Stocks Performance (U.S. Stocks)

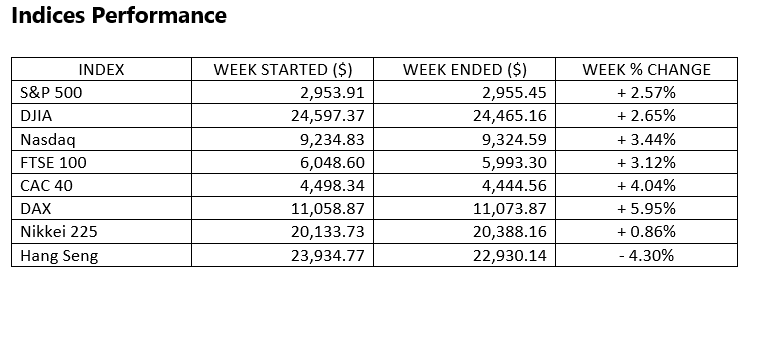

Stocks Performance (U.S. Stocks) Stocks rose for the week, with the S&P 500 Index touching its highest level since March 6 on Wednesday before falling back somewhat. Small- and mid-cap stocks saw the strongest gains, and slower-growing value shares outperformed higher-valuation growth shares.

Stocks started the week strong, helped by news of encouraging early test results for a possible coronavirus vaccine. Moderna Therapeutics announced that its vaccine candidate that uses pioneering mRNA technology had produced abundant antibodies in a small group of volunteers in a first-stage clinical trial, which began in March.

By sectors, the most outperformed weekly stocks were led by Transportation at 8.63%, followed by Producer Manufacturing at 7.45%, and Distribution Services (7.33%).

Meanwhile, the weakest sectors were the Health Technology sector (0.44%), Communication (1.02%), Health Services (1.25%) and Retail Trade sector (1.65%).

Stocks rose for the week, with the S&P 500 Index touching its highest level since March 6 on Wednesday before falling back somewhat. Small- and mid-cap stocks saw the strongest gains, and slower-growing value shares outperformed higher-valuation growth shares.

In a further sign of oil’s stabilization, prices for physical oil and oil futures have been closely aligned in recent days.

Market-Moving News Modest breakoutThe major U.S. stock indexes climbed more than 3%, breaking out of a rut that has largely kept stocks in a holding pattern since late April. The S&P 500 climbed to its highest level since early March and was up 32% from a recent low on March 23.

Strong start

Nearly all of the week’s positive momentum came on Monday, when the S&P 500 surged more than 3% for its best day since early April. Most of the gain came early in the day following comments from U.S. Federal Reserve Chairman Jerome Powell and a positive announcement from a pharmaceutical company that’s seeking to develop a coronavirus vaccine.

Crude comeback

U.S. crude oil prices surged for the fourth consecutive week, eclipsing $34 per barrel on Thursday. That level is up sharply from oil’s historic lows in April, when some U.S. oil futures contracts briefly slipped below $0. In a further sign of oil’s stabilization, prices for physical oil and oil futures have been closely aligned in recent days.

Small-cap surge

Small-cap stocks outperformed the broader U.S. stock market by a wide margin, as a small-cap benchmark, the Russell 2000 Index, added nearly 8% for the week. The gain extended a recent run of strong performance for small caps.

Japan's struggle

Japan’s government started the week with an announcement that the world’s third-largest economy has fallen into a recession, with GDP shrinking at an annualized rate of 3.4% in this year’s first quarter. On Friday, Japan’s central bank announced a program to support $700 billion in business financing to help offset the impact of coronavirus-related restrictions.

China's uncertainty

China’s government is declining to set an economic growth target for 2020—the first year that it’s failed to offer GDP guidance since it began setting annual targets in 1994. Friday’s move comes after China recently reported that first-quarter GDP shrank by 6.8% as coronavirus-related restrictions weighed on the world’s second-largest economy.

What We Can Expect from The Market This Week

U.S. financial markets will be closed May 25 in observance of Memorial Day.

Global stocks finished higher on optimism over the reopening of the economies and some positive news about progress on vaccine trials. Later in the week some caution returned that raised geopolitical tensions, as China planned to impose a new security law on Hong Kong and as a U.S. Senate bill was introduced that could force Chinese firms to delist from U.S. exchanges. We think investors can be confident in a longer-term recovery but should position portfolios and expectations to weather periods of volatility along the way.

Canada: Gross Domestic Product (March), Industrial Product, Raw Materials Price Indices (April)

U.S.: Conference Board Consumer Confidence Index (May), New home sales (April), Gross Domestic Product (First Quarter), Durable goods orders (April), Pending home sales (April), Personal Income and Spending (April), Univ. of Michigan Consumer Sentiment Index (May).