.7 in April—down from 64.7 in March and below expectations for a 65.0 reading. A separate reading on the services sector also fell below expectations.

Copper Rally

Prices of the widely used industrial metal copper surpassed record highs set in 2011 amid expectations of a global economic recovery. Copper futures prices on the London Metal Exchange rose nearly 3% on Friday to $10,386 per metric ton—roughly double the price 12 months ago.

Vaccine approval

The WHO on Friday granted emergency-use approval for a vaccine developed by a Chinese state-owned drugmaker. The vaccine is the first developed by a non-Western country to win WHO backing.

Other Important Macro Data and Events

This was one of the busiest weeks in earnings news, but like the weeks before, the results were not a catalyzing factor this week despite remaining on the side of better than expected. More interesting were the key economic reports that indicated a deceleration in the fast-paced economic recovery and perhaps explained the general lackluster response to earnings.

The ISM Manufacturing Index for April decelerated to 60.7% from 64.7% in March. The ISM Non-Manufacturing Index for April decelerated to 62.7% from 63.7% in March.

The April employment report released on Friday was particularly eye-catching given its sizable disappointment. 266,000 jobs were added in April, compared with an expectation for a gain of nearly one million. The unemployment rate rose from 6.0% to 6.1%.

The disappointing jobs data sparked a decrease in Treasury yields on Friday morning, pushed the yield on the benchmark 10-year note to a two-month low before finishing lower for the week.

The dollar turned lower for the week. Against a basket of major currencies, the index declined -1.16% to stay at 90.229. EUR/USD advanced 1.19%, USD/JPY slipped -0.65%, and GBP/USD rose 1.24%.

Core eurozone bond yields fell at the start of the week on underwhelming U.S. manufacturing data. Yields steadied after a European Central Bank policymaker hinted that the institution’s bond purchases could slow in June.

With most European countries easing lockdowns, and as the vaccination programs progressed, the European Commission also announced plans to reopen the EU’s borders again to holidaymakers from outside the bloc by June.

Japan’s government extended a state of emergency in Tokyo and other prefectures until May 31 to curb a surge in coronavirus cases and give the government time to accelerate its vaccination program.

What Can We Expect from the Market this Week

The narrative divide between the cyclically oriented (Dow Jones) and growth-oriented (Nasdaq) is expected to take centre stage to the market this week.

Periodic pullbacks are expected to be a norm, affected by concerns ranging from tax issues, geopolitical tensions, and market imbalances, among others. This continues to support the case for a well-diversified portfolio allocation and a disciplined approach by investors.

Important economic data being released this week include JOLTs job openings, inflation data, Federal budget, Michigan Sentiment index, and retail sales.